Caterpillar (CAT) Q4 Earnings, Revenues Lag Estimates, Up Y/Y

Caterpillar Inc. CAT delivered adjusted earnings per share of $2.55 in fourth-quarter 2018, lagging the Zacks Consensus Estimate of $2.98. However, the figure improved 18% year over year driven by continued strength in many of its end markets and incessant focus on cost control. Caterpillar’s shares dipped 6% in pre-market trading as results fell short of expectations.

Including one-time items, Caterpillar’s fourth-quarter earnings per share came in at $1.78 against a loss per share of $2.18 in the prior-year quarter.

Improved End Markets Drive Revenues

Revenues improved 11% year over year to $14.3 billion in the quarter under review, missing the Zacks Consensus Estimate of $14.4 billion. The company witnessed higher sales volume due to improved end-user demand across all segments. However, unfavorable currency impacted revenues slightly. Sales increased across all regions, led by North America and EAME with an increase of 13% and 12%, respectively. Sales in Latin America rose 10% while Asia Pacific witnessed an increase of 8%.

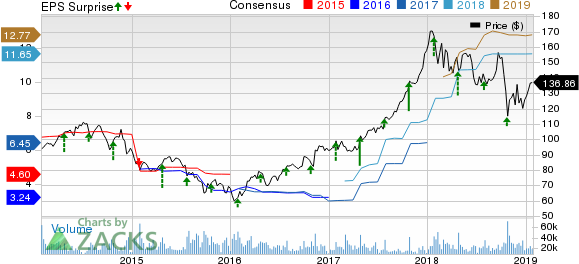

Caterpillar Inc. Price, Consensus and EPS Surprise

Caterpillar Inc. price-consensus-eps-surprise-chart | Caterpillar Inc. Quote

Higher Sales Lead to Improved Profits

In fourth-quarter, cost of sales increased 11% year over year to $10 billion due to higher manufacturing costs, including material, labor and freight costs. Gross profit advanced 11% to $4.4 billion.

Selling, general and administrative (SG&A) expenses increased 6% to $1.5 billion. Research and development (R&D) expenses went down 6% year over year to $466 million. Operating profit came in at $1.9 billion, an improvement from the prior-year quarter figure of $1.4 billion aided by higher sales volume and favorable price realization, offset by higher manufacturing costs and lower profit from Financial Products.

All Segments Deliver Growth

Machinery and Energy & Transportation (ME&T) sales surged 12% year over year to $13.6 billion. Sales of Energy & Transportation gained 11% to $5.6 billion from the prior-year quarter, driven by higher sales volume across all applications except Industrial. Sales at Resource Industries improved 21% year over year to $2.3 billion aided by higher demand for both mining and heavy construction equipment. Construction Industries sales rose 8% year over year to $5.3 billion on the back of higher sales volume for construction equipment.

The ME&T segment delivered an operating profit of $1.9 billion, an improvement of 44% from the year-ago quarter. At the Energy & Transportation segment, operating profit improved 23% to $1.1 billion. Higher sales volume was offset by higher manufacturing costs, including freight costs.

The Resource Industries reported operating profit of $400 million in the fourth quarter, a surge of 90% from the prior-year quarter thanks to higher sales volume and favorable price realization. However, higher material and freight costs dented profits. Construction Industries’ profit inched up 1% to $845 million due to higher sales volume and favorable price realization, partially negated by higher manufacturing costs.

Financial Products’ revenues went up 4% to $812 million. Financial Products' profits were $29 million in the reported quarter, down considerably from $233 million in the prior-year quarter.

2018 Performance

Caterpillar’s adjusted earnings per share in fiscal 2018 stood at $11.22, which marked an improvement of 63% from the $6.88 reported in the prior fiscal. However, earnings missed the Zacks Consensus Estimate of $11.65 per share. Caterpillar had guided adjusted earnings per share at $11.00-$12.00 for the year. Including one-time items, earnings per share was $10.26 compared with $1.26 in fiscal 2017. Revenues in fiscal 2018 were at $54.7 billion, in line with the Zacks Consensus Estimate.

Cash Position

Caterpillar ended fiscal 2018 with cash and short-term investments of $7.9 billion, down from $8.3 billion at 2017 end. In 2018, ME&T operating cash flow was $6.3 billion. During the year, the company repurchased $3.8 billion of its common stock, made dividend payments of $2 billion and a discretionary pension contribution of $1.0 billion.

Backlog

At the end of 2018, Caterpillar’s backlog was at $16.5 billion, a year-over-year improvement $700 million aided by increase in Energy & Transportation and Construction Industries, partially offset by a lower backlog at Resource Industries.

Guidance Initiated

For 2019, Caterpillar expects earnings per share to range between $11.75 and $12.75. The mid-point of the guidance depicts year-over-year growth of 9% over the adjusted earnings per share of $11.22 in fiscal 2018. However, the company stated that it expects modest sales growth increase based on the fundamentals of its diverse end markets as well as the macroeconomic and geopolitical environment. The company will continue to focus on cost discipline and investment in expanded offerings and services to drive growth.

Over the past year, Caterpillar stock has dipped 15.8%, compared with the industry’s decline of 17.3%.

Zacks Rank & Stocks to Consider

Caterpillar currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the sector include Alarm.com Holdings, Inc. ALRM, Cintas Corporation CTAS and Enersys ENS. While Alarm.com Holdings sports a Zacks Rank #1 (Strong Buy), Cintas and Enersys carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alarm.com has a long-term earnings growth rate of 17%. The stock has appreciated 65% over the past year.

Cintas has a long-term earnings growth rate of 12%. The company’s shares have gained around 12% over the past year.

Enersys has a long-term earnings growth rate of 10%. Its shares have gained 16% over the past year.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

See Latest Stocks Today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cintas Corporation (CTAS) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research