Cboe Global (CBOE) Raises Medium-Term Financial Target

Cboe Global Markets Inc. CBOE has unveiled its medium-term growth goals. Boasting one of the world’s largest global derivatives and securities networks, CBOE Global expects to deliver total net revenue growth of 5-7% annually, an increase from 4-6% growth expected earlier. For the first time, CBOE guided medium-term return on invested capital target of at least 10%.

While Cboe Global expects Data and Access Solutions to contribute organic net revenue growth of 7- 10% annually over the medium term, derivatives initiatives will likely contribute 2-4% of total organic net revenue growth over the medium term. Organic growth remains Cboe Global’s key strength.

CBOE’s growth strategy revolves around expanding its product line across asset classes, broadening geographic reach to highest value markets, diversifying business mix with recurring revenues, ramping up growth with recurring non-transaction revenues and leveraging technology. Cboe Global expects medium- to long-term organic total net revenue growth of 4-6%.

Cboe Global’s strategic priorities include expanding the BIDS network in the Asia Pacific in 2022, first into Australia and then Japan. It has already launched futures and options on five country-specific indices and one pan-European index. Cboe Global remains on track to grow its recurring non-transaction revenues and expand BIDS Trading. In June 2021, Cboe Global announced a plan to launch Cboe LIS powered by BIDS in Canada to expand BIDS' block trading platform in February 2022.

This Zacks Rank #2 (Buy) company remains focused on deploying its capital prudently in organic opportunities and strategic mergers and acquisitions as well as growing dividend and opportunistically repurchasing shares.

A few other players from the same space like Nasdaq Inc. NDAQ and Intercontinental Exchange ICE have also provided guidance.

Nasdaq, a leading provider of trading, clearing, marketplace technology, regulatory, securities listing, information, also remains focused on achieving its medium-term plans. Nasdaq’s organic growth has been aided by its strategy of accelerating its non-trading revenue base, which includes market technology, listing and information revenues. Nasdaq management’s long-term outlook calls for 5-7% growth, thereby infusing dynamism in its business profile.

Nasdaq estimates 5%-8% revenue organic growth at Investment Intelligence, 8%-11% at Market Technology and 3%-5% at Corporate Platforms over the medium term.

With its third-quarter earnings release, Intercontinental Exchange guided fourth-quarter recurring revenues between $892 million and $907 million. Intercontinental Exchange expects recurring revenues at ICE Mortgage Technology to grow sequentially and be in the range of $147 million to $152 million in the fourth quarter of 2021, indicating around 25% growth year over year.

Concurrently, Intercontinental Exchange guided recurring revenues in Fixed Income and Data Services segment to improve sequentially to a range of $415 million to $420 million and in the range of $330 million and $335 million at Exchange segment.

Another Stock to Consider

Another top-ranked player from the same industry is OTC Markets Group OTCM.

Sporting a Zack Rank #1 (Strong Buy), OTC Markets Group has witnessed the Zacks Consensus Estimate for 2021 and 2022 move up 4.6% and 7.4% in the past seven days. The expected long-term earnings growth rate is pegged at 9%, in line with the industry average.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Price Performance

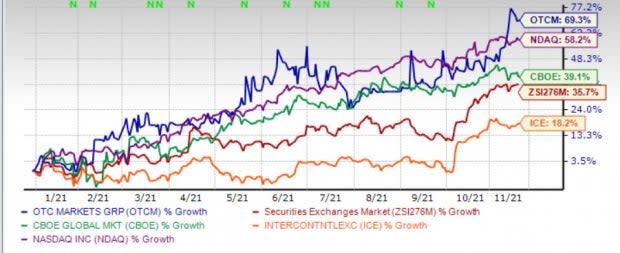

Shares of Cboe Global, Nasdaq and OTC Markets have rallied 39.1%, 58.2% and 69.3% year to date, outperforming the industry’s increase of 35.7%. Intercontinental Exchange has gained 18.2% in the same time frame.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intercontinental Exchange Inc. (ICE) : Free Stock Analysis Report

Nasdaq, Inc. (NDAQ) : Free Stock Analysis Report

Cboe Global Markets, Inc. (CBOE) : Free Stock Analysis Report

OTC Markets Group Inc. (OTCM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research