Caterpillar Overcomes Inflationary Pressures With Higher Prices

Caterpillar Inc. (NYSE:CAT) reported quarterly earnings results earlier this month that were mixed. The company did show solid growth on both revenue and earnings per share, however.

The stock is also trading slightly below its GF Value. Combined with a solid dividend that has been increased for nearly three decades, total return potential could push into the low double-digit range by my estimates.

Lets examine the company and its most recent quarter to see why I am bullish on Caterpillar.

Earnings highlights

Caterpillar reported second-quarter earnings results on Aug. 2. Revenue grew 10.5% year over year to $14.25 billion, but this was $136 million lower than expected by Wall Street analysts. Adjusted earnings per share of $3.18 compared very favorably to $2.60 in the prior-year quarter and was 16 cents above estimates.

By segment, sales for Construction Industries grew 7% to $6 billion. Higher manufacturing costs lowered profit by 4% and segment profit margins contracted 180 basis points to 16.4%.

Resource Industries increased 16% to $3 billion. Profit was stable at $355 million, but inflationary pressures caused profit margins to fall 170 basis points to 12%.

Energy and Transportation improved 15% to $5.7 billion. Profit did fall almost 11% as profit margins contracted 320 basis points to 11.6% as higher expenses and manufacturing costs impacted results.

Adjusting for restructuring expenses, the operating margin contracted 30 basis points to 13.6%, but Caterpillar experienced a 5.6% improvement in operating profit to $1.9 billion.

Capital returns to shareholders totaled $1.7 billion for the quarter, with $1.1 billion in share repurchases. In mid-July, Caterpillar announced an 8.1% dividend increase, extending the companys dividend growth streak to 28 consecutive years.

Caterpillar provided guidance for the remainder of the year with leadership now expecting third-quarter sales to advance due to demand growth and better pricing. The company projects that pricing will be more than enough to overcome input costs as well. According to Yahoo Finance, analysts except that Caterpillar will earn $12.53 per share in 2022, which would be a 14% increase from the prior year and a new company record.

Takeaways

In terms of revenue, the most recent quarter was Caterpillars best since the second quarter of 2019, despite the small miss of estimates. The two primary contributors to top-line growth were higher price realization and sales volumes, with the former adding $1.1 billion and the latter contributing $499 million to revenue results. Currency was a $258 million headwind to results.

Pricing and volume increases also aided operating profit growth. Here, however, these gains were offset by higher costs of materials and transportation. Increased manufacturing costs were felt in every segment of the company. This impact was expected and is likely to continue for some time as manufacturing costs are still quite high. Thats the bad news for the company.

The good news is that Caterpillar saw gains in its three largest businesses, with mid-double-digit revenue growth for Resources Industries and Energy and Transportation. Gains were seen in almost every aspect of these businesses. On the plus side, much of this growth was due to higher prices that didnt impact demand all that much.

Construction Industries performance in North America and Latin America was driven primarily by favorable price realization. This segment did see a weaker performance in Asia, mostly on account of weaker demand in China due to Covid-19 restrictions.

Resource Industries also enjoyed volume growth even as price increases, especially in aftermarket part sales, were passed along to customers. All businesses within Energy and Transportation showed growth year-over-year as end markets were mostly acting well.

Guidance for the rest of the year shows that leadership expects the positives the company is seeing to continue. Management also stated that the adjusted operating margin is also expected to improve over the next two quarters, showing that Caterpillar might be getting a handle on manufacturing costs. In the worst case, it should be able to raise prices more to address these costs.

Either way, the company seems likely to see a material benefit to its bottom line in my view. This opinion seems to be reflected by analysts projections for the year.

Valuation analysis

With shares of the company closing Tuesdays trading session at $197.21, Caterpillar is trading at 15.7 times forward earnings estimates. This is slightly below the 10-year average price-earnings ratio of 16.5, according to Value Line.

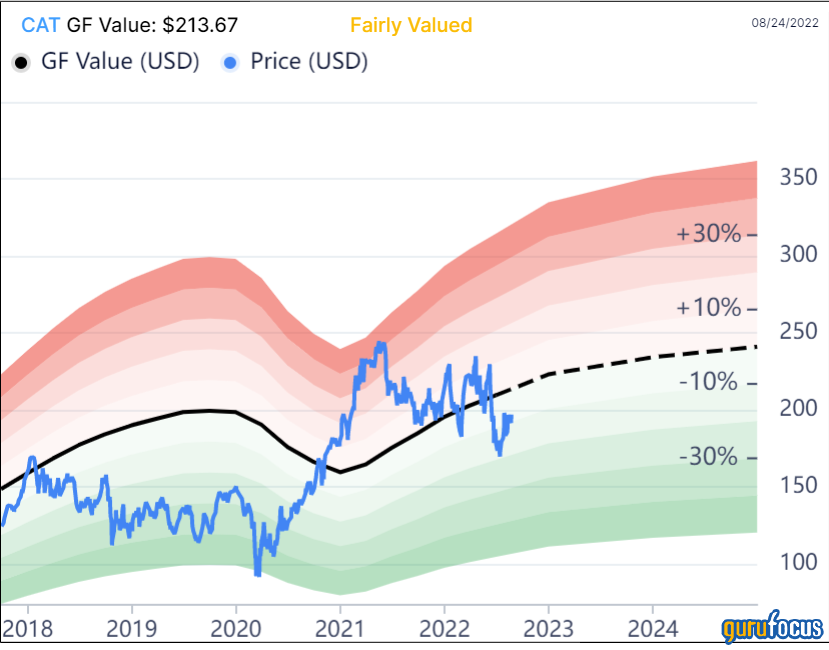

The GF Value chart shows the stock to be trading at a discount to intrinsic value.

Caterpillar has a GF Value of $213.67, resulting in a price-to-GF-Value ratio of 0.92. Reaching the GF Value would mean an 8.3% gain from the most recent close. Factor in the companys dividend yield of 2.4% and total return potential could be in the low double-digit range.

Caterpillar has been a leader in its industry for a long time, due to the strength of its business model. The company receives a solid GF Score of 86 out of 100 from GuruFocus.

Final thoughts

For the most part, Caterpillar produced a solid second quarter, showing gains on both revenue and earnings per share. Revenue missed estimates, but this masks how well each of the three main segments of the company performed. Manufacturing and freight costs are a persistent headwind, one that could remain an issue for some time.

On the other hand, Caterpillar has more than offset this weakness with price increases that have done little to dent overall demand. This speaks to the strength of the Caterpillar brand, the trust customers have for the companys products and the performance of the end markets that the company services.

At the same time, shares trade with a reasonable valuation and could provide double-digit return potential by my estimates. The dividend has been increased for 28 consecutive years and has a compound annual growth rate of 9% over the last decade. Overall, there is a lot to like about Caterpillar.

This article first appeared on GuruFocus.