Charles Schwab and TD Ameritrade: Does the Deal Really Break Buffett's Rule on Acquisitions?

On Monday, Nov. 23, Charles Schwab Corp. (NYSE:SCHW) announced its $26 billion all-stock deal to acquire fellow online broker TD Ameritrade Holding Corp. (NASDAQ:AMTD). The deal is expected to be completed in late 2020, after which Schwab shareholders will own 69% of the combined company. Each TD Ameritrade share will be bought for 1.0837 Schwab shares, which will result in TD Ameritrade's largest shareholder, Toronto-Dominion Bank (NYSE:TD), getting a 13% stake, while the remaining 18% will go to TD Ameritrade's other shareholders.

Following the announcement of the deal, headlines started rolling out about how the deal breaks Warren Buffett (Trades, Portfolio)'s famous rule on acquisitions - that companies should not use their shares to make acquisitions. However, according to brokerage industry analysts, that particular rule should not apply to the Schwab-Ameritrade deal.

Cash premium

According to Morningstar analyst Michael Wong, "Even if Schwab shareholders gave up a little bit of the value by issuing shares, both are better off from this deal." This is largely due to the possibility that a cash deal would be too expensive for Schwab in the short term.

While $26 billion in stock is an acceptable amount for TD Ameritrade, it would likely balk at the idea of a $26 billion all-cash transaction. As of Dec. 4, TD Ameritrade's market cap is $27.87 billion and its enterprise value is $24.47 billion. Moreover, the synergies created by combining such similar businesses would demand a high cash premium on top of the paper value. Both companies provide investment products and electronic platforms for the trading of financial assets, so merging would grant the combined company 68% to 70% of all U.S. individual investment account assets.

As you can see in the chart below, investor sentiment holds that the merger would be profitable for both companies. Since the announcement, Charles Schwab shares have risen approximately 7%, while TD Ameritrade shares have risen approximately 3.7%.

Charles Schwab currently has approximately $20 billion in cash. Assuming that an all-cash price would need to go over the $30 billion mark in order to account for the premium of purchasing its largest competitor, it would be difficult for Charles Schwab to finance an all-cash transaction. Thus, it might be more profitable in this case to go ahead with an all-stock deal, especially since it leaves billions that could be used for share buybacks in the future.

Berkshire's failed all-stock deal

The acquisition of one online broker by another to create some sort of online mega-broker is quite a different situation from the one that led Warren Buffett (Trades, Portfolio) to the conclusion that no company should use its own stock to finance an acquisition.

In 1993, Buffett acquired Dexter Shoe Co. in a $400 million all-stock transaction, in what he would later proclaim as one of his worst mistakes as an investor. After cheaper alternatives to Dexter shoes flooded the market, the price of the company dropped to practically nothing within a few years.

"By using Berkshire stock, I compounded this error hugely," Buffett commented on the situation. "That move made the cost to Berkshire shareholders not $400 million, but rather $3.5 billion. In essence, I gave away 1.6% of a wonderful business - one now valued at $220 billion - to buy a worthless business."

The Berkshire-Dexter situation was a case of a conglomerate that would eventually earn most of its revenue from acquisitions making a poor acquisition choice of a very different type of company. In contrast, Schwab acquiring a competitor is much more of a natural acquisition, as it is essentially just making the company into a larger version of itself.

While losses of an acquired company are compounded in an all-stock purchase, gains can also be compounded if the combined company gains enough of a competitive edge, even if the profits must be split among a larger number of shares. This may well be the case with the Schwab-Ameritrade deal, as the combined company would nearly have a monopoly over investment account assets in the U.S.

Rule or guideline?

It is also important to consider that even Buffett himself has not completely conformed to his rule of not using stock to fund acquisitions. In February 2010, for example, Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) acquired the railroad Burlington North Santa Fe (BNSF) in a $26.5 billion cash-and-stock purchase ($15.9 billion cash and $10.6 billion newly issued Berkshire common stock).

In the 2009 Berkshire Hathaway annual report, Buffett wrote:

"In our BNSF acquisition, the selling shareholders quite properly evaluated our offer at $100 per share. The cost to us, however, was somewhat higher since 40% of the $100 was delivered in our shares, which Charlie and I believed to be worth more than their market value. Fortunately, we had long owned a substantial amount of BNSF stock that we purchased in the market for cash. All told, therefore, only about 30% of our cost overall was paid with Berkshire shares.

In the end, Charlie and I decided that the disadvantage of paying 30% of the price through stock was offset by the opportunity the acquisition gave us to deploy $22 billion of cash in a business we understood and liked for the long term."

The Burlington Northern deal was also mainly an investment in the overall health of the U.S. economy. As the U.S. recovered from the 2008-09 recession, Buffett knew that increasing economic activity would lead to increased profitability for railroads, so he had reasonable confidence that it was worth it to issue more stock to fund the expense.

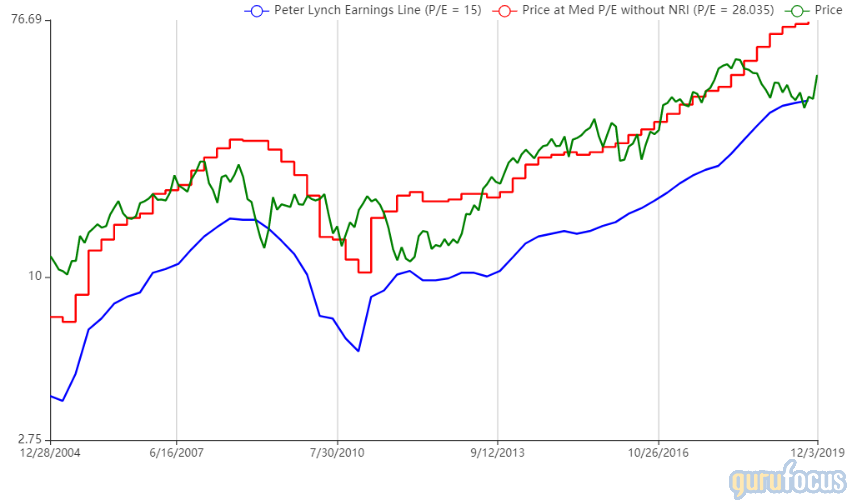

The bitter [ill to swallow in the Burlington Northern deal was that Berkshire stock was undervalued at the time due to the recent recession, so its had decreased purchasing power. According to the Peter Lynch chart below, shares of Charles Schwab were trading at the lower end of the fairly valued zone when the company made its offer for TD Ameritrade. However, this is offset by the fact that, as the same type of company, TD Ameritrade's share price has also suffered recently for the same reason - namely, the necessity of getting rid of online trading commissions in order to remain competitive against smaller brokers.

Conclusion

The Schwab-Ameritrade deal is more similar to Buffett's Burlington Northern acquisition than to his Dexter acquisition, so the rule of not using stock to fund acquisitions may not necessarily apply in this case.

Like the Burlington Northern deal, the stock that Schwab is issuing to purchase TD Ameritrade is an investment in the future of an industry at large. As small, new online broker startups spring up left and right, built from the ground up without commissions in mind, older and larger brokers like Schwab and TD Ameritrade may find it necessary to band together in order to cement their competitive advantage.

Disclosure: Author owns no shares in any of the stocks mentioned.

Read more here:

Chase Coleman's 3rd-Quarter Buys

Chris Davis' 3rd-Quarter Buys

Jeremy Grantham's 3rd-Quarter Buys

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.