Chase Coleman Trims Redfin, JD.com

- By Tiziano Frateschi

Tiger Global Management founder Chase Coleman (Trades, Portfolio), who started his career working for Julian Robertson (Trades, Portfolio), now manages a portfolio of more than $19 billion. During the second quarter, he sold shares of the following stocks.

Warning! GuruFocus has detected 4 Warning Signs with CRM. Click here to check it out.

The intrinsic value of RDFN

The guru trimmed 69.40% off his Redfin Corp. (RDFN) stake, impacting the portfolio by -0.81%.

The residential real estate brokerage company has a market cap of $1.75 billion and an enterprise value of $1.56 billion.

GuruFocus gives the company a profitability and growth rating of 2 out of 10. The return on equity of -172.91% and return on assets of -9.64% are underperforming 95% of companies in the Global Real Estate Services industry. Its financial strength is rated 9 out of 10. The cash-debt ratio of 55.62 is above the industry median of 0.33.

Coleman is the largest guru shareholder of the company with 2.65% of outstanding shares, followed by Robertson with 0.13%.

The TransDigm Group Inc. (TDG) holding was reduced by 11.97%. The trade had an impact of -0.68% on the portfolio.

The company, which is engaged in the production of commercial and military aircraft components, has a market cap of $18.68 billion and an enterprise value of $29.72 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on assets of 8.38% and return on capital of 120.53% are outperforming 82% of companies in the Global Aerospace and Defense industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.14 is below the industry median of 0.53.

Coleman is the company's largest guru shareholder with 4.63% of outstanding shares, followed by Steve Mandel (Trades, Portfolio) with 3.35% and Ron Baron (Trades, Portfolio) with 0.76%.

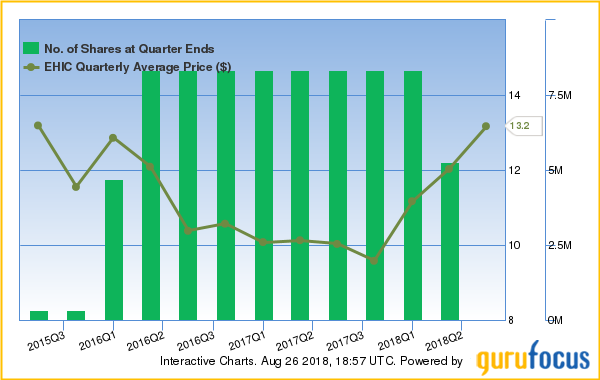

The guru exited his position in eHi Car Services Ltd. (EHIC). The transaction had an impact of -0.41% on the portfolio.

The car rental company has a market cap of $882.68 million and an enterprise value of $1.62 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of 2.37% and return on assets of 1.12% are underperforming 61% of companies in the Global Rental and Leasing Services industry. Its financial strength is rated 5 out of 10. Its cash-debt ratio of 0.12 is below the industry median of 0.66.

Jim Simons (Trades, Portfolio) is the largest guru shareholder of the company with 1.94% of outstanding shares.

The JD.com Inc. (JD) stake was reduced by 1.58%. The trade had an impact of -0.18% on the portfolio.

The Chinese online direct sales company has a market cap of $44.8 billion and an enterprise value of $40.83 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of -1.04% and return on assets of -0.29% are underperforming 65% of companies in the Global Specialty Retail industry. Its financial strength is rated 6 out of 10. Its cash-debt ratio of 2.21 is above the industry median of 0.99.

Coleman is the largest guru shareholder of the company with 2.82% of outstanding shares, followed by Dodge & Cox with 1.84% and Ken Fisher (Trades, Portfolio) with 0.74%.

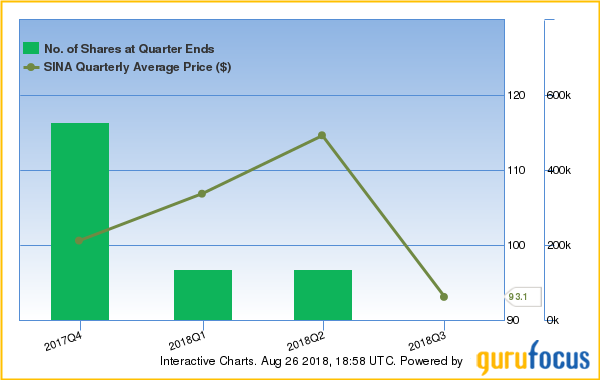

The guru divested of his SINA Corp. (SINA) holding, impacting the portfolio by -0.09%.

The online media company has a market cap of $4.99 billion and an enterprise value of $4.29 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 5.66% and return on assets of 2.93% are outperforming 55% of companies in the Global Internet Content and Information industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 2.40 is below the industry median of 7.46.

Pioneer Investments (Trades, Portfolio) is the company's largest guru shareholder with 0.35% of outstanding shares, followed by Louis Moore Bacon (Trades, Portfolio) with 0.35% and Simons with 0.3%.

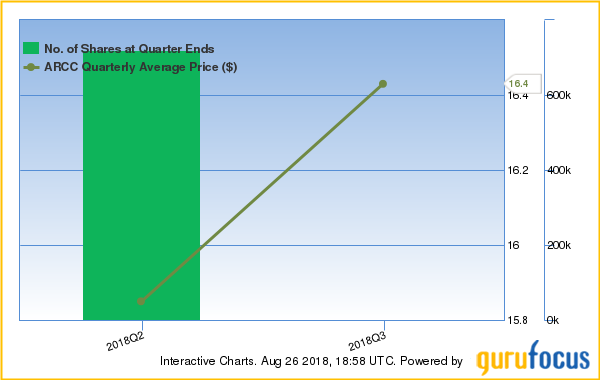

The Ares Capital Corp. (ARCC) position was closed, impacting the portfolio by -0.08%.

The specialty finance company has a market cap of $7.42 billion and an enterprise value of $11.45 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of 12.17% and return on assets of 7.03% are outperforming 70% of companies in the Global Asset Management industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.11 is well below the industry median of 85.28.

Columbia Wanger (Trades, Portfolio) is the largest guru shareholder of the company with 0.6% of outstanding shares, followed by NWQ Managers (Trades, Portfolio) with 0.24% and Scott Black (Trades, Portfolio) with 0.03%.

Disclosure: I do not own any stocks mentioned in this article.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Signs with CRM. Click here to check it out.

The intrinsic value of RDFN