Champions Oncology Inc (CSBR) And The Healthcare Industry Prospect For 2017

Champions Oncology Inc (NASDAQ:CSBR), a USD$36.03M small-cap, operates in the healthcare industry, which has experienced tailwinds from issues such as higher demand driven by an aging population and the increasing prevalence of diseases and comorbidities. Healthcare analysts are forecasting for the entire industry, a strong double-digit growth of 22.30% in the upcoming year, and an enormous growth of 54.12% over the next couple of years. Not surprisingly, this rate is more than double the growth rate of the US stock market as a whole. Today, I will analyse the industry outlook, as well as evaluate whether CSBR is lagging or leading in the industry. See our latest analysis for CSBR

What’s the catalyst for CSBR's sector growth?

Companies operating in the life sciences sector are confronted with ways to improve R&D productivity, increase the efficiency of its operations, rationalise spending on sales and marketing and enhance financial performance. Over the past year, the industry saw growth of 9.56%, beating the US market growth of 4.49%. CSBR leads the pack with its impressive earnings growth of 59.30% over the past year. This proven growth may make CSBR a more expensive stock relative to its peers.

Is CSBR and the sector relatively cheap?

The life sciences industry is trading at a PE ratio of 39x, higher than the rest of the US stock market PE of 22x. This illustrates a somewhat overpriced sector compared to the rest of the market. However, the industry did return a higher 12.85% compared to the market’s 9.99%, which may be indicative of past tailwinds. Since CSBR’s earnings doesn’t seem to reflect its true value, its PE ratio isn’t very useful. A loose alternative to gauge CSBR’s value is to assume the stock should be relatively in-line with its industry.

What this means for you:

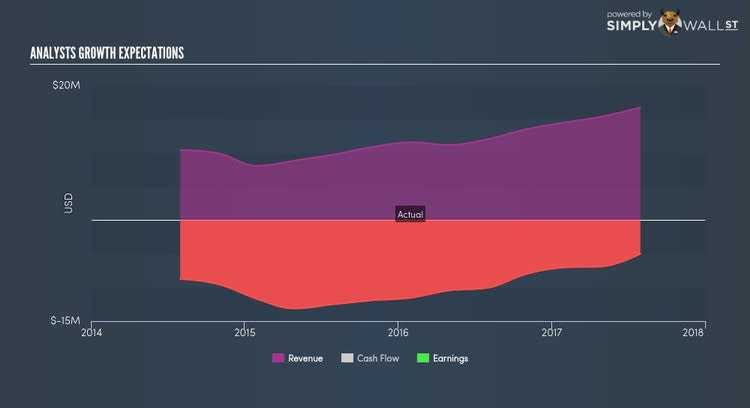

Are you a shareholder? CSBR recently delivered an industry-beating growth rate in earnings, which is a positive for shareholders. If you’re bullish on the stock and well-diversified by industry, you may decide to hold onto CSBR as part of your portfolio. However, if you’re relatively concentrated in life sciences, you may want to value CSBR based on its cash flows to determine if it is overpriced based on its current growth outlook.

Are you a potential investor? If CSBR has been on your watchlist for a while, now may be the time to enter into the stock, if you like its ability to deliver growth and are not highly concentrated in the life sciences industry. Before you make a decision on the stock, take a look at CSBR’s cash flows and assess whether the stock is trading at a fair price.

For a deeper dive into Champions Oncology's stock, take a look at the company's latest free analysis report to find out more on its financial health and other fundamentals. Interested in other healthcare stocks instead? Use our free playform to see my list of over 1000 other healthcare companies trading on the market.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.