Chewy Springs Forward on 4th-Quarter Earnings Beat

- By James Li

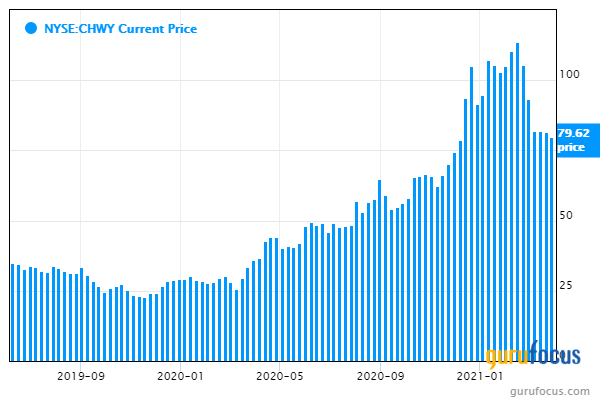

Shares of Chewy Inc. (NYSE:CHWY) surged more than 9% in aftermarket trading on Monday on the back of reporting a surprise profit during the fourth quarter of fiscal 2020.

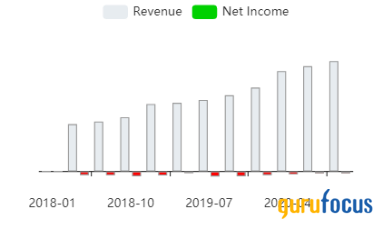

For the three months ending Jan. 31, the Dania Beach, Florida-based pet food and supplies retailer reported net income of $21.05 million, or 5 cents in diluted earnings per share, compared with net loss of $60.94 million, or 15 cents in diluted earnings per share, in the prior-year quarter. Revenue of $2.043 billion topped the FactSet estimate of $1.97 billion while earnings smashed the FactSet forecast of a loss of 10 cents per diluted share.

Company caps off challenging year with a profit, sees growth ahead

Chewy CEO Sumit Singh said that the company's full-year net sales of $7.15 billion increased 47% from fiscal 2019 net sales, boosted by customer growth of 43% year over year. The pet-focused retailer reported during the fourth quarter of fiscal 2020 its first quarter of positive net income, further delivering its first full year of positive adjusted Ebitda during the "challenging and unpredictable" year of 2020.

The company detailed in its shareholder letter that amid the Covid-19 pandemic, Chewy launched several initiatives like e-gift cards, personalized products and the company's "Connect with a Vet" telehealth platform. The retailer added 5.7 million net active customers during the fourth quarter, boosting the total number of pet parents to over 19 million as of January.

Chewy then further discussed several growth trends for the upcoming years, including the increasing number of households owning pets and the company's market position in the "growing" U.S. pet market.

Stock surges in aftermarket trading

Shares of Chewy traded at around $88.18 in aftermarket trading, up approximately 9.7% from Tuesday's closing price of $80.38.

According to GuruFocus, Chewy has a strong Altman Z-score of 13.27 and a cash-to-debt ratio that outperforms over 69% of global retail companies, suggesting good financial strength.

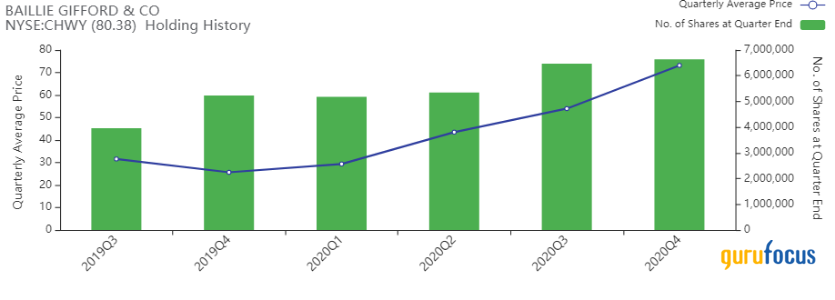

Gurus with holdings in Chewy include Baillie Gifford (Trades, Portfolio) & Co., Jim Simons (Trades, Portfolio)' Renaissance Technologies, Pioneer Investments (Trades, Portfolio), Paul Tudor Jones (Trades, Portfolio)' Tudor Investment and Lee Ainslie (Trades, Portfolio)'s Maverick Capital.

Disclosure: No positions.

Read more here:

Vizio Debuts in the Dark as Investors Monitor Streaming Market

Darden Restaurants Blossoms on Upbeat Fiscal 2021 Guidance

Nike Slips on Fiscal 3rd-Quarter Revenue Miss

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.