Cheap Stocks To Watch Out For In April

Stocks recently deemed undervalued include Firan Technology Group and Badger Daylighting, as they trade at a market price below their true valuations. There’s a few ways you can determine how much a company is actually worth. The most popular methods include discounting the company’s cash flows it is expected to create in the future, or comparing its price to its peers or the value of its assets. The discrepancy between the price and value means investors have an opportunity to buy shares at a discount. Below are the stocks I believe are undervalued on all criteria, based on their latest financial data.

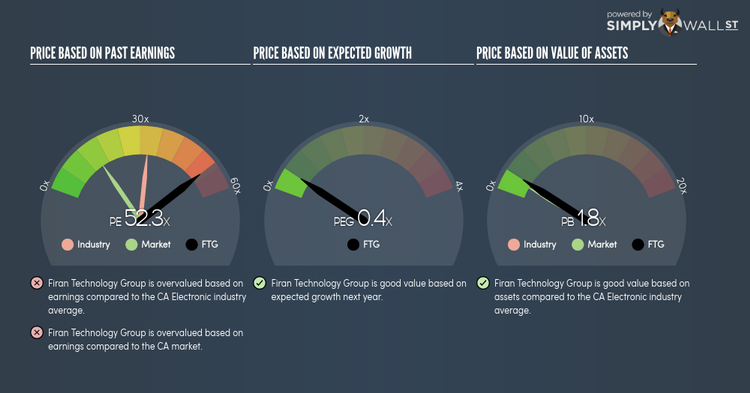

Firan Technology Group Corporation (TSX:FTG)

Firan Technology Group Corporation manufactures and sells printed circuit boards and precision illuminated display systems. Established in 1983, and run by CEO Bradley Bourne, the company currently employs 499 people and has a market cap of CAD CA$66.97M, putting it in the small-cap stocks category.

FTG’s shares are currently floating at around -61% less than its true value of $7.64, at the market price of CA$2.95, based on its expected future cash flows. The discrepancy signals an opportunity to buy low.

FTG is also in great financial shape, as current assets can cover liabilities in the near term and over the long run. Finally, its debt relative to equity is 35.43%, which has been declining over time, signifying its capacity to reduce its debt obligations year on year. More detail on Firan Technology Group here.

Badger Daylighting Ltd. (TSX:BAD)

Badger Daylighting Ltd. provides non-destructive excavating and related services in Canada and the United States. Started in 1992, and currently headed by CEO Paul Vanderberg, the company size now stands at 1,943 people and has a market cap of CAD CA$956.08M, putting it in the small-cap category.

BAD’s shares are now hovering at around -41% beneath its actual level of $41.99, at the market price of CA$24.78, based on my discounted cash flow model. signalling an opportunity to buy the stock at a low price. In terms of relative valuation, BAD’s PE ratio stands at around 13.96x compared to its Construction peer level of, 25.76x meaning that relative to other stocks in the industry, you can buy BAD for a cheaper price. BAD is also strong financially, with near-term assets able to cover upcoming and long-term liabilities.

More detail on Badger Daylighting here.

Magna International Inc. (TSX:MG)

Magna International Inc. designs, develops, and manufactures automotive systems, assemblies, modules, and components in North America, Europe, Asia, and South America. Formed in 1957, and run by CEO Donald Walker, the company currently employs 168,000 people and with the company’s market capitalisation at CAD CA$26.01B, we can put it in the large-cap group.

MG’s stock is currently hovering at around -29% below its true level of $97.98, at a price tag of CA$69.98, based on its expected future cash flows. This discrepancy gives us a chance to invest in MG at a discount. Furthermore, MG’s PE ratio is currently around 9.13x while its Auto Components peer level trades at, 18.16x suggesting that relative to other stocks in the industry, we can buy MG’s stock at a cheaper price today. MG also has a healthy balance sheet, with near-term assets able to cover upcoming and long-term liabilities.

More on Magna International here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.