Is Chesapeake Granite Wash Trust (NYSE:CHKR) A Buy At Its Current PE Ratio?

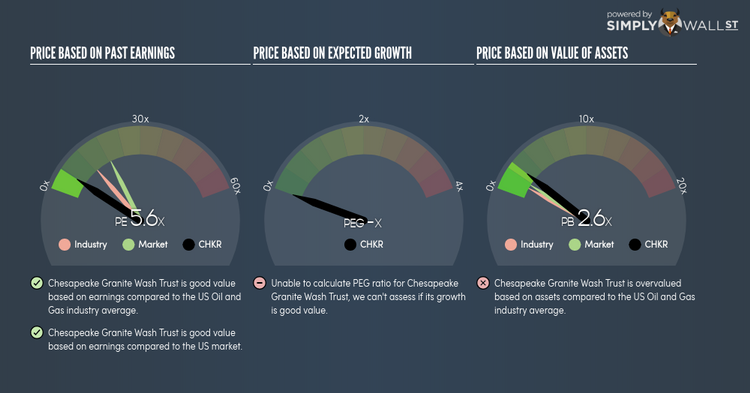

Chesapeake Granite Wash Trust (NYSE:CHKR) trades with a trailing P/E of 5.6x, which is lower than the industry average of 12.7x. While this makes CHKR appear like a great stock to buy, you might change your mind after I explain the assumptions behind the P/E ratio. Today, I will break down what the P/E ratio is, how to interpret it and what to watch out for. See our latest analysis for Chesapeake Granite Wash Trust

Breaking down the P/E ratio

The P/E ratio is a popular ratio used in relative valuation since earnings power is a key driver of investment value. By comparing a stock’s price per share to its earnings per share, we are able to see how much investors are paying for each dollar of the company’s earnings.

P/E Calculation for CHKR

Price-Earnings Ratio = Price per share ÷ Earnings per share

CHKR Price-Earnings Ratio = $1.6 ÷ $0.283 = 5.6x

On its own, the P/E ratio doesn’t tell you much; however, it becomes extremely useful when you compare it with other similar companies. We want to compare the stock’s P/E ratio to the average of companies that have similar characteristics as CHKR, such as size and country of operation. One way of gathering a peer group is to use firms in the same industry, which is what I’ll do. Since CHKR’s P/E of 5.6x is lower than its industry peers (12.7x), it means that investors are paying less than they should for each dollar of CHKR’s earnings. Therefore, according to this analysis, CHKR is an under-priced stock.

Assumptions to be aware of

However, before you rush out to buy CHKR, it is important to note that this conclusion is based on two key assumptions. Firstly, our peer group contains companies that are similar to CHKR. If this isn’t the case, the difference in P/E could be due to other factors. For example, if you are comparing lower risk firms with CHKR, then its P/E would naturally be lower than its peers, as investors would value those with lower risk at a higher price. The second assumption that must hold true is that the stocks we are comparing CHKR to are fairly valued by the market. If this is violated, CHKR’s P/E may be lower than its peers as they are actually overvalued by investors.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.