The Children's Place (PLCE) Q2 Earnings Top, Sales Increase Y/Y

In spite of a challenging backdrop, The Children’s Place, Inc. PLCE reported decent second-quarter fiscal 2021 results. Although the top line fell short of the Zacks Consensus Estimate, the bottom line continued with its positive surprise streak for the fourth straight quarter. Impressively, net sales and earnings per share of this pure-play children’s specialty apparel retailer improved from the year-ago period.

Fleet optimization strategy, introduction of Gymboree into portfolio of brands and accelerated digital investments continued to drive results. Management also highlighted that back-to-school sales improved significantly in the last two weeks of July, and the company kicked-off the third quarter on a promising note.

Markedly, this Zacks Rank #1 (Strong Buy) stock has surged 36.1% in the past six months against the industry’s decline of 9.1%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Let’s Analyze

The Children’s Place posted adjusted earnings of $1.71 per share that comfortably surpassed the Zacks Consensus Estimate of 50 cents. Remarkably, the bottom line improved significantly from an adjusted loss of $2.68 per share reported in the year-ago period, thanks to higher net sales and margin expansion.

Net sales of $413.9 million rose 12.2% year over year, as a result of favorable customer response toward product assortment, reset of pricing and promotional strategy driving higher AUR, sturdy back-to-school sales, and the enhanced child tax credit payments commencing in mid-July. However, temporary and permanent store closures and the adverse impact of lower operating hours in mall stores, as directed by the mall owners hurt the company’s top-line performance to an extent. The top line fell short of the Zacks Consensus Estimate of $452 million.

U.S. net sales jumped 12% year over year to $372 million, while Canadian net sales increased 13% to $37 million. Comparable retail sales rose 14.1% compared with the year-ago period.

Consolidated digital sales declined 33% during the quarter. We note that digital sales represented 43% of total net sales with more than 70% of digital business now coming through a mobile device. The company notified that its active mobile users were up double digits. Digital sales fell 36% in the United States but the metric increased 7% in Canada. Management informed that U.S. digital penetration was about 70% in the prior-year period, as majority of stores were closed for more than half of the quarter.

The expansion of digital business coupled with the significant sales transfer rate that the company is attaining owing to the strategic decision to shutter 300 stores are resulting in long-term steady state annual digital penetration of 50%.

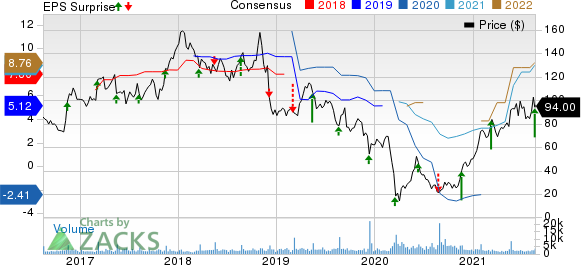

The Childrens Place, Inc. Price, Consensus and EPS Surprise

The Childrens Place, Inc. price-consensus-eps-surprise-chart | The Childrens Place, Inc. Quote

Margin Discussions

Moving on, second-quarter fiscal 2021 adjusted gross profit was $168.1 million, up significantly from $69.8 million in the year-ago period. Again, gross margin expanded to 40.6% from 18.9% in the prior-year quarter. This increase was driven by higher merchandise margins across both stores and digital channels as a result of strategic pricing and promotional changes as well as lower occupancy expenses on account of favorable lease negotiations and permanent store closures. Additionally, fixed cost leverage stemming from higher net sales favorably impacted the gross margin rate.

Adjusted SG&A expenses increased 10.3% to $114.1 million in the reported quarter. As a percentage of net sales, the metric leveraged 48 basis points to 27.6% primarily due to fixed expense leverage resulting from the increase in net sales, partly offset by higher incentive compensation accruals.

The company’s adjusted operating income amounted to $40.1 million, against operating loss of $49.2 million in the year-ago period, and leveraged 2,302 basis points to 9.7% of net sales. The company remains well on track to accelerate operating margin expansion in fiscal 2021 and beyond.

Jane Elfers, president and CEO, said, “With the pandemic-driven acceleration of competitor liquidations and store closures, the competitive landscape now enables us to reset our pricing and promotional strategy, which we believe will be another key driver of accelerated operating margin expansion.”

Store Update

As of Jul 31, 2021, The Children’s Place had more than 99% of its stores open to the public in the United States, Canada and Puerto Rico. The company ended the quarter with 708 stores.

With respect to its store fleet optimization strategy, The Children’s Place permanently shuttered 42 stores during the six-month period ended Jul 31, 2021. The company now plans to shutter additional 81 stores in fiscal 2021. This will take the total store closure count to 300.

Since the announcement of the fleet optimization initiative in 2013, the company has permanently closed 491 stores. These store closures are seen as part of the company’s effort to lower dependency on brick-and-mortar platform and shift toward digitization due to the changing consumer shopping pattern. Moreover, entering fiscal 2022, the company aims to generate 75% of its total revenues from sources outside the traditional malls.

Other Financial Aspects

The Children’s Place ended the quarter with cash and cash equivalents of $64 million. The company had $199.8 million outstanding in its revolving credit facility at the end of the quarter. Stockholders' equity at the end of the quarter was $168.2 million.

The company had incurred capital expenditures of approximately $7 million during the quarter. Management anticipates fiscal 2021 capital expenditures in the range of $40 million with major portion to be allocated to digital and supply chain fulfillment initiatives.

During the quarter, the company bought back 117 thousand shares for approximately $11.1 million. As of Jul 31, the company had approximately $79.5 million remaining under its existing share repurchase program.

Outlook

The Children’s Place has commenced third-quarter fiscal 2021 on a strong note. The company is likely to benefit from the enhanced child tax credit payments. It hinted that both digital and store sales would increase meaningfully in the month of August 2021 compared with the prior year, as consumers stock up apparel and accessories for back-to-school. However, the impact of — loss of revenues from the permanent closure of 265 stores since 2019, global supply chain disruption due to the pandemic, and uncertainty related to the Delta variant of coronavirus — cannot be ignored.

Management anticipates third-quarter gross margin to expand year over year driven by merchandise margins across both stores and digital channels as a result of reduced promotions and higher price realization along with lower occupancy expenses. However, increase in inbound transportation expenses due to ocean carrier equipment shortages, capacity constraints and higher container rates may hurt the same. Meanwhile, SG&A expenses are expected in the range of $115 million.

Check These 3 Trending Stocks

Gap GPS has a long-term earnings growth rate of 12%. Currently, it sports a Zacks Rank #1.

Abercrombie & Fitch ANF, a Zacks Rank #1 stock, has a long-term earnings growth rate of 18%.

American Eagle Outfitters AEO, a Zacks Rank #2 (Buy) stock, has a trailing four-quarter earnings surprise of 24.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

The Childrens Place, Inc. (PLCE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research