Chilean Stocks Reach The Summit

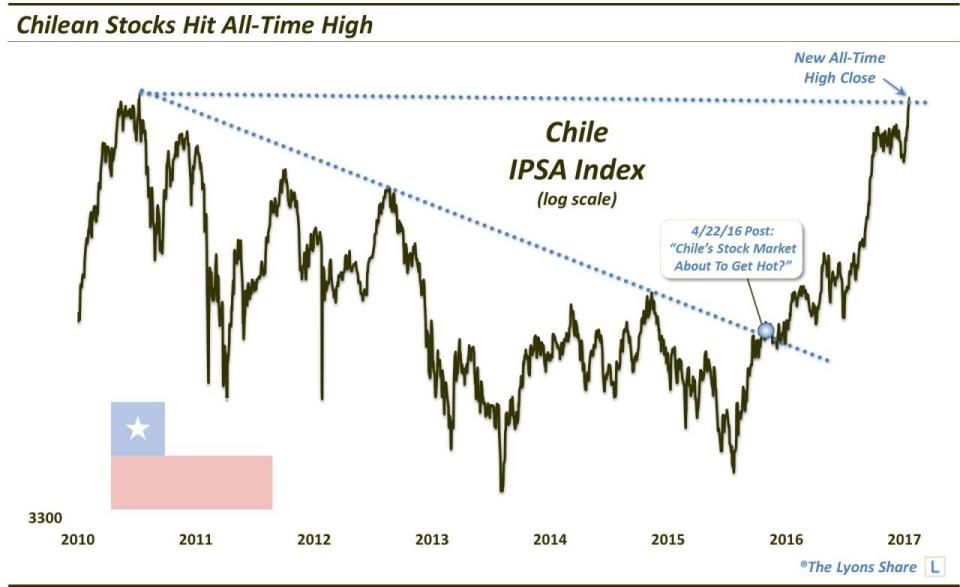

After 6 and a half years, Chile’s stock market has finally hit an all-time high again.

About 15 months ago, the global post-January/February 2016 equity rally began to take form. Yes, there had already been a nice pop in most markets off of the lows. However, that initial move could most reasonably be considered a mean-reversion bounce. Furthermore, pretty much the only country that had gained key ground on a technical basis was the U.S.. That began to change in April 2016.

One country whose stock market we highlighted for its (possibly huge) potential last April was Chile. Like many resource-laden emerging markets, Chile’s IPSA Index had suffered severely over the prior 6 years. However, the signs of a potential turnaround were evident.

First off, the IPSA had already twice tested potentially key long-term support in the 61.8% Fibonacci Retracement of its 2009-2011 rally, near 3400. Secondly, its post-January bounce had brought it up to test its post-2010 Down trendline near the 4050 level. After several touches over the prior few years, we surmised that the index stood a reasonable chance of finally breaking up through the trendline.

As we stated in that April 2016 post:

Therefore, we have 2 key ingredients in place for a potentially more successful and robust breakout: 1) a major level off of which the breakout move was launched, and 2) a comprehensive test of that key level prior to liftoff. All that is left now is for the IPSA to convincingly break its 5-year downtrend.

And just to get ahead of ourselves a little bit here, the potential upside for the index could be massive. In our view, the IPSA likely launched a secular bull market in 2002, with 2 up waves complete (2002-2007 and 2008-2011). If the 2011-2016 formation in the IPSA is merely a consolidation pattern to digest the 2008-2011 gains, the next (and final?) up wave should send the market to new highs – and perhaps considerable new highs at that.

But first things first. The setup is in place. Now we wait for price to break out, which may now be underway. If it is successful, Chile may become one hot market indeed.

Well, it took a few more months of chipping away at the trendline, but the IPSA did finally break out above it in July, prompting a nice rally into November. After a few months of consolidation, and one more test of that 4050 level, from above, the IPSA came out of the shoot quickly in 2017. In the 1st quarter alone, the IPSA jumped some 20% to near the 4900 level.

The IPSA spent the 2nd quarter in a consolidation pattern, digesting the 1st quarter move in about as optimal a fashion as a Chile bull could have hoped. For 3 months, the index never dropped more than 3% below its rally highs, until a brief dip toward the end of June in what we surmised may simply be a “shakeout”. Indeed, the index snapped back immediately in slingshot fashion, hitting new multi-year highs in early July.

As we suggested in our post 15 months prior, and in recent member videos at The Lyons Share, all that remained were new all-time highs. It didn’t take long as the IPSA closed at a new all-time high yesterday of 2046.88.

So is the Chilean market ready for liftoff to those “perhaps considerable new highs” that we mentioned in the April 22, 2016 post? Or is the index overbought at this point and in need of a rest? And how can one take advantage of potential opportunities in the Chilean market?

In a premium post at The Lyons Share, we’ll discuss the important things to monitor in measuring the near and long-term potential in Chile, including the next key levels to watch in the IPSA. Furthermore, we will discuss how to potentially profit from such developments.

If you want that “all-access” version of our charts and research, we invite you to check out our new site, The Lyons Share. Thanks for reading!

Photo of Torres del Paine National Park, Chile.

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.