Chevron Stock Will Overcome Other Oil Stocks Sooner Than You Think

There has been a big disparity in the performance of big oil stocks so far in 2018. The price of oil itself has been waffling back and forth between upward cycles and downward ones with a slight upward skew. There have been events and conditions that have restricted oil output from some countries, while others have boosted production in order to meet worldwide demand.

Even with the roller coaster ride that oil has been on, some oil companies have seen their stocks rise rather sharply. Hess (NYSE:HES) has seen its stock rise by over 45% so far this year and ConocoPhillips (NYSE:COP) is up almost 39% on the year. Conversely, Chevron (NYSE:CVX) is up a measly 1.7% so far in 2018. As such, investors might be overlooking CVX stock at this point, but they shouldn’t.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Here are some reasons why.

While Chevron stock has lagged its fellow oil companies for the last nine months, I think that is getting ready to change and it’s mainly due to what is going on with the chart.

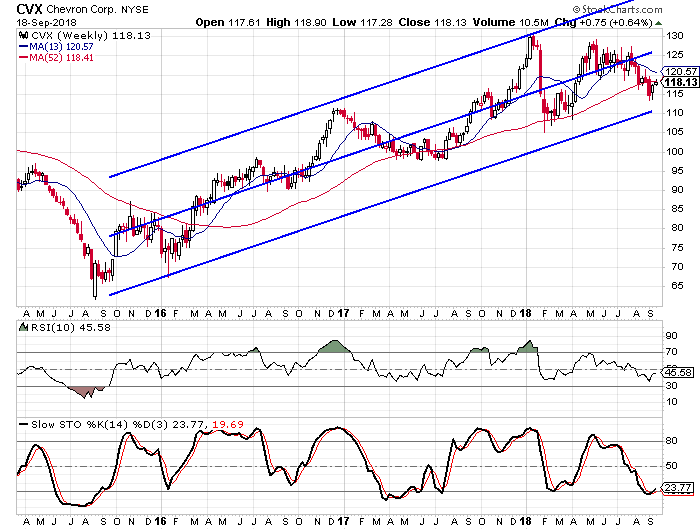

I first noticed the chart when I was scrolling through a series of charts over the weekend. Last week, the weekly stochastic readings made a bullish crossover after hitting oversold territory and it dipped below its 52-week moving average. The last time these two things happened on the CVX stock chart was last summer and the stock went on to rally from the $100 area up to the $130 area.

After looking at the chart a little longer, I noticed the channel and drew a Raff Regression Channel on the chart. The middle line represents the regression line over the last three years with the outer lines marking the lows and highs and they are equidistant from the regression line.

I use regression channels to gauge the overall trend of a stock and sometimes I will look at standard deviation channels. The standard deviation channels are more useful to me as they measure deviations from the prevailing trend. The standard deviation channel on Chevron stock added to my bullish opinion.

CVX stock just hit the lower rail of the channel for the first time since early 2016. After it hit the lower rail back then, the stock rallied from the $80 level up to $107.50.

This Is How Investors Should Approach CVX Stock

There are essentially two trains of thought when it comes to buying stocks — momentum or reversion to the mean. Looking at the chart for Chevron stock, it is a combination of the two.

The momentum has been to the upside for the last three years with a slight dip in the last few months. The long-term momentum in CVX stock is still to the upside, but it has dipped below the regression line as much as it has at any point in the last three years. At the very least, I see stock in Chevron moving back up to the regression line.

As I was doing more research on the CVX stock price, I noticed something strange about the stock’s performance compared to the company’s fundamentals. I looked at the earnings-per-share ratings and SMR ratings from Investor’s Business Daily on all seven of the stocks in the comparative performance chart above. While Chevron has lagged on its price performance, it is right in the middle of the seven when it comes to the fundamental ratings.

The EPS rating is a 69 and the SMR rating is a C. This means that the company has seen earnings grow faster than 69% of all publicly traded companies and that it is average when it comes to sales growth, profit margin and return on equity (SMR).

What I found especially interesting was that Hess was tied for the worst EPS rating and tied for the worst SMR rating. And yet the HES stock price is up more this year than any of the others.

This leads me to believe that we will see Chevron stock outperform Hess in the coming months and outperform its most recent earnings growth. The most recent earnings report for Chevron showed earnings growth of 131% on a year-over-year basis. Earnings are expected to grow by 107% for the year as a whole.

I look for the CVX stock price to gain at least 25% over the next six months and that projection is based on the previous stochastic crossovers and the way the stock touched the lower rail of the standard deviation channel.

As of this writing, Rick Pendergraft did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post Chevron Stock Will Overcome Other Oil Stocks Sooner Than You Think appeared first on InvestorPlace.