Chennai Petroleum (NSE:CHENNPETRO) Shareholders Booked A 92% Gain In The Last Five Years

Stock pickers are generally looking for stocks that will outperform the broader market. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, long term Chennai Petroleum Corporation Limited (NSE:CHENNPETRO) shareholders have enjoyed a 92% share price rise over the last half decade, well in excess of the market return of around 22% (not including dividends).

View our latest analysis for Chennai Petroleum

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Chennai Petroleum's earnings per share are down 2.7% per year, despite strong share price performance over five years. By glancing at these numbers, we'd posit that the decline in earnings per share is not representative of how the business has changed over the years. Therefore, it's worth taking a look at other metrics to try to understand the share price movements.

We are not particularly impressed by the annual compound revenue growth of 0.4% over five years. So it seems one might have to take closer look at earnings and revenue trends to see how they might influence the share price.

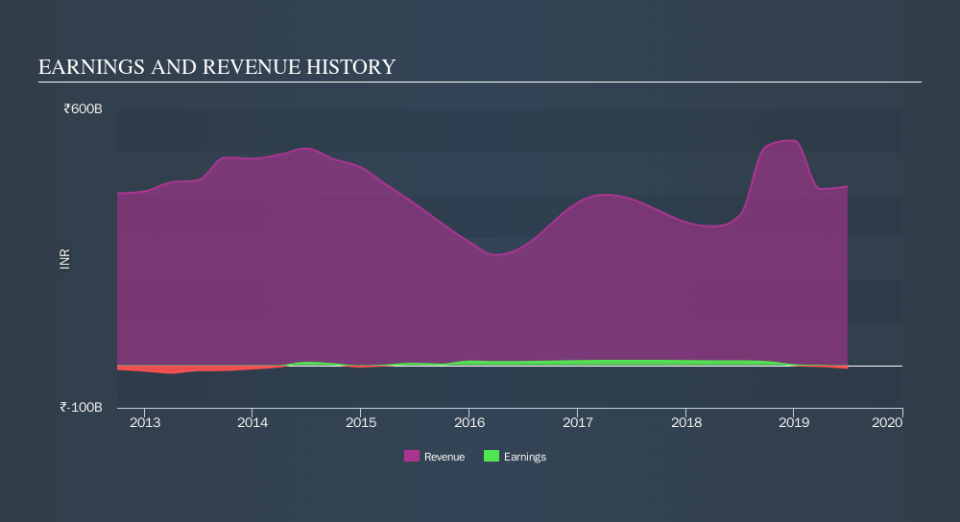

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Chennai Petroleum in this interactive graph of future profit estimates.

A Dividend Lost

The value of past dividends are accounted for in the total shareholder return (TSR), but not in the share price return mentioned above. In some ways, TSR is a better measure of how well an investment has performed. Chennai Petroleum's TSR over the last 5 years is 117%; better than its share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

We regret to report that Chennai Petroleum shareholders are down 33% for the year. Unfortunately, that's worse than the broader market decline of 9.5%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 17%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

We will like Chennai Petroleum better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.