Chemours (CC) Starts Strategic Review of Mining Solutions Unit

The Chemours Company CC recently announced the initiation of a strategic review to assess the potential divestment of its Mining Solutions business. This is the next step for its growth and repositioning, which is intended to boost shareholders’ value and enhance portfolio.

Mining Solutions is a part of Chemours’ Chemical Solutions segment. It is one of the biggest North American producers of solid sodium cyanide, which is an important component for the safe, efficient, environmentally friendly and cost-effective extraction of gold and silver from mined ores.

Optimizing its portfolio continues to be a top strategic priority for Chemours. The overall goal and intent are to position each of its businesses including Mining Solutions to deliver the highest level of profitable growth for the benefit of its shareholders, Chemours noted.

Chemours also stated that the recent investments in production capability and infrastructure at its Memphis plant along with supply chain optimization will enable Mining Solutions to maximize growth and expand margins. This is expected to further increase the value of this highly-successful business. Mining Solutions is focused on meeting the ever-changing needs of the precious metals mining industry, throughout and following the strategic review, per the company.

Shares of Chemours have gained 129.7% in the past year compared with 78% rise of the industry.

Chemours, in its last earnings call, stated that it expects adjusted EBITDA in the band of $1-$1.15 billion in 2021. It also sees adjusted earnings per share between $2.40 and $3.12 for the year. The company also expects free cash flow of more than $350 million for the year.

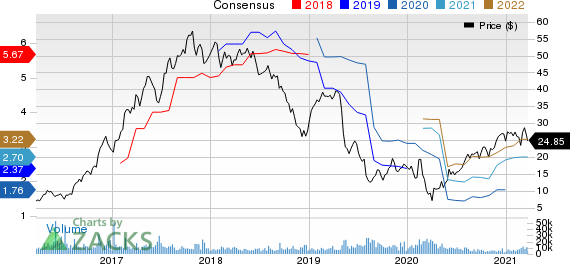

The Chemours Company Price and Consensus

The Chemours Company price-consensus-chart | The Chemours Company Quote

Zacks Rank & Other Key Picks

Chemours currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Fortescue Metals Group Limited FSUGY, Ashland Global Holdings Inc. ASH and Impala Platinum Holdings Limited IMPUY.

Fortescue has a projected earnings growth rate of 107.8% for the current fiscal. The company’s shares have surged 137.6% in a year. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ashland has an expected earnings growth rate of 83.9% for the current fiscal. The company’s shares have gained 86.4% in the past year. It currently sports a Zacks Rank #1.

Impala has an expected earnings growth rate of 197.6% for the current fiscal. The company’s shares have skyrocketed 263.5% in the past year. It currently flaunts a Zacks Rank #1.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ashland Global Holdings Inc. (ASH) : Free Stock Analysis Report

Impala Platinum Holdings Ltd. (IMPUY) : Free Stock Analysis Report

Fortescue Metals Group Ltd. (FSUGY) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research