Cheap Stocks With Growing EPS

- By Tiziano Frateschi

Companies with growing earnings per share (EPS) are often good investments as they can return a solid profit to investors. Here is a selection of the most undervalued companies that have five-year growing EPS, according to the DCF calculator.

Warning! GuruFocus has detected 3 Warning Signs with IDCC. Click here to check it out.

The intrinsic value of IDCC

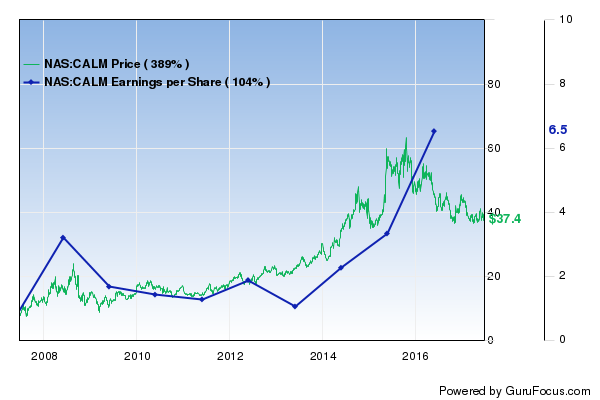

The EPS of Cal-Maine Foods Inc. (CALM) grew by 36% over the last five years.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 439.2% at $37.75. The price has been as high as $46.71 and as low as $35.10 in the last 52 weeks. It is 19.50% below its 52-week high and 7.12% above its 52-week low.

Cal-Maine Foods has a market cap of $1.83 billion and is a producer and marketer of shell eggs in the U.S. The company's main business is the production, grading, packaging, marketing and distribution of shell eggs.

The company's largest shareholder among the gurus is Chuck Royce (Trades, Portfolio) with 1.89% of outstanding shares followed by Steven Cohen (Trades, Portfolio) with 0.63% and Jeff Auxier (Trades, Portfolio) with 0.01%.

The EPS of Allegiant Travel Co. (ALGT) grew by 40% over the last five years.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 56.1% at $142.65. The price-earnings (P/E) ratio is 12.49; the price has been as high as $182.25 and as low as $121.70 in the last 52 weeks. It is 21.87% below its 52-week high and 17.01% above its 52-week low.

Allegiant Travel has a market cap of $2.37 billion and is a leisure travel company. It is engaged in transporting travelers in small cities to leisure destinations. The company provides air-related services and products along with air transportation.

Jim Simons (Trades, Portfolio) with 7.14% of outstanding shares is the largest investor among the gurus followed by PRIMECAP Management (Trades, Portfolio) with 0.25%, Ronald Muhlenkamp (Trades, Portfolio) with 0.09%, Royce with 0.07%, Cohen with 0.07% and Diamond Hill Capital (Trades, Portfolio) with 0.01%.

The EPS of GATX Corp. (GATX) grew by 21% over the last five years.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 24.7% at $61.59. The P/E ratio is 10.45, and the price has been as high as $66.30 and as low as $40.66 in the last 52 weeks. It is 3.88% below its 52-week high and 56.74% above its 52-week low.

GATX has a market cap of $6.6 billion and leases, operates, manages and remarkets long-lived used assets in the rail and marine market. It also provides leasing, shipping, asset remarketing and asset management services.

The company's largest shareholder among the gurus is Mario Gabelli (Trades, Portfolio) with 7.17% of outstanding shares followed by Joel Greenblatt (Trades, Portfolio) with 0.35%, John Hussman (Trades, Portfolio) with 0.15% and Paul Tudor Jones (Trades, Portfolio) with 0.01%.

The EPS of Grupo Aeroportuario del Centro Norte SAB (OMAB) grew by 21% over the last five years.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 9.3% at $45.20. The P/E ratio is 21.01; the price has been as high as $53.58 and as low as $30.05 in the last 52 weeks. It is 16.72% below its 52-week high and 48.49% above its 52-week low.

Grupo Aeroportuario del Centro Norte has a market cap of $2.56 billion and through its subsidiaries holds concessions to operate, maintain and develop close to 13 airports in Mexico. It provides aeronautical services related to use of its airport facilities by airlines and passengers.

Simons with 0.64% of outstanding shares is the largest investor among the gurus.

Sally Beauty Holdings Inc. (SBH)'s EPS grew by 6% over the last five years.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 51.6% at $19.05. The P/E ratio is 11.97, and the price has been as high as $30.73 and as low as $17.26 in the last 52 weeks. It is 37.23% below its 52-week high and 11.76% above its 52-week low.

Sally Beauty Holdings has a market cap of $2.65 billion and is a specialty retailer and distributor of professional beauty supplies with operations in North America, South America and Europe.

The company's largest shareholder among the gurus is Gabelli with 0.7% of outstanding shares followed by Simons with 0.4%, Ray Dalio (Trades, Portfolio) with 0.08% and Greenblatt with 0.06%.

Dorman Products Inc. (DORM)'s EPS grew by 14% over the last five years.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 13.1% at $79.19. The P/E ratio is 24.73, and the price has been as high as $88.50 and as low as $51.87 in the last 52 weeks. It is 10.52% below its 52-week high and 52.67% above its 52-week low.

Dorman Products has a market cap of $2.72 billion and is a supplier of replacement parts and fasteners for passenger cars, light trucks and heavy-duty trucks in the automotive aftermarket.

Royce with 2.7% of outstanding shares is the largest investor among the gurus followed by Columbia Wanger (Trades, Portfolio) with 0.56%, Third Avenue Management (Trades, Portfolio) with 0.17%, Murray Stahl (Trades, Portfolio) with 0.1% and Greenblatt with 0.05%.

The EPS of InterDigital Inc. (IDCC) grew by 21% over the last five years.

According to the DCF calculator, the stock is undervalued and trading with a margin of safety of 57.9% at $80.0. The P/E ratio is 8.97, and the price has been as high as $102.30 and as low as $51.97 in the last 52 weeks. It is 21.80% below its 52-week high and 53.93% above its 52-week low.

InterDigital has a market cap of $2.77 billion and functions within the communication segment. It develops technologies that enable and enhance wireless communications.

The company's largest shareholder among the gurus is Simons with 1.37% of outstanding shares followed by First Pacific Advisors (Trades, Portfolio) with 1.28%, Greenblatt with 1.07%, FPA Capital Fund (Trades, Portfolio) with 0.65%, Jones with 0.05% and Caxton Associates (Trades, Portfolio) with 0.01%.

Disclosure: I do not own any shares of any stocks mentioned in this article.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Signs with IDCC. Click here to check it out.

The intrinsic value of IDCC