Chegg (CHGG) Meets Q1 Earnings Estimates, Raises '18 View

Chegg, Inc.’s CHGG first quarter 2018 adjusted earnings of 1 cents per share was in line with the Zacks Consensus Estimate and increased substantially from the prior-year quarter’s loss of 3 cents. The upside can be attributed to increased investments behind new subjects, content, formats and services.

Net revenues of $76.9 million surpassed the consensus estimate of $74.4 million by 3.5% and rose 23% year over year. The uptrend was primarily backed by increase in Chegg Services revenues.

Post the earnings release, shares of Chegg returned more than 5.9% in after-hours trading on Apr 26. Also, the company’s shares have rallied 140.7% in the past year, outperforming the industry’s rise of 23.4%.

Let’s delve deeper into the numbers.

Chegg Services Revenues & Subscription Details

Chegg’s total net revenues are derived from two streams, Chegg Services revenues and Required Materials revenues.

Chegg Services revenues of $56.3 million increased 37% year over year and was above the guidance of $54-$55.5 million. The upside was driven by an increased rate of subscription. The Chegg Services subscriber base totaled 1.6 million in the quarter, up 44% year over year.

Total Chegg Study content views surged 59% year over year to 158 million.

Operating Highlights

Gross profit of $56.7 million in the quarter increased 37.6% from the year-ago quarter’s level. Gross margin of 73.7% was higher than the prior-year quarter and the company’s expectations, courtesy of additional revenues from Chegg Services.

Adjusted EBITDA of $16.7 million shows a substantial improvement from the year-ago quarter’s level by improving 75%. The figure is also slightly above the company’s earlier expectations of $14-$16 million.

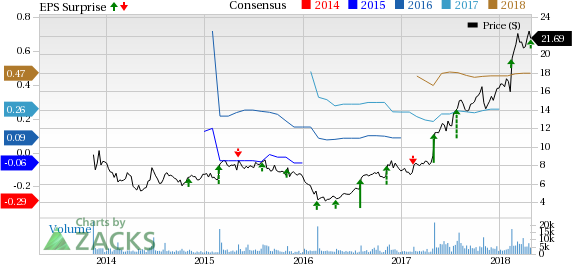

Chegg, Inc. Price, Consensus and EPS Surprise

Chegg, Inc. Price, Consensus and EPS Surprise | Chegg, Inc. Quote

Balance Sheet

Chegg had cash and cash equivalents of $106.8 million for the period ending Mar 31, 2018, compared with $126.5 million as of Dec 31, 2017.

Second-Quarter 2018 Guidance

Net revenues are expected in the range of $69-$71 million, whereas Chegg Services Revenues are anticipated in the band of $58-$60 million. Gross margin is expected to increase between 74% and 75%, and adjusted EBITDA is projected within $17-$18.5 million.

2018 Guidance

For 2018, the company expects net revenues in the range of $300-$305 million, higher than the previous range of $295-$300 million. Chegg Services Revenues are projected in the range $243-$246 million, up from previous projection of $240-$243 million.

Gross margin between 72% and 74% is expected for 2018, same as the previous range. The company expects adjusted EBITDA in the range of $77-$79 million, up from previous range of $74-$76 million.

Capital expenditures are still expected within $30-$35 million.

Zacks Rank & Stocks to Consider

Chegg has a Zacks Rank #3 (Hold).

A few better-ranked stocks in the Computer and Technology sector are Nice Systems NICE , Twitter, Inc. TWTR and Veeva Systems Inc. VEEV , each flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Nice System’s and Twitter’s earnings for 2018 are expected to grow 12.2% and 36.4% respectively.

Veeva Systems’ fiscal 2019 earnings are expected to grow 12.2%,

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chegg, Inc. (CHGG) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

Twitter, Inc. (TWTR) : Free Stock Analysis Report

Nice Ltd. (NICE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research