Cheniere Energy (LNG) Q1 Earnings Top Estimates, Down Y/Y

After missing earnings estimates in the trailing three quarters, Cheniere Energy, Inc. LNG delivered a comprehensive beat this time around, with both the top and bottom lines surpassing the Zacks Consensus Estimate. The largest U.S. liquefied natural gas (LNG) exporterreported first-quarter 2019 net earnings per share of 54 cents, significantly beating the Zacks Consensus Estimate of 29 cents. Higher-than-expected revenues on the back of increasing volumes of LNG exports led to the outperformance. Precisely, total LNG revenues came in at $2,143 million, topping the Zacks Consensus Estimate of $1,990 million. However, the bottom line deteriorated from the year-ago profit of $1.50 a share amid increasing y/y operating costs.

Quarterly revenues edged up 1% to $2,261 million from $2,242 million recorded in the year-ago quarter. The top line also surpassed the Zacks Consensus Estimate of $1,691 million in the quarter under review.

The company posted first-quarter 2019 adjusted EBITDA of $650 million, with DCF of more than $200 million. During the quarter, Cheniere Energy shipped 87 cargoes, reflecting an increase of 30% from a year ago. Total volumes of LNG exported in the reported quarter were 309 trillion British thermal units (TBtu) compared with 241TBtu in the year-ago period.

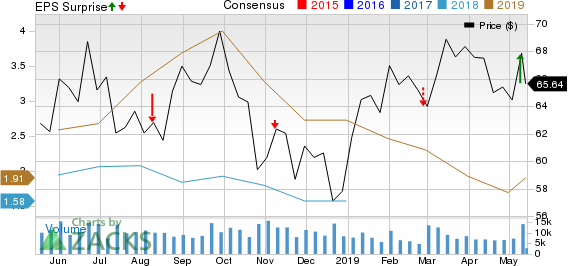

Cheniere Energy, Inc. Price, Consensus and EPS Surprise

Cheniere Energy, Inc. price-consensus-eps-surprise-chart | Cheniere Energy, Inc. Quote

Costs & Expenses

Overall costs and expenses rose 11% from the corresponding quarter last year to $1,655 million. The increase is mainly attributed to higher cost of sales that scaled up to $1,204 million from $1,178 million in the prior-year quarter, and a 58% year-over-year increase in operating and maintenance expenses to $221 million. Depreciation/amortization and SG&A expenses increased 32% and 9% from the prior-year quarter to $144 million and $73 million, respectively.

Balance Sheet

As of Mar 31, Cheniere Energy had approximately $1,093 million in cash and cash equivalents. It recorded $28,726 million in net long-term debt (with a debt-to-capitalization ratio of 93%).

2019 Guidance Reiterated

Cheniere Energy reiterated its guidance for 2019. It anticipates adjusted EBITDA within $2,900-$3,200 million, with distributable cash flow expected between $600 million and $800 million.

Progress Report

Sabine Pass Liquefaction Project (SPL): Sabine Pass is North America’s first large-scale liquefied gas export facility. Cheniere intends to construct up to six trains at the Sabine Pass, with each train expected to have a capacity of about 4.5 million tons per annum (Mtpa). Notably, expected run-rate LNG production is 4.4-4.9 Mtpa. While Trains 1 through 5 are functional, Train 6 is currently awaiting a positive financial investment decision. Notably, the 5th Train came online during the quarter under review.

Corpus Christi Liquefaction Project (CCL): Cheniere Energy’s Corpus Christi LNG project, under which the company intends to develop three trains, is expected to come online in 2019. Each train is expected to have a nominal production capacity of 4.5 Mtpa of LNG. Train 1 came online during the quarter under review, Train 2 is undergoing commissioning and Train 3 is under construction.

Corpus Christi Expansion Project: Cheniere Energy intends to develop seven midscale liquefaction trains adjacent to the CCL Project. The total production capacity of these trains is expected to be approximately 9.5 Mtpa.

Zacks Rank and Key Picks

Cheniere Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Meanwhile, investors interested in the energy space can consider some better-ranked players such as:

Devon Energy Corporation DVN: Devon’s 2019 earnings are expected to grow 68.2% on a year-over-year basis.

Repsol SA REPYY: Repsol delivered average positive earnings surprise of 8.98% in the trailing four quarters.

Bonanza Creek Energy, Inc. BCEI: The company delivered average positive earnings surprise of 3.99% in the trailing four quarters. Bonanza Creek’s 2019 revenues are expected to grow 23.1% y/y.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Repsol SA (REPYY) : Free Stock Analysis Report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

Bonanza Creek Energy, Inc. (BCEI) : Free Stock Analysis Report

Cheniere Energy, Inc. (LNG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research