Charles River's (CRL) New CDMO Tie-Up to Boost Clinical Trials

Charles River Laboratories International, Inc. CRL recently announced a viral vector contract development and manufacturing organization (CDMO) partnership with Rznomics Inc. South Korea-based biopharmaceutical company Rznomics will leverage Charles River’s viral vector CDMO experience to initiate clinical development of its RNA-based anticancer gene therapy in liver cancer patients.

The latest partnership is a significant stepping stone for Charles River and is expected to solidify its foothold in the global CDMO space. The company’s CDMO services are a part of its Biologics Solutions business, a part of the broader Manufacturing Solutions segment.

Rationale Behind the Tie-Up

Rznomics’ RZ-001 is the first ribozyme-based RNA reprogramming approach approved by the FDA for assessment in patients. The treatment, which was developed utilizing Rznomics’ proprietary RNA reprogramming and editing technology, takes the form of an adenoviral vector that expresses an hTERT targeting ribozyme to treat hepatocellular carcinoma (HCC) patients. Per estimates, HCC is the most common type of primary liver cancer and accounts for approximately 80% of cases worldwide.

Charles River’s high-yield, optimized methods will likely increase the speed of clinical manufacturing by reducing process development time and costs while ensuring the highest quality products.

Per Charles River’s management, the tie-up, which will utilize its CDMO capabilities, is expected to bring the RZ-001, a potentially curative therapy, to HCC patients.

Rznomics’ management feels this partnership will enable it to bring its leading pipeline, RZ-001, into clinical development.

Industry Prospects

Per a report by Fortune Business Insights, the global CDMO market was estimated to be $130.8 billion in 2018 and is anticipated to reach $278.98 billion by 2026 at a CAGR of 10%. Factors like the growing demand for novel therapies and increasing investments in healthcare infrastructure are likely to drive the market.

Given the market potential, the latest tie-up is expected to significantly strengthen Charles River’s global CDMO services portfolio.

Recent Developments

This month, Charles River announced the launch of its new CliniPrime suite of Good Manufacturing Practice-compliant cellular starting materials.

The same month, Charles River announced the launch of its eXpDNA plasmid platform, established from its CDMO and biologics testing experience.

Last month, Charles River launched the Endosafe Nexus 200, expanding its endotoxin testing portfolio. The Nexus 200, powered by Endosafe EndoScan-V version 6.1, allows for data to be exported into a Laboratory Information Management System integration and provides improved traceability, security and data management on an integrated touch screen.

Price Performance

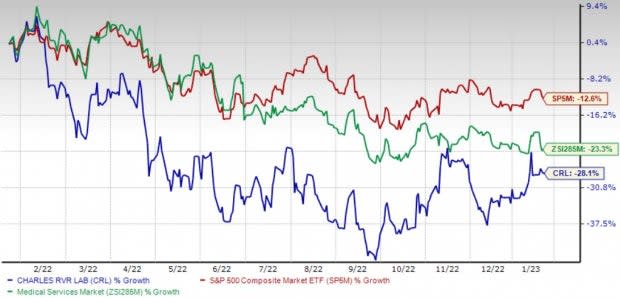

Shares of the company have lost 28.1% in the past year compared with the industry’s 23.3% decline and the S&P 500's 12.7% fall.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Currently, Charles River carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space are AMN Healthcare Services, Inc. AMN, Cardinal Health, Inc. CAH and Merit Medical Systems, Inc. MMSI.

AMN Healthcare, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 3.3%. AMN’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 10.9%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMN Healthcare has gained 2.9% against the industry’s 23.3% decline in the past year.

Cardinal Health, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11.7%. CAH’s earnings surpassed estimates in two of the trailing four quarters and missed the same in the other two, the average beat being 3%.

Cardinal Health has gained 49.3% against the industry’s 1.6% decline over the past year.

Merit Medical, flaunting a Zacks Rank #1 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average beat being 25.4%.

Merit Medical has gained 24.7% against the industry’s 1.6% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Charles River Laboratories International, Inc. (CRL) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report