The Centerra Gold (TSE:CG) Share Price Has Gained 34% And Shareholders Are Hoping For More

It hasn't been the best quarter for Centerra Gold Inc. (TSE:CG) shareholders, since the share price has fallen 15% in that time. On the bright side the returns have been quite good over the last half decade. After all, the share price is up a market-beating 34% in that time.

View our latest analysis for Centerra Gold

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Centerra Gold has made a profit in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. So it might be better to look at other metrics to try to understand the share price.

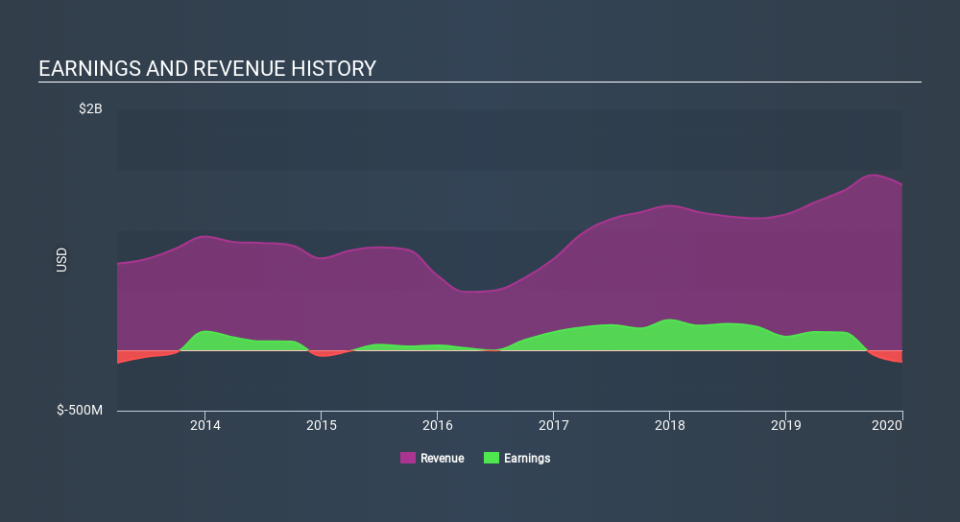

The modest 1.8% dividend yield is unlikely to be propping up the share price. On the other hand, Centerra Gold's revenue is growing nicely, at a compound rate of 16% over the last five years. In that case, the company may be sacrificing current earnings per share to drive growth.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Centerra Gold's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Centerra Gold the TSR over the last 5 years was 38%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Centerra Gold shareholders have received a total shareholder return of 26% over one year. And that does include the dividend. That gain is better than the annual TSR over five years, which is 6.7%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. You could get a better understanding of Centerra Gold's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

We will like Centerra Gold better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.