Chris Davis' Firm Slims New Oriental Education, Boosts 2 Financial Companies in 1st Quarter

Davis Selected Advisers, the firm whose chairman is Chris Davis (Trades, Portfolio), disclosed last week that its top three trades included a pullback from its holding in New Oriental Education & Technology Group Inc. (NYSE:EDU) and position boosts in the following two financial services companies: U.S. Bancorp (NYSE:USB) and Capital One Financial Corp. (NYSE:COF).

The Tuscan, Arizona-based firm invests in durable, well-managed businesses that can be purchased at value prices and held for the long term. According to its website, Davis is "highly sensitive" to valuation as price directly contributes to the generation of attractive long-term results.

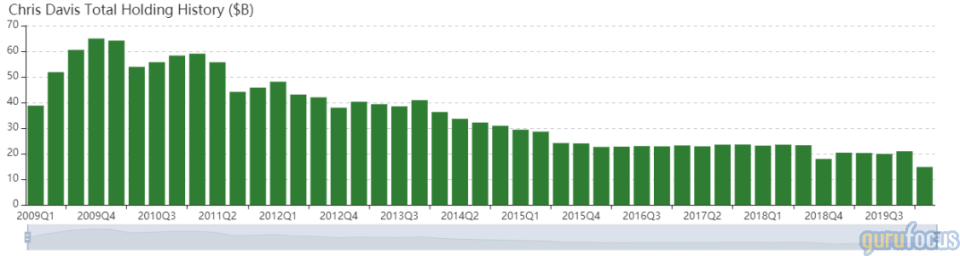

The average holding period of stocks in the Davis New York Venture Fund is between four and seven years. As of the quarter's end, Davis' $14.62 billion equity portfolio contains 123 stocks with a turnover ratio of 3%. The top three sectors in terms of weight are financial services, communication services and consumer cyclical, representing 37.83%, 15.42% and 13.81% of the equity portfolio.

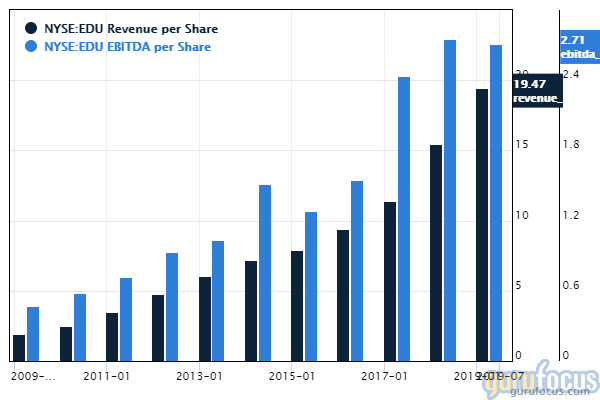

New Oriental Education

Davis sold 3,466,185 shares of New Oriental Education, reducing the stake 33.84% and the equity portfolio 2.01%. Shares averaged $128.59 during the first quarter.

GuruFocus ranks the Chinese private education service provider's profitability 10 out of 10 on several positive investing signs, which include a 4.5-star predictability rank and a three-year revenue growth rate that outperforms over 81% of global education companies. Despite this, debt ratios are underperforming 60% of global competitors, suggesting modest financial strength.

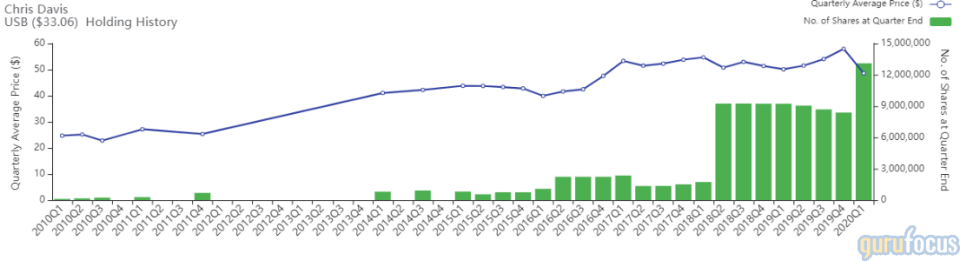

U.S. Bancorp

Davis purchased 4,717,407 shares of U.S. Bancorp, increasing the position 56.26% and the equity portfolio 1.11%. Shares averaged $48.59 during the first quarter.

GuruFocus ranks the Minneapolis-based bank's financial strength 3 out of 10 on the back of debt ratios underperforming over 77% of global competitors, suggesting high leverage. Despite this, net margins and returns are outperforming as much as 75% of global banks.

Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (BRK.A)(BRK.B) owns 132,459,618 shares of U.S. Bancorp as of March 31.

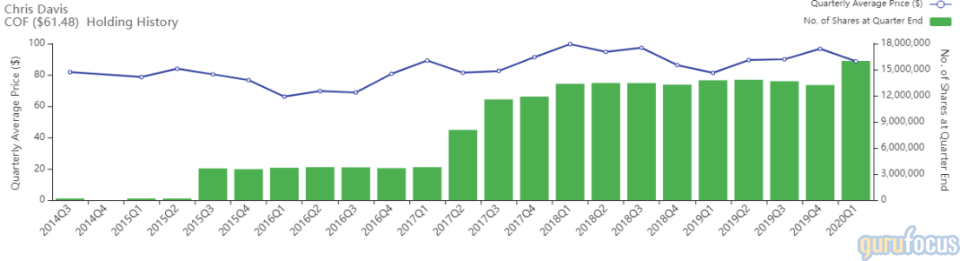

Capital One

Davis purchased 2,769,648 shares of Capital One, increasing the holding 20.94% and the equity portfolio 0.96%. Shares averaged $88.63 during the first quarter.

The McLean, Virginia-based company offers a diverse spectrum of financial products and services to its clients. According to GuruFocus, Capital One's financial strength ranks a low 3 out of 10 on the back of equity-to-asset ratios underperforming over 80% of global competitors.

Disclosure: No positions.

Read more here:

Lee Ainslie Packs Into Ackman's Restaurant Brands in the 1st Quarter

Andreas Halvorsen's Top 5 Buys in the 1st Quarter

Top 5 Buys of Jeremy Grantham's GMO in the 1st Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.