Check Point Software Returns to the Undervalued Predictable List

- By Robert Abbott

Check Point Software Technologies Ltd. (NASDAQ:CHKP) has hit the right combination of metrics to return to an exclusive group. It could be found on the GuruFocus Undervalued Predictable list when I profiled it in 2016, and it has recently returned.

To get a place on that list, a company must have a GuruFocus predictability rating of at least four out of five stars and be undervalued based on the discounted cash flow method. Only 127 companies make the list it in mid-March 2021.

What is Check Point?

In its Feb. 2 earnings release, Check Point described itself as a provider of cybersecurity solutions to governments and corporations around the world.

Through organic growth and acquisitions, it has developed a range of cybersecurity solutions for physical and virtual networks, cloud and mobile environments, critical infrastructures and the internet of things.

The Israeli company says it categorizes threats and attacks by generations. The world is currently experiencing the fifth generation of cyber attacks and a sixth generation is emerging through sophisticated targeting of vulnerable IoT systems.

It also reports most businesses are generationally behind and unable to effectively protect themselves from these attacks. This state of affairs creates a market for Check Point and its peers for protection against malware, ransomware and other malevolent attacks.

It claims to offer "the most comprehensive and intuitive one point of control security management system."

It is, of course, a technology business and depends heavily on creating, deploying and protecting intellectual property. To maintain its position in the industry, it must invest in research and development. Of its 2,434 employees at the end of 2019, 1,524 employees and subcontractors were dedicated to research and development and quality assurance. That year, it spent $239.2 million on research and development (12% of revenus), up from $211.5 million the previous year.

Competition

The company describes its business as being intensely competitive, and that it will become even more competitive.

It lists its primary competitors as Cisco Systems Inc. (NASDAQ:CSCO), Juniper Networks Inc. (NYSE:JNPR), Fortinet Inc. (NASDAQ:FTNT), SonicWall Inc. and Palo Alto Networks Inc. (NYSE:PANW), as well as other network security companies.

Competitors on specific Check Point products are Microsoft Corp. (NASDAQ:MSFT), McAfee Inc. (NASDAQ:MCFE), International Business Machines Corp. (NYSE:IBM), Hewlett-Packard Enterprise Co. (NYSE:HPQ) and FireEye Inc. (NASDAQ:FEYE).

It has been argued that the company is losing market share to competitors, or that its growth is not as fast as that of competitors. But, as Nicola Guida pointed out in his article, "Check Point Software: Satisfying the Quality Checklist":

"I've read some criticism against Check Point in regard to the fact that it is not aggressively investing for growth. However, the cybersecurity market will likely grow at a very fast rate, so the company will be very busy with new orders even in the presence of very good competitors in the cyber arena."

Recent results

In February, the company announced its fourth-quarter and full-year 2020 results. For the full year, these were the highlights:

Revenue: $2.065 billion, up 4% year over year.

GAAP earnings per share: $5.96, an increase of 10% year over year.

Non-GAAP earnings per share: $6.78, an 11%increase year over year.

Gil Shwed, the founder and CEO of Check Point, said of the year, "The global pandemic drove the new normal, a hybrid work environment and accelerated digital transformation that created security challenges across all types of organizations. The Infinity security platform enables the prevention of Gen V cyber-attacks across all major attack vectors."

In December, the company surveyed its customers and learned that 58% of them had experienced an increase in cyberattacks since the Covid-19 outbreak. For the majority of companies, securing remote workers over the next two years will be their top priority.

During 2020, the company also introduced or updated several products and signed partnership agreements with other organizations.

Risks

As we saw in the Competition section, Check Point operates in a highly competitive industry. That means other companies could produce better products or services, and the corollary risk that its own product development falls short.

Similarly, hackers might develop new methods or products that leave some or all cybersecurity companies behind, leading to reputational losses and subsequent financial losses.

It is an international company, so it has currency exchange risks, particularly between Israeli shekels and euros. Some 46% of its expenses were in foreign currencies in 2019. Check Point does hedge against some of that risk, at least, but hedges do become another expense.

Financial strength

It's no surprise Check Point gets such a high (and unusual) rating for financial strength, given that it has no debt and a stockpile of cash. At the end of 2020, it had cash, cash equivalents and marketable securities worth $1.68 billion.

And there should be more to come; as we see at the bottom of the table, the company's return on invested capital is more than triple its weighted average cost of capital.

The Piotroski F-Score and Altman Z-Score are both strong, reinforcing our belief that this is a quality company.

Profitability

Again, Check Point has a near-perfect score, indicating an ability to convert revenue into earnings quite effectively.

The GuruFocus warning signs system has just one severe alert for the company: that its operating margin has declined. That's true of both the operating and net margins:

Of course, when margins are in the 40s, there's little need to look for the exits or to take it off your shortlist.

