Charles de Vaulx's IVA Worldwide Fund Boosts Sodexo and Acuity in 2nd Quarter

- By James Li

Charles de Vaulx (Trades, Portfolio), manager of the IVA Worldwide Fund, disclosed this week that his firm increased its holdings in several companies, including Sodexo (SW.PA), Acuity Brands Inc. (AYI) and Cimarex Energy Co. (XEC). The firm also established two new positions during the quarter: Daou Technology Inc. (023590.KS) and ASKUL Corp. (TSE:2678).

Warning! GuruFocus has detected 3 Warning Signs with BABA. Click here to check it out.

The intrinsic value of XPAR:SW

Fund underperforms in volatile global market

De Vaulx and co-portfolio manager Charles de Lardemelle said in their portfolio review that the IVA Worldwide Fund returned -1.27% during the quarter, lagging the MSCI All Country World Index by approximately 1.80%. Top detractors were in South Korean, Japanese and Irish companies, which returned -0.60%, -0.40% and -0.10%. The fund managers listed several geopolitical concerns that increased market volatility: rising U.S. interest rates, turmoil in emerging markets, political uncertainties in Europe and a simmering trade war between the U.S. and China.

Despite market volatility, de Vaulx and de Lardemelle said they were "net buyers" for the quarter, adding to existing positions and "finding new names in Japan and South Korea."

Sodexo

De Vaulx and de Lardemelle added 1,297,995 shares of Sodexo for an average price of 82.68 euros ($96.76) per share. The fund managers increased their equity portfolio 2.96% with this transaction. As of quarter-end, Sodexo represents the firm's eighth-largest holding in terms of portfolio weight.

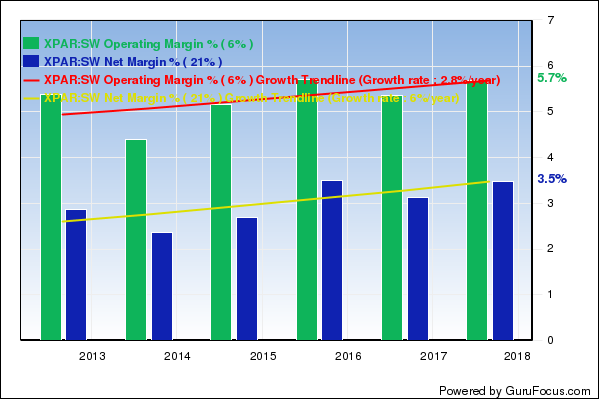

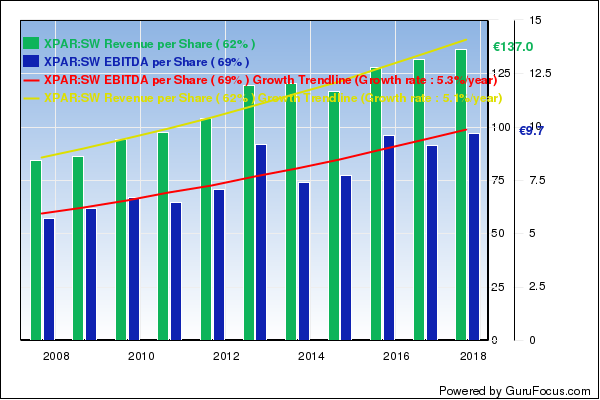

Sodexo, which is based in France, operates on-premise catering facilities in over 80 countries worldwide. GuruFocus ranks the company's profitability 8 out of 10 on several positive investing signs, which include consistent revenue growth and a strong Piotroski F-score of 8. The company's operating margins have increased approximately 2.80% per year over the past five years despite underperforming 56% of global competitors.

GuruFocus ranks Sodexo's business predictability three stars out of five as the company had consistent revenue growth over the past 10 years.

Acuity Brands

The fund managers added 756,603 shares of Acuity Brands for an average price of $121.89 per share, boosting the equity portfolio 2%.

The Atlanta-based company provides lighting and building management solutions and services for commercial, institutional, industrial and residential applications. GuruFocus ranks the company's profitability 7 out of 10 and lists expanding operating margins as a positive investing sign. Additionally, Acuity Brands' return on equity is outperforming 89% of global competitors.

