Caterpillar (CAT) Gains on Q1 Earnings Beat, Hikes '18 View

Caterpillar Inc. CAT delivered adjusted earnings per share of $2.82 in first-quarter 2018, surging a whopping 120% year over year. This can be attributed to continued strength in many of its end markets as well as incessant focus on cost control. Earnings also surpassed the Zacks Consensus Estimate of $2.11 by a margin of 34%. The quarterly performance marked the company’s fifth consecutive quarter of both top and bottom-line growth after a string of dismal performances for four years. Following the upbeat results, Caterpillar’s shares advanced 3.77% in pre-market trading.

Including one-time items, Caterpillar reported earnings per share of $2.74 in the quarter compared with 32 cents per share in the prior-year quarter.

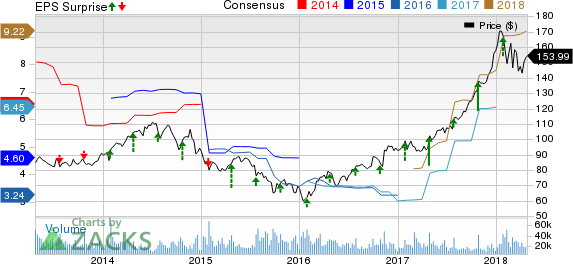

Caterpillar Inc. Price, Consensus and EPS Surprise

Caterpillar Inc. price-consensus-eps-surprise-chart | Caterpillar Inc. Quote

Improved End Markets Drive Revenues

Revenues improved 32% year over year to $12.9 billion in the quarter, surpassing the Zacks Consensus Estimate of $11.6 billion. The company witnessed higher sales volume owing to improved end-user demand and favorable changes in dealer inventories. End-user demand improved across all regions and most end markets. Sales increased across all regions with Asia/Pacific and North America leading the pack.

Higher Sales Lead to Imporved Profits

In the reported quarter, cost of sales increased 26% year over year to $8.6 billion. Gross profit advanced 42% to $4.3 billion. Selling, general and administrative (SG&A) expenses increased 20% to $1.3 billion due to higher short-term incentive compensation expense and targeted investments. Research and development (R&D) expenses rose 4% year over year to $443 million.

Adjusted profit before taxes were pegged at $2.6 billion, a substantial improvement from $1.5 billion in the prior-year quarter. Higher sales volume and favorable price realization were somewhat offset by higher selling, general and administrative (SG&A) and research and development (R&D) expenses. Manufacturing costs were flat as lower warranty expense and the favorable impact from cost absorption were negated by higher material costs, freight costs and short-term incentive compensation expense.

All Segments Deliver Growth

Machinery and Energy & Transportation (ME&T) sales surged 33% year over year to $12.2 billion. Sales of Energy & Transportation gained 26%, owing to higher sales across all applications. Sales at Resource Industries improved 31% driven by higher end-user demand for equipment in all regions. Construction Industries sales rose 38% on the back of favorable impact of changes in dealer inventories as well as higher end-user demand for construction equipment.

The ME&T segment delivered an operating profit of $2 billion, substantial improvement from $0.2 billion in the year-ago quarter. At the Energy & Transportation segment, operating profit improved 60% to $874 million higher sales volume and favorable price realization, partially offset by higher short-term incentive compensation expense and targeted investments.

The Resource Industries reported operating profit of $378 million in the quarter, a 136% surge from $160 million in the prior-year quarter thanks to higher sales volume and favorable price realization which was partially offset by higher short-term incentive compensation expense and a slightly unfavorable impact from currency. Construction Industries’ profit soared 76% to $1.1 billion due to favorable price realization, higher sales volume. However, higher SG&A/R&D expenses, material costs, primarily for steel, and freight costs somewhat negated these gains.

Financial Products’ revenues went up 4% to $733 million. Financial Products' profit was $139 million in the quarter, down from $186 million in the prior-year quarter. The increase can be attributed to higher average earning assets in Asia/Pacific and higher average financing rates in North America, partially offset by an unfavorable impact from lower intercompany lending activity in North America. Financial Products’ segment profit was $141 million in the first quarter of 2018, compared with $183 million in the prior-year quarter due to an increase in the provision for credit losses at Cat Financial, partially offset by an increase in net yield on average earning assets.

Financial Position

Caterpillar ended the first quarter 2018 with cash and short-term investments of $7.9 billion, down from $8.3 billion at 2017 end. ME&T operating cash flow for the quarter was $948 million, lower than $1.5 billion in the prior-year quarter mainly due to higher short-term incentive compensation payments in the first quarter of 2018, compared with the first quarter of 2017. Caterpillar repurchased $500 million of shares in the reported quarter.

The debt-to-capital ratio at ME&T was 34.4% as of first-quarter 2018 end, lower than 36.6% as of 2017-end.

Robust Backlog

At the end of first-quarter 2018, Caterpillar’s backlog was at $17.5 billion, up from $15.8 billion at 2017 end. The increase was mainly driven by higher backlog at Construction Industries and Energy & Transportation while backlog at Resource Industries remained flat from 2017-end.

Hikes Guidance for 2018

Backed by strong first-quarter 2018 performance, improving demand across all regions and end-markets and continued global economic growth, Caterpillar now expects adjusted earnings per share between $10.25 and $11.25 for fiscal 2018. The company had earlier provided adjusted earnings per share guidance of $8.25-$9.25 for the fiscal. All the segments as well as regions are expected to log growth in the year and contribute to improved volumes. However, improved price realization is anticipated to be partially offset by material cost increases due to higher commodity prices.

Over the past year, the Caterpillar stock has outperformed the industry it belongs to. The company has delivered a return of 59%, while the industry grew 57%.

Zacks Rank & Other Key Picks

Caterpillar currently sports a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other top-ranked stocks worth considering in the same sector include Axon Enterprise, Inc. AAXN, Alarm.com Holdings, Inc. ALRM and DMC Global Inc. BOOM. While Axon Enterprise and Alarm.com Holdings sport a Zacks Rank #1, DMC Global carries the same Zacks rank as Caterpillar.

Axon Enterprise has an average earnings surprise history of 188.3% in the trailing four quarters. Its shares have appreciated 78% in a year’s time.

Alarm.Com Holdings has an average earnings surprise history of 55.9% in the trailing four quarters. Its shares have gone up 28% in a year’s time.

DMC Global has an average earnings surprise history of 22.9% in the trailing four quarters. Its shares have soared 93% in a year’s time.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research. It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

DMC Global Inc. (BOOM) : Free Stock Analysis Report

Alarm.com Holdings, Inc. (ALRM) : Free Stock Analysis Report

Axon Enterprise, Inc (AAXN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research