Celanese Hikes Price of Engineered Materials Polymer Products

Celanese Corporation CE is raising the prices of Engineered Materials Polymer Products. The price hike will be put into effect for orders shipped on or after Sep 17, or as contracts permit.

The company will hike the price of Polyamide 66 compounded products by 35 cents per lb in America. Prices of the same will be raised by 60 euro cents per Kg in Europe and 75 cents per Kg in Asia. Prices of Polyamide 6 compounded products will be hiked by 10 cents per lb in America and 25 cents per Kg in Asia. Moreover, prices of Ecomid/Nylfor R will rise by 10 cents per lb in America and the same will be hiked by 40 euro cents per Kg in Europe and 25 cents per Kg in Asia.

Celanese has outperformed the industry in a year’s time. While shares of the company have moved up around 18.6%, the industry saw a rough 6.3% rise.

The company’s strategic measures, including acquisitions and operational cost savings through productivity actions and efficiency enhancement, are likely to boost earnings in 2018. Earnings are expected to be driven by productivity actions, price hike actions and operational improvement.

In July, Celanese raised its adjusted earnings per share guidance for 2018 to roughly $10.50-$10.75 based on strength across Engineered Materials (EM) and Acetyl Chain units. The company expects the Acetyl Chain momentum to continue in the third quarter.

Sales from the EM unit increased year over year in the second quarter. Growth in Asia and the Americas, better product mix, recent acquisitions and project commercializations contributed to the division’s earnings. Nilit and Omni Plastics acquisitions are expected to drive earnings in the Engineered Materials unit.

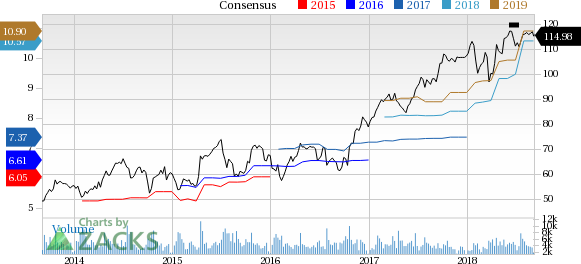

Celanese Corporation Price and Consensus

Celanese Corporation Price and Consensus | Celanese Corporation Quote

Zacks Rank & Other Stocks to Consider

Celanese is a Zacks Rank #1 (Strong Buy) stock.

Some other top-ranked companies in the basic materials space are Huntsman Corporation HUN, Ingevity Corporation NGVT and Air Products and Chemicals, Inc. APD.

Huntsman has an expected long-term earnings growth rate of 8.5% and a Zacks Rank #1. The company’s shares have gained 11.7% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ingevity has an expected long-term earnings growth rate of 12% and a Zacks Rank #1. The company’s shares have rallied 61.8% in the past year.

Air Products has an expected long-term earnings growth rate of 16.2% and a Zacks Rank #2 (Buy). Its shares have gained 14.6% in a year’s time.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

Huntsman Corporation (HUN) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

Ingevity Corporation (NGVT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research