Choice Hotels (CHH) Rewards Shareholders With 6% Dividend Hike

Choice Hotels International, Inc. CHH recently announced a hike in its quarterly dividend payout. The company raised the quarterly dividend by 6%, which reflects its intention to utilize free cash for boosting shareholders’ returns.

The company raised the quarterly dividend to 23.75 cents per share (or 95 cents annually) from the previous payout of 22.5 cents (or 90 cents annually). The hiked dividend will be paid out on Jan 18, 2022, to shareholders on record as of Jan 4, 2022. Based on the closing price of $146.64 per share on Dec 6, 2021, the stock has a dividend yield of 0.6%.

Dividend hikes not only boost shareholders’ returns but also raise the market value of the stock. Therefore, companies often attract new investors and retain the old ones through this strategy. Year to date (through October 2021), the company paid more than $35 million to its shareholders in the form of cash dividends and repurchases of common stock.

What’s Driving the Dividend Policy?

This hike reflects on the lodging franchisors’ solid progress on the flagship Comfort brand, renovated hotels that are capturing more business travel on high developer demand and rapid growth in the upscale Cambria brand.

To support its franchise business at a critical juncture in the recovery process, the company rolled out a new mobile-enabled revenue management app. The tool allows franchisees to effectively manage their channel rates and inventory by adapting to local market trends. This includes repricing and competitive rate shopping to executing the right pricing strategy. With the higher acceptance of rate recommendations coupled with solid bookings for winter holidays, the company anticipates this enhanced capability to drive the top line in the upcoming periods.

Apart from this, the company is emphasizing on the improvement of unit economics with the roll out of a new digital registration capability. The cost-effective, cloud-based solution offers simplification in the hotel’s registration process (for front desk staff), savings on labor, speed up check-ins and improvement in overall guest experience.

We believe that the initiatives are likely to strengthen the company’s business and drive the sustainability of its cash flows in the upcoming periods.

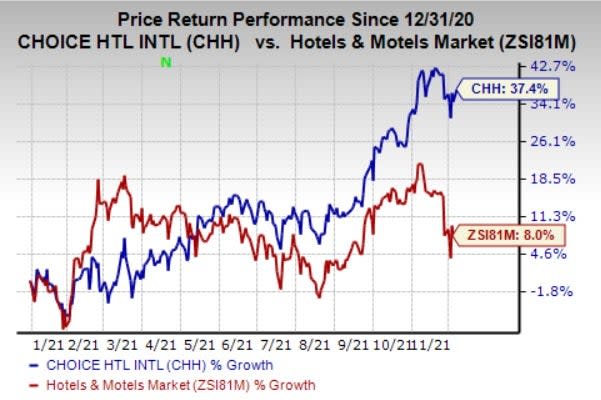

Image Source: Zacks Investment Research

So far this year, shares of Choice Hotels have surged 37.4% compared with the Zacks Hotels and Motels industry's 8% growth.

Zacks Rank and Stocks to Consider

Currently, Choice Hotels carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Some better-ranked stocks in the Consumer Discretionary sector include Hilton Grand Vacations Inc. HGV, Bluegreen Vacations Holding Corporation BVH and Camping World Holdings, Inc. CWH.

Hilton Grand Vacations sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 411.1%, on average. Shares of the company have increased 59.6% so far this year.

The Zacks Consensus Estimate for Hilton Grand Vacations’ current financial-year sales and earnings per share (EPS) suggests growth of 222.1% and 170.8%, respectively, from the year-ago period’s levels.

Bluegreen Vacations flaunts a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 695%, on average. Shares of the company have surged 127.4% so far this year.

The Zacks Consensus Estimate for Bluegreen Vacations’ current financial-year sales and EPS indicates a rise of 27.5% and 199.3%, respectively, from the year-ago period’s levels.

Camping World carries a Zacks Rank #2 (Buy). The company benefits from the launch of a fresh peer-to-peer RV rental marketplace and a mobile service marketplace. It has been investing heavily in product development.

Camping World has a trailing four-quarter earnings surprise of 70.9%, on average. Shares of the company have appreciated 61.1% so far this year. The Zacks Consensus Estimate for CWH’s financial-year sales and EPS suggests growth of 25.9% and 77.6%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Choice Hotels International, Inc. (CHH) : Free Stock Analysis Report

Camping World (CWH) : Free Stock Analysis Report

Hilton Grand Vacations Inc. (HGV) : Free Stock Analysis Report

Bluegreen Vacations Holding Corporation (BVH) : Free Stock Analysis Report

To read this article on Zacks.com click here.