Cass Information Systems: Unique Company at a Good Price

- By Praveen Chawla

If you are a large business with far-flung operations, paying your bills is a big deal, especially complex bills like freight, utilities, telecom and so on. How do you know if the bills are correct or not and whether you are getting the best deal in terms of discounts? Either you establish a large internal department to manage all this or you can outsource to someone like Cass Information Systems Inc. (NASDAQ:CASS). Cass can manage a large part of a company's accounts payable function from data management, reconciliation, accounting and auditing to payment processing. Cass also incorporates a regulated internal bank, which is complementary to its payment processing business, but is also a standalone industrial bank (called Cass Commercial Bank.) The company had a loan portfolio of about $772 million outstanding at the end of 2019. The company started out as a bank and has been around for over 100 years, though it has been a public company since 1996.

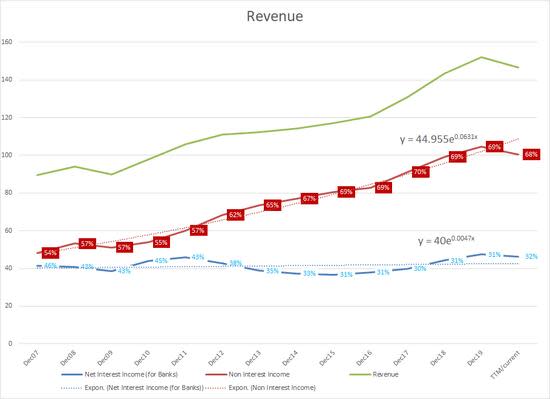

Revenue comes from two major sources, payment processing fees (about 70%) and net interest income (30%) from its banking segment. Total revenue has grown at about 6% a year over the last 15 years, with almost all of the growth coming from the payment processing side (the red line in the chart below.) The current recession and low-interest environment have put a dent in both these revenue sources, but payment processing should recover as the economy recovers. Because of the low-interest rate environment, the net interest margin is likely to decline.

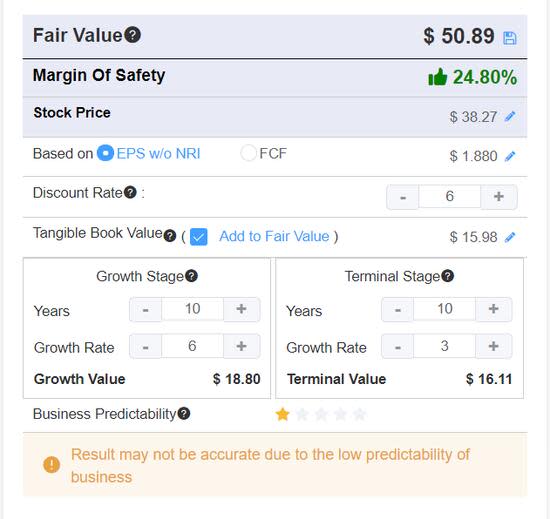

Cass has no net debt and a tangible book value of about $16 per share. It does face credit risks due to delinquent loans from its banking business and has reserved against such occurrences.

Source: Simplywall.St

Cass is currently paying a dividend and yielding about 2.1%. The dividend has grown at a pace of around 10% a year over the last decade.

Valuation

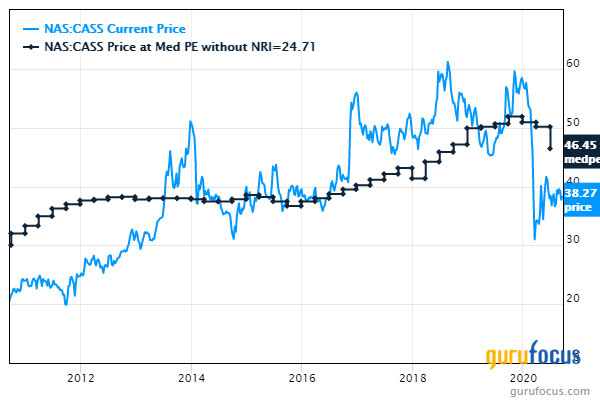

Over the last 10 years, Cass has traded at a median price-earnings ratio of around 25, which is quite high for a business growing only by about 6% a year. The price-earnings ratoi has now dropped to about 20, still a bit overvalued but a decent time to start a position in this unique and high-quality company.

With the aid of GuruFocus' two-stage discounted cash flow calculator, I estimate the intrinsic value of the shares at around $50. I assume the company will continue to grow earnings at around 6% for the next decade and then slow to 3% for the following decade. After 20 years, the company is sold or liquidated at the current tangible book value. I also use a discount rate of 6%, which seems appropriate for a company with no debt. The fact that tangible book value has compounded at the rate of 6% per annum over the last 10 years provides an additional margin of safety.

Conclusion

Overall, I am quite impressed with the company and its business model. It has a unique combination of a payment processor and a bank. It could be an attractive acquisition target for a large bank or business services company looking to incorporate its business model and capabilities. Its debt-free balance sheet gives it stability. The bank side of the business, though not growth-oriented, appears to give it an edge on similar business service providers. Also, because it is holding so much equity (and no debt), the return on equity is around 12%, which is on the lower side. The company has now started to expand internationally, which should provide it additional growth runway.

The recession has given potential investors an opportunity to get in at a reasonable (but not cheap) valuation. While the GuruFocus system has flagged the company as a potential value trap, my research has not found anything is amiss. If you notice anything, I welcome your comments below.

Disclosure: At the time of writing, the author did not have a position in Cass.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.