Chuck Royce's Firm Saws Another Chunk Off of L.S. Starrett

Royce & Associates, the investment firm founded by renowned guru Chuck Royce (Trades, Portfolio) in 1972, disclosed earlier this week it slashed its position in The L.S. Starrett Co. (NYSE:SCX) by 85.07%.

The New York-based firm, which specializes in small-cap companies, picks stocks based on an active, bottom-up, risk-conscious and fundamental approach. The portfolio managers also look for value opportunities among companies trading at a discount to enterprise value.

Having reduced the holding over the last several quarters, GuruFocus Real-Time Picks, a Premium feature, revealed the firm divested of an additional 268,797 shares of the Athol, Massachusetts-based company on Oct. 31. It now holds a total of 47,162 shares. The stock traded for an average per-share price of $5.36.

The company, which manufactures saws blades, precision measuring tools and instruments used by machinists, has a $41.29 million market cap an enterprise value of $59.67 million; its shares were trading around $5.94 on Friday with a price-earnings ratio of 6.67, a price-book ratio of 0.5 and a price-sales ratio of 0.18.

According to the Peter Lynch chart, the stock is undervalued since it is trading below its fair value.

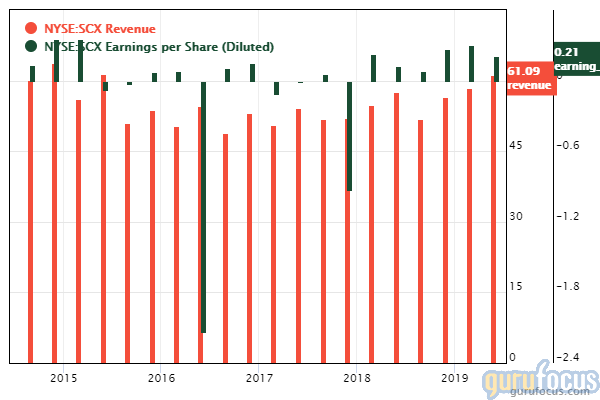

The company reported its third-quarter results on Oct. 31. It posted earnings of 11 cents per share on $52.1 million in revenue.

GuruFocus rated L.S. Starrett's financial strength 5 out of 10. Despite issuing approximately $4.79 million in new long-term debt over the past three years, it is at a manageable level. The Altman Z-Score of 2.74, however, suggests the company is under some financial pressure as its revenue per share has declined over the past five years.

The company's profitability scored a 4 out of 10 rating on the back of margins and returns that underperform a majority of competitors. L.S. Starrett also has a moderate Piotroski F-Score of 6, which indicates operating conditions are stable, and a business predictability rank of one out of five stars. GuruFocus says companies with this rank typically see their stocks gain an average of 1.1% per annum over a 10-year period.

Of the gurus invested in L.S. Starrett, Jim Simons (Trades, Portfolio)' Renaissance Technologies has the largest holding with 6.26% of outstanding shares. Mario Gabelli (Trades, Portfolio) is also a shareholder.

Portfolio composition and performance

The firm's $11.06 billion equity portfolio, which was composed of 1,153 stocks as of the end of the second quarter, is largely invested in the industrials and technology sectors.

Other industrials stocks Royce's firm held as of the three months ended June 30 included Mistras Group Inc. (NYSE:MG), Generac Holdings Inc. (NYSE:GNRC), Primoris Services Corp. (NASDAQ:PRIM), Mayville Engineering Co. Inc. (NYSE:MEC) and GrafTech International Ltd. (NYSE:EAF).

According to its website, the Royce Premier Fund slightly outperformed its benchmark in 2018 with a return of -10.4%. The Russell 2000 posted a -11% return.

Disclosure: No positions.

This article first appeared on GuruFocus.