The China-Hongkong Photo Products Holdings (HKG:1123) Share Price Is Down 69% So Some Shareholders Are Wishing They Sold

Statistically speaking, long term investing is a profitable endeavour. But that doesn't mean long term investors can avoid big losses. For example the China-Hongkong Photo Products Holdings Limited (HKG:1123) share price dropped 69% over five years. That's an unpleasant experience for long term holders. And it's not just long term holders hurting, because the stock is down 59% in the last year. Even worse, it's down 28% in about a month, which isn't fun at all.

Check out our latest analysis for China-Hongkong Photo Products Holdings

China-Hongkong Photo Products Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade China-Hongkong Photo Products Holdings reduced its trailing twelve month revenue by 0.2% for each year. While far from catastrophic that is not good. With neither profit nor revenue growth, the loss of 21% per year doesn't really surprise us. We don't think anyone is rushing to buy this stock. Ultimately, it may be worth watching - should revenue pick up, the share price might follow.

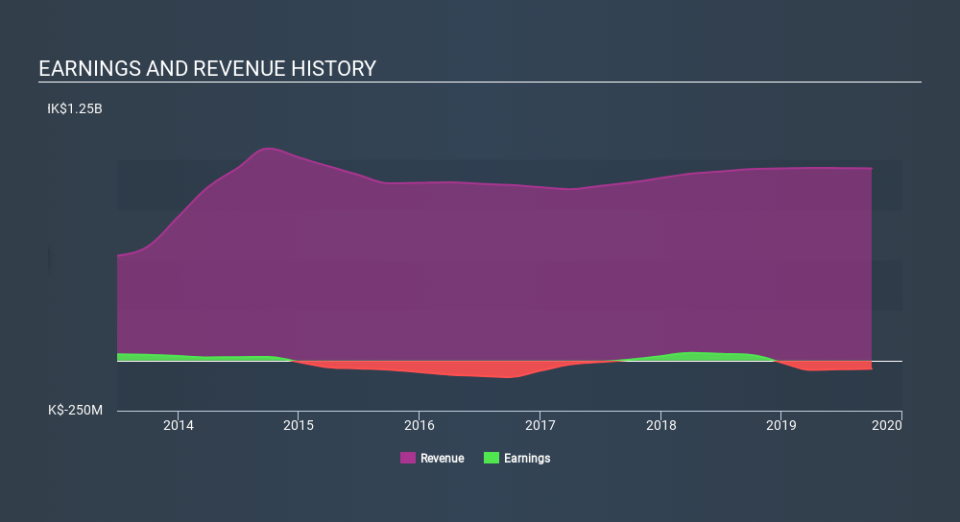

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We regret to report that China-Hongkong Photo Products Holdings shareholders are down 59% for the year. Unfortunately, that's worse than the broader market decline of 17%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 21% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 3 warning signs we've spotted with China-Hongkong Photo Products Holdings .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.