Cimarex

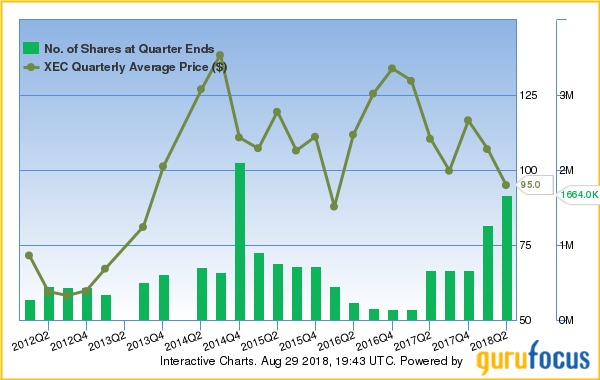

The fund managers added 400,179 shares of Cimarex for an average price of $95 per share, boosting the equity portfolio 0.93%.

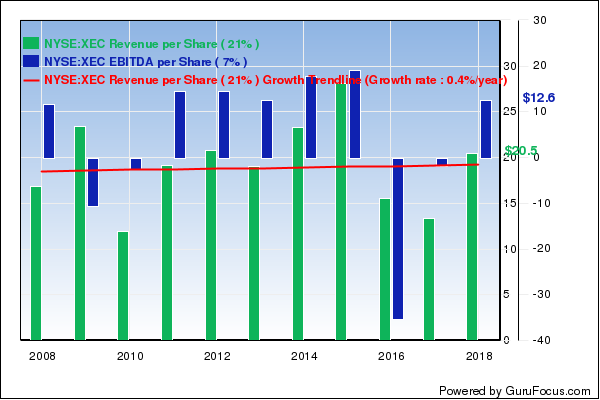

Denver-based Cimarex engages in the exploration and production of oil and gas throughout the southern and central U.S. GuruFocus ranks the company's profitability 6 out of 10: although the margins and returns outperform 88% of global competitors, Cimarex's revenue has declined approximately 5.30% over the past five years.

New buys

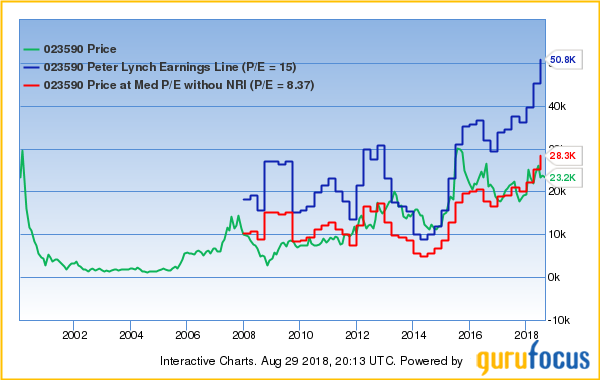

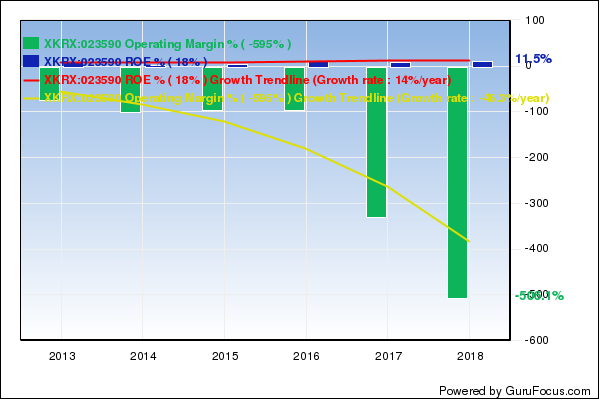

De Vaulx and de Lardemelle invested in 502,499 shares of Daou Technology for an average price of 24,023.30 Korean won ($21.63) per share and 98,300 shares of ASKUL Corp. for an average price of 3374.46 yen ($30.21) per share. The fund managers dedicated 0.31% of their equity portfolio to these two positions in the aggregate.

South Korea-based Daou Technology provides information technology products and solutions, with brands including Terrace mail, Unicro, Enfax and Citrix. GuruFocus ranks the company's profitability 2 out of 10 on several red flags , including a weak Piotroski F-score of 3. Daou's operating margin of -56.99% underperforms 90% of global competitors.

ASKUL, a Japanese office equipment retailer, has a profitability rank of 6. Even though operating margins of 1.16% underperform 68% of global competitors, ASKUL's three-year revenue growth rate of 12.10% outperforms 81% of global specialty retail companies.

Disclosure: No positions.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Signs with BABA. Click here to check it out.

The intrinsic value of XPAR:SW