Be Cautious About Under Armour (UAA) Stock Following Q2 Earnings

Shares of Under Armour UAA climbed Thursday after the sports apparel company reported better-than-expected second quarter revenue growth. Under Armour also posted an adjusted quarterly loss and said its restructuring costs will be higher than it initially anticipated.

Quick Q2 Overview

Under Armour’s Q2 revenues jumped roughly 8% to hit $1.17 billion, which topped our Zacks Consensus Estimate of $1.15 billion. However, the Baltimore-based company reported a total quarterly loss of $95.5 million, with $79 million coming from restructuring and impairment charges. UAA posted an adjusted loss of $0.08 per share, which matched our Q2 estimate.

Looking ahead, the company reaffirmed its fiscal 2018 adjusted earnings guidance to come in between $0.14 and $0.19 per share, with the high-end above our current $0.19 estimate. Under Armour expects its top line to climb by approximately 3% to 4%, which the firm noted would reflect international expansion of around 25% and a low to mid-single digit decline in North America.

The Good

Under Armour’s direct-to-consumer business hit $414 million in the second quarter, which marked a 7% jump and represented 35% of global revenues. This is a step in the right direction as the company bolsters its e-commerce unit in order to adapt in a new retail age. The firm, like fellow sportswear companies Nike NKE and Adidas ADDYY, has started to focus more on its own stores and online sales as Amazon AMZN dries up some traditional retail business from Dick’s Sporting Goods DKS and others.

Investors will also likely be pleased to note that Under Armour saw its revenues outside of North America surge by 28% to hit $302 million. Europe, the Middle East, and Africa revenues climbed 31% to $136 million, while the Asia-Pacific region jumped 34% to touch $126 million. UAA’s revenues popped by 7% in Latin America to touch $41 million.

Under Armour’s apparel revenues also climbed by nearly 10% to hit $747 million, and footwear sales surged over 14% to hit $271 million. However, the company saw just a 2% increase in North America sales, which is not a great sign for the company that still relies heavily on its domestic market.

The Bad

UAA saw its North American sales hit $843 million, which represented roughly 72% of the company’s total second quarter revenues. Meanwhile, international sales accounted for just 26%—with connected fitness making up the other roughly 2%.

Wholesale revenues climbed by more than UAA’s direct-to-consumer business at 9% to reach $710 million, and accounted for over 60% of revenues. This is not necessarily bad, but the industry is headed in an e-commerce and direct-to-consumer direction, so investors likely want to see direct-to-consumer growth come in better than wholesale.

The company also said that it expects to incur between $190 million and $210 million of pretax restructuring and related charges in 2018, up from its February estimates that called for $110 million to $130 million.

The Really Bad?

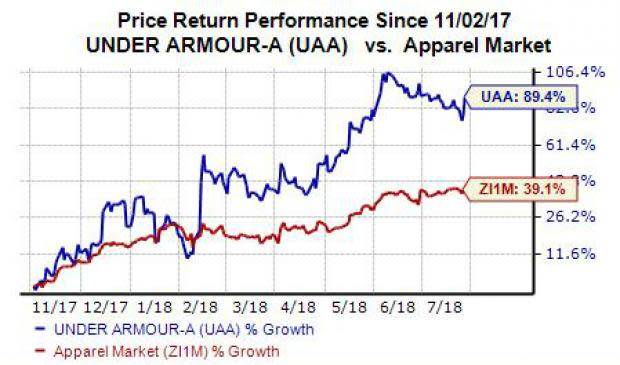

Shares of UAA tumbled from the fall of 2015 until the fall of 2017, when Under Armour stock hit its lowest point since 2013. Under Armour has seen its stock price skyrocket nearly 90% since its post-Q3 fiscal 2017 sell-off. Over the last six month, shares of UAA are up roughly 54%, prior to Thursday’s gains. This crushed the S&P 500’s near stagnation and its industry’s 13% climb.

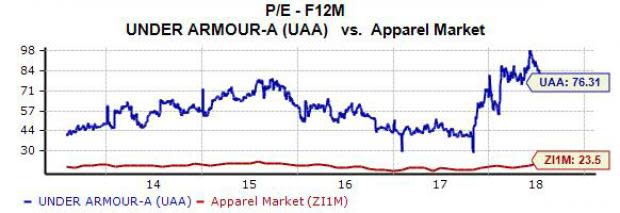

With Under Armour’s huge climb comes a rather stretched valuation picture. UAA is currently trading at 76.3X forward 12-month Zacks Consensus EPS estimates, which marks a massive premium to its industry’s 23.5X average and Nike’s 28.8X. The company has traded as high as 97.6X over the last year, but it has also traded as low as 29.1X. Looking back even further, investors will note that UAA stock appears rather expensive at its current level.

Looking Ahead

Under Armour is projected to see its full-year revenues climb by 3.8% to hit $5.17 billion, based on our current estimates. Plus, the firm’s adjusted earnings are expected to fall by over 5%. At this point, it might be wise to just watch UAA after its stellar run, especially as it faces competition from not just Nike and Adidas, but Lululemon LULU and others while it struggles to grow in the widely popular athleisure category.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

NIKE, Inc. (NKE) : Free Stock Analysis Report

Adidas AG (ADDYY) : Free Stock Analysis Report

Under Armour, Inc. (UAA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research