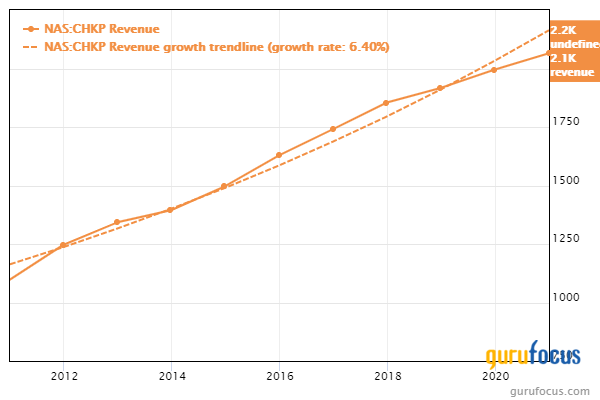

The growth lines at the bottom of the table suggest that revenue growth is below what it used to be. However, this 10-year chart shows it has actually grown consistently, at an average rate of 6.4% per year:

This chart shows Ebitda and earnings per share without non-recurring items doing much the same:

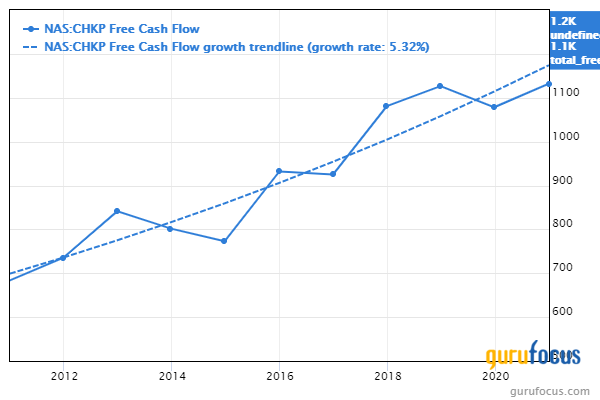

Going a step further, we see free cash flow has also grown an average of 5.32% per year for the past 10 years:

Seeing these charts, is it any surprise that Check Point garners a full five stars for predictability? Perhaps some investors see this company as a bond substitute.

Dividend and share buybacks

There are no dividends from Check Point, but it has been repurchasing its own shares. Once again, the word is "consistency":

In 2020, the company reported buying back about 11.4 million shares for $1.298 billion.

Valuation

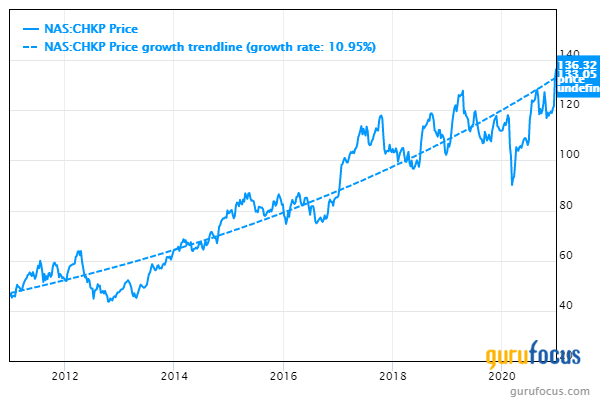

This is a 10-year price chart:

Note that the trendline reports an average annual growth rate of just under 11%, and that the current price is near the trendline.

The valuation metric used for Undervalued Predictable stocks is the discounted cash flow, and using default values it shows Check Point to be undervalued:

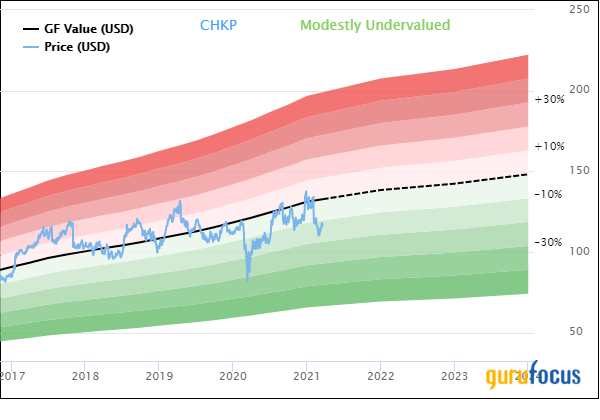

Using its own proprietary trendline, the GF Value Chart arrives at the same conclusion:

The same is true for the price-earnings ratio. At 19.51, it is below the software industry median of 32.11.

The only outlier is the PEG ratio, which puts price into the context of Ebitda growth. It comes in at 3, which is above the fair value mark of 1.

Gurus

The gurus are on board for Check Point, buying more than they've been selling over the past year:

Of the gurus, nine hold positions. At the end of 2020, the three biggest positions were those of:

Jim Simons (Trades, Portfolio)' Renaissance Technologies, who had the largest stake with 552,564 shares. They represent 0.39% of Check Point's shares outstanding and 0.08% of the firm's total assets under management. During the fourth quarter, the firm reduced its holding by 13.2%.

John Rogers (Trades, Portfolio) of Ariel Investment held 331,912 shares after boosting his position by 29.89%.

Diamond Hill Capital (Trades, Portfolio) reduced its stake by 5.37% during the quarter to finish with 179,298 shares.

Conclusion

Check Point Software Technologies deserves its place on the Undervalued Predictable list. Its results have been exceptionally consistent over the past decade, from the top line to the bottom line. What's more, the share price has risen relatively consistently as well, which gives credence to the idea that this tech company might be considered a bond substitute.

Valuation is not so clear-cut. While it does have a margin of safety, the margin is slim. Still, when you buy this stock, you have a reasonably good idea of what kind of capital gains lie ahead, which is unusual. And to bolster the case that it can continue to produce solid results, we need look no further than its ample stash of cash and its debt-free status.

Check Point could be a prospect for value investors with its strong balance sheet and current pricing, though a dip would make it more attractive. Growth investors looking for steady capital gains might find it worthwhile investigating further. Income investors will pass it by because it has no dividend.

Disclosure: I do not own shares in any of the companies named in this article and do not expect to buy any in the next 72 hours.

Read more here:

Clorox: Staying Strong as the Pandemic Recedes

Keurig Dr Pepper: Now Showing Benefits From the Merger

MYR Group Becomes a Buffett-Munger Stock

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.