Cenovus (CVE) Shares Gain 2.6% Despite Q3 Earnings Miss

Cenovus Energy Inc. CVE shares have gained 2.6% despite reporting lower-than-expected third-quarter 2022 earnings on Nov 2, before the opening bell. The upward price movement can be attributed to the company’s debt-management abilities and a strong commitment to returning capital to shareholders.

Q3 Results

Cenovus reported third-quarter earnings per share of 62 cents, missing the Zacks Consensus Estimate of earnings of 78 cents. The bottom line significantly improved from the year-ago quarter’s earnings of 21 cents per share.

Total quarterly revenues of $17,471 million surpassed the Zacks Consensus Estimate of $10,412 million. The top line also increased from the year-ago quarter’s $12,701 million.

Lower-than-expected quarterly earnings can be attributed to higher transportation and blending expenses, and expenses for purchased products. The negatives were partially offset by higher contributions from the upstream segment.

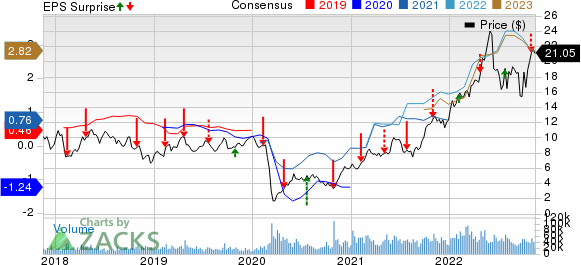

Cenovus Energy Inc Price, Consensus and EPS Surprise

Cenovus Energy Inc price-consensus-eps-surprise-chart | Cenovus Energy Inc Quote

Operational Performance

Upstream

The quarterly operating margin from the Oil Sands unit was C$2,220 million, improving from C$1,923 million reported a year ago.

In the September-end quarter, the company recorded daily oil sand production of 585 thousand barrels, down 2% year over year due to lower contribution from its Foster Creek operation.

The operating margin at the Conventional unit was C$290 million, up from C$191 million in the year-ago quarter. In the third quarter, the company recorded daily liquid production of 26.8 thousand barrels, down 14.9% year over year.

The Offshore segment generated an operating margin of C$339 million, up from C$328 million in the year-ago quarter. In the reported quarter, the company recorded daily offshore liquid production of 21.3 thousand barrels.

Downstream

From the Canadian Manufacturing unit, the company reported an operating margin of C$249 million, up from C$130 million in the year-ago quarter. The company recorded Crude Oil processed volumes of 98.5 thousand barrels per day (MBbl/D).

The operating margin from the U.S. Manufacturing unit was C$244 million, up from C$122 million in the prior-year quarter. Crude oil processed volumes were 435 MBbl/D, signifying a decline from 445.8 MBbl/D in the year-ago quarter.

For the Retail unit, the company reported an operating loss of C$3 million, turning around from an operating income of C$16 million in the prior-year quarter.

Expenses

Transportation and blending expenses in the reported quarter increased to C$2,684 million from C$1,966 million a year ago. Expenses for purchased products rose to C$10,012 million from C$6,691 million in the prior-year quarter.

Capital Investment & Balance Sheet

The company made a total capital investment of C$2,467 million in the quarter under review.

As of Sept 30, 2022, the Canadian energy player had cash and cash equivalents of C$3,494 million. Total long-term debt was C$8,774 million. Its total debt-to-capitalization was 24%.

Outlook

For 2022, Cenovus reiterated its upstream production guidance of 780,000-810,000 barrels of oil equivalent per day (Boe/d). It expects daily oil sand production of 574-620 thousand barrels for the year.

The company expects a downstream throughput volume of 530,000-580,000 barrels per day for 2022.

Cenovus stated its upstream capital expenditure guidance of $2.1-$2.4 billion for the year.

Zacks Rank & Stocks to Consider

Cenovus currently carries a Zacks Rank #5 (Strong Sell).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Equinor ASA EQNR reported third-quarter adjusted earnings per share of $2.12, beating the Zacks Consensus Estimate of $1.78. The strong quarterly earnings were driven by higher commodity prices and production.

Equinor’s board increased its extraordinary cash dividend to 70 cents per share from 50 cents per share for the third of 2022. This reflects the firm’s strong commitment to returning capital to shareholders.

Patterson-UTI Energy PTEN reported a third-quarter 2022 adjusted net profit of 28 cents per share, beating the Zacks Consensus Estimate of a profit of 19 cents. The outperformance was driven by solid segmental performances.

In good news for investors, Patterson-UTI doubled its quarterly cash dividend to 8 cents per share from the previous 4-cent payout. The dividend will be paid out on Dec 15, 2022, to shareholders of record as of Dec 1, 2022. PTEN also increased its share repurchase authorization to $300 million.

Marathon Petroleum Corporation MPC reported third-quarter 2022 adjusted earnings per share of $7.81, comfortably beating the Zacks Consensus Estimate of $6.80. The bottom line was favorably impacted by the stronger-than-expected performance of its Refining & Marketing segment.

In October, Marathon Petroleum completed its target to buy back $15 billion in common stock. Currently, MPC has the remaining authorization of $5 billion with no expiration date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PattersonUTI Energy, Inc. (PTEN) : Free Stock Analysis Report

Cenovus Energy Inc (CVE) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research