Centene (CNC) Q4 Earnings Surpass Estimates, Tumble Y/Y

Centene Corporation CNC reported fourth-quarter 2020 adjusted earnings per share of 46 cents, beating the Zacks Consensus Estimate of 45 cents by 2.2% on the back of higher revenues. However, the bottom line plunged 37% year over year.

For the fourth quarter, total revenues surged 50% to $28.3 billion from the year-ago period, primarily aided by the WellCare buyout, growth in Medicaid and Health Insurance Marketplace business plus expansions and new programs across many states. However, this upside was offset by the Illinois health plan divestiture.

Moreover, the top line missed the consensus mark by 0.6%

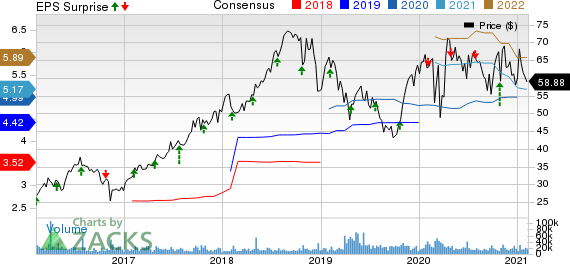

Centene Corporation Price, Consensus and EPS Surprise

Centene Corporation price-consensus-eps-surprise-chart | Centene Corporation Quote

Quarterly Operational Update

As of Dec 31, 2020, managed care membership came in at 25.5 million, up 67% year over year.

Health Benefit Ratio (HBR) for the reported quarter was 88.4%, flat year over year. This can be attributed to the prevalent COVID-led lower medical utilization trends as well as the reinstatement of the health insurer fee.

Adjusted Selling, General & Administrative (SG&A) expense ratio was 9.7% in the quarter compared with 9.5% in the same period last year.

Financial Update

As of Dec 31, 2020, the company's cash and cash equivalents totaled $10.8 billion, down 10.9% from the figure at 2019 end.

As of Dec 31, 2020, total assets were up 67.6% to $68.7 billion from the level at 2019 end.

Centene’s long-term debt summed $16.7 billion, up 22.3% from the figure at 2019 end.

Net cash provided by operating activities as of Dec 31, 2020 was $5.5 billion compared with net cash provided by operating activities of $1.4 billion a year ago.

2020 Outlook

Following fourth-quarter results, the company issued its 2021 guidance. Management expects total revenues to range between $116.1 and$118.1 billion.

Adjusted EPS of Centene is projected in the band of $5-$5.30 per share.

Adjusted SG&A expense ratio is estimated at 8.3-8.8%.

Full-Year Update

For 2020, total revenues came in at $111.1 billion, up 49% year over year. Adjusted EPS of the company stood at $5 per share, up 13.1% year over year. This also compared favorably with the Zacks Consensus Estimate of $4.99 per share.

HBR for the full year came in at 86.2% compared with the 2019 reported figure of 87.3%.

Adjusted SG&A expense ratio of 8.9% for 2020 compared favorably with 9.2% for 2019.

Zacks Rank and Performance of Other Players

Centene carries a Zacks Rank #5 (Strong Sell), currently.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other players from the medical space that have reported fourth-quarter earnings so far, the bottom-line results of UnitedHealth Group Incorporated UNH and HCA Healthcare Inc. HCA beat estimates while that of Anthem, Inc. ANTM missed the same.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

Anthem, Inc. (ANTM) : Free Stock Analysis Report

To read this article on Zacks.com click here.