Celanese (CE) Surpasses Earnings and Sales Estimates in Q4

Celanese Corporation CE logged earnings from continuing operations of $12.50 per share in fourth-quarter 2020, up from 35 cents in the year-ago quarter.

Barring one-time items, adjusted earnings were $2.09 per share, up from $1.99 in the year-ago quarter. The figure surpassed the Zacks Consensus Estimate of $1.72.

Revenues of $1,591 million increased 11% year over year and beat the Zacks Consensus Estimate of $1,412.1 million.

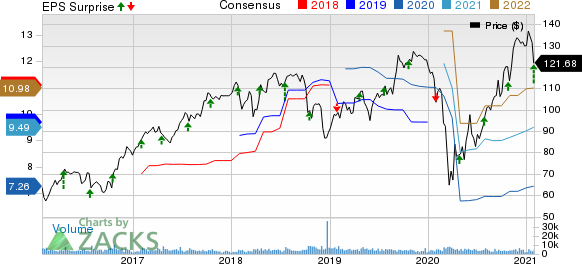

Celanese Corporation Price, Consensus and EPS Surprise

Celanese Corporation price-consensus-eps-surprise-chart | Celanese Corporation Quote

Segment Review

Net sales in the Engineered Materials unit were $572 million in the fourth quarter, up 6.1% year over year. The segment witnessed demand recovery at the year end, yet volumes were below prior year’s levels in automotive, electronics, consumer and medical end markets.Volumes rose sequentially in the quarter on the back of strong demand recovery across several end markets, while pricing was flat.

The Acetyl Chain segment posted net sales of $910 million, up 18% year over year. The segment displayed the resiliency of its business model, despite significant industry headwinds. It saw higher demand levels toward the end of 2020. Volumes and pricing rose sequentially in the quarter due to tightened industry conditions in November and December.

Net sales in the Acetate Tow segment were $134 million, down 9.5% year over year.

FY20 Results

Earnings (as reported) for full-year 2020 were $16.85 per share compared with $6.89 per share a year ago. Net sales fell 10.2% year over year to roughly $5.7 billion.

Financials

Celanese ended the quarter with cash and cash equivalents of $955 million, up 106.3% year over year. Long-term debt fell 5.3% year over year to $3,227 million.

Celanese generated operating cash flow of $1.3 billion and free cash flow of $950 million in 2020. Capital expenditures amounted to $364 million in 2020.

The company also executed on controllable initiatives during 2020 including more than $200 million in productivity actions amid the pandemic.

Outlook

Celanese stated that the global demand during the fourth quarter recovered and end-markets progressed toward pre-pandemic levels. It expects current demand conditions to persist and favorable Acetyl Chain industry dynamics to continue in the first quarter of 2020. It expects contributions from its controllable actions as well as demand recovery to help it deliver adjusted earnings of $9.50-$10 per share in 2021.

Price Performance

Celanese’s shares have gained 10.5% in the past year compared with 10.6% rise of the industry.

Zacks Rank & Other Key Picks

Celanese currently carries a Zacks Rank #2 (Hold).

Some other top-ranked stocks in the basic materials space are Fortescue Metals Group Limited FSUGY, BHP Group BHP and Impala Platinum Holdings Limited IMPUY.

Fortescue has a projected earnings growth rate of 75.5% for the current fiscal. The company’s shares have surged around 131.7% in a year. It currently sports a Zacks Rank #1(Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BHP has an expected earnings growth rate of 59.5% for the current fiscal. The company’s shares have gained around 30.8% in the past year. It currently flaunts a Zacks Rank #1.

Impala has an expected earnings growth rate of 189.4% for the current fiscal. The company’s shares have rallied around 41.1% in the past year. It currently sports a Zacks Rank #1.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BHP Group Limited (BHP) : Free Stock Analysis Report

Impala Platinum Holdings Ltd. (IMPUY) : Free Stock Analysis Report

Fortescue Metals Group Ltd. (FSUGY) : Free Stock Analysis Report

To read this article on Zacks.com click here.