Chuck Royce's Firm Trims Medidata, Circor Positions

Chuck Royce (Trades, Portfolio)'s Royce & Associates sold shares of the following stocks in the second quarter.

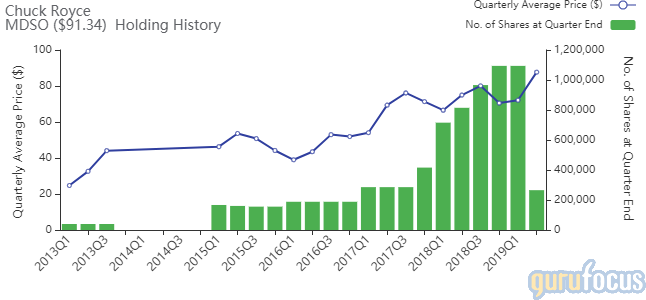

The firm curbed its Medidata Solutions Inc. (NASDAQ:MDSO) holding by 75.74%. The trade had an impact of -0.52% on the portfolio.

The provider of cloud-based solutions has a market cap and an enterprise value of $5.70 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of 7.14% and return on assets of 4.49% are underperforming 75% of companies in the Application Software industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 1.07 is below the industry median of 3.13.

The largest guru shareholder of the company is Royce's firm with 0.42% of outstanding shares, followed by the Eaton Vance Worldwide Health Sciences Fund (Trades, Portfolio) with 0.07% and Mario Gabelli (Trades, Portfolio) with 0.02%.

Royce's firm reduced its Circor International Inc. (NYSE:CIR) position by 52.37%. The portfolio was impacted by -0.28%.

The company, which designs and manufactures engineered products and systems, has a market cap of $716.97 million and an enterprise value of $1.37 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on equity of -9.49% and return on assets of -2.87% are underperforming 100% of companies in the Industrial Products industry. Its financial strength is rated 3.9 out of 10. The cash-debt ratio of 0.10 is below the industry median of 0.85.

The largest guru shareholder of the company is Gabelli with 9.62% of outstanding shares, followed by Royce's firm with 4.73% and PRIMECAP Management (Trades, Portfolio) with 1.78%.

The investment firm trimmed its Vishay Intertechnology Inc. (NYSE:VSH) stake by 26.12%. The portfolio was impacted by -0.21%.

The provider of discrete semiconductors has a market cap of $2.27 billion and an enterprise value of $2.11 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 20.50% and return on assets of 9.27% are outperforming 67% of companies in the Semiconductors industry. Its financial strength is rated 6.1 out of 10. The cash-debt ratio of 1.27 is below the industry median of 1.59.

The company's largest guru shareholder is Ken Fisher (Trades, Portfolio) with 3.59% of outstanding shares, followed by Royce's firm with 2.62%, the T Rowe Price Equity Income Fund (Trades, Portfolio) with 1.74% and Jeremy Grantham (Trades, Portfolio) with 1.04%.

The firm cut the Landstar System Inc. (NASDAQ:LSTR) holding by 26.02%, impacting the portfolio by -0.20%.

The company has a market cap of $4.26 billion and an enterprise value of $4.13 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 36.83% and return on assets of 19.15% are outperforming 94% of companies in the Transportation and Logistics industry. Its financial strength is rated 8 out of 10. The cash-debt ratio of 1.92 is above the industry median of 0.27.

Another notable guru shareholder of the company is Joel Greenblatt (Trades, Portfolio) with 0.14% of outstanding shares, followed by Grantham with 0.05% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.03%

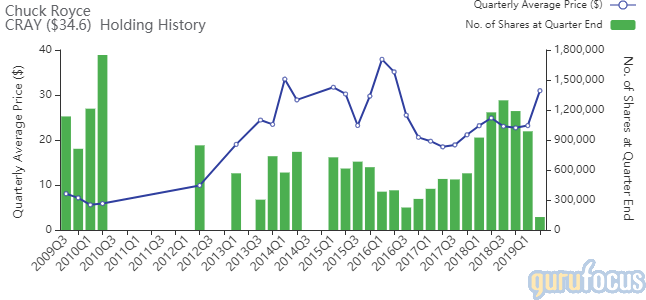

Royce's firm reduced its Cray Inc. (NASDAQ:CRAY) position by 86.87%. The portfolio was impacted by -0.19%.

The company, which manufactures high-performance supercomputers, has a market cap of $1.43 billion and enterprise value of $1.33 billion.

GuruFocus gives the company a profitability and growth rating of 2 out of 10. The return on equity of -32.47% and return on assets of -21.51% are underperforming 100% of companies in the Computer Hardware industry. Its financial strength is rated 6.2 out of 10. The cash-debt ratio of 3.70 is above the industry median of 1.18.

Mairs and Power (Trades, Portfolio) is the company's largest guru shareholder with 1.35% of outstanding shares, followed by PRIMECAP Management (Trades, Portfolio) with 0.80% and Simons' firm with 0.60%.

The Monro Inc. (NASDAQ:MNRO) holding was curbed by 60.08%, impacting the portfolio by -0.19%.

The company, which provides automobile service stations, has a market cap of $2.69 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 11.93% and return on assets of 6.11% are outperforming 60% of companies in the Autos industry. Its financial strength is rated 5.3 out of 10. The cash-debt ratio of 0.02 is below the industry median of 0.49.

Lee Ainslie (Trades, Portfolio) is the company's largest guru shareholder with 0.81% of outstanding shares, followed by Royce with 0.52%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Stocks With High Business Predictability Ratings

Ken Heebner's Firm Exits Zebra Technologies, Phillips 66

6 Stocks With Low Price-Sales Ratios

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.