Church & Dwight (CHD) Q1 Earnings Top Estimates, Sales Up

Church & Dwight Co., Inc. CHD reported first-quarter 2021 results, wherein earnings and sales surpassed the Zacks Consensus Estimate and the latter increased year over year. Results continued to gain from strong demand for household and personal care products owing amid the pandemic-led higher at-home consumption.

The company began 2021 on a robust note and expects it to be another solid year. Notably, Church & Dwight raised its sales view for 2021. However, it expects some pressure from increased raw material and transportation costs.

Quarter in Detail

Church & Dwight posted adjusted earnings of 83 cents per share that topped the Zacks Consensus Estimate of 80 cents, and remained in line with the year-ago quarter level.

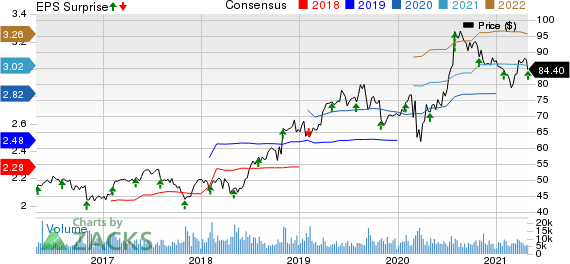

Church & Dwight Co., Inc. Price, Consensus and EPS Surprise

Church & Dwight Co., Inc. price-consensus-eps-surprise-chart | Church & Dwight Co., Inc. Quote

Net sales of $1,238.9 million advanced 6.3% year over year and surpassed the Zacks Consensus Estimate of $1,208.3 million. Results were backed by continued increase in pandemic-led demand for a number of the company’s products. Further, online sales surged 54% and formed 14.8% of quarterly sales.

Church & Dwight continued to witness robust consumption in the first quarter. The company saw double-digit consumption gains in several domestic categories, particularly gummy vitamins, pregnancy test kits, women’s electric grooming, battery toothbrush and toothache, amid the pandemic. Further, the company’s international business saw organic sales growth despite a number of countries undergoing lockdowns. International organic sales growth was backed by Global Markets Group.

Organic sales rose 4.9%, fueled by volume gains of 3.1% and a favorable price and product mix of 1.8%.

Gross margin declined 120 basis points (bps) to 44.5% due to elevated distribution costs and increased manufacturing costs — largely owing to commodities, pandemic-led expenses and elevated tariffs. This was partly offset by productivity and improved price and volumes.

Marketing expenses increased 2.4% to $98.7 million. As a percentage of sales, it fell 30 bps to 8%. Adjusted SG&A expenses, as a percentage of sales, increased 60 bps on account of buyout-related intangible amortization.

Segment Details

Consumer Domestic: Net sales in the segment rose 5.8% to $942.4 million owing to higher household and personal care sales, as well as gains from buyouts. Organic sales improved 5.1%, driven by volume growth and higher price and product mix. The upside was fueled by VITAFUSION and L’IL CRITTERS gummy vitamins, FLAWLESS beauty products, WATERPIK oral care products, ARM & HAMMER clumping cat litter, VIVISCAL hair thinning, and KABOOM bathroom cleaners.

Consumer International: Net sales in the segment increased 9% to $216.4 million, mainly on the back of the Global Markets Group and positive currency impacts. Even amid lockdowns in Europe, organic sales improved 3.2% on higher volumes, partly negated by unfavorable price and mix. Organic sales gained from the strength in WATERPIK, ARM & HAMMER liquid laundry detergent, OXICLEAN stain fighter, and FEMFRESH intimate wash in the Global Markets Group; WATERPIK in Germany, as well as ANUSOL hemorrhoidal products in the U.K.

Specialty Products: Sales in the segment rose 6% to $80.1 million, mainly on the back of the dairy market. Organic sales increased on better pricing, partially countered by reduced volumes. Meanwhile, milk prices have been stable.

Other Financial Updates

Church & Dwight ended the quarter with cash on hand of $127.5 million and total debt of $2,095.3 million. During the first three months of 2021, cash from operating activities was $100.2 million and the company incurred capital expenditures of $26.3 million.

Additionally, on Apr 28, the company announced dividend of 25.25 cents per share, which is payable on Jun 1, 2021 to shareholders of record as on May 14. Notably, this marks the company’s 481St straight regular dividend payment.

2021 Outlook

Management raised its sales outlook and now expects reported sales growth of 5-6% compared with 4.5% rise anticipated earlier. Organic sales are now expected to rise nearly 4-5%, up from about 3% growth projected earlier.

Adjusted earnings per share for 2021 are still envisioned in a band of $3-$3.06, suggesting growth of 6-8% on the back of higher operating income. The sales growth is likely to be countered by reduced anticipations for gross margin growth.

Management stated that costs of raw materials and transportation started to escalate in the first quarter of 2021 due to the Texas freeze. Consequently, it expects additional input costs of $90 million for full-year 2021. However, this is likely to be partly negated by reduced coupons and promotions, along with the planned price hikes. As a result, gross margin is expected to be flat in 2021 compared with 2020 levels. Also, the company expects adjusted operating margin to expand 80 bps compared with 100 bps increase anticipated before.

Q2 Outlook

For the second quarter of 2021, the company expects roughly a 4.5% increase in reported sales, and organic sales are expected to rise nearly 4%. Further, management expects gross margin to contract 350 bps owing to comparisons with low promotional levels last year. Management further stated that its planned price hike actions are likely to help counter commodity and transport costs in the third quarter. Adjusted earnings per share are expected to be 69 cents in the second quarter, indicating a decline of 10.4% from the year-ago quarter’s figure. The downside includes an adverse impact related to a voluntary product recall. Also, it reflects increased marketing spend to support product introductions.

In the past six months, shares of this Zacks Rank #4 (Sell) company have lost 4.5% compared with the industry’s decline of 13.5%.

Check These Solid Consumer Staples Stocks

Sanderson Farms, Inc. SAFM, currently sporting a Zacks Rank #1 (Strong Buy), has a long-term earnings growth rate of 43.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Pilgrims Pride PPC has a Zacks Rank #2 (Buy) and a long-term earnings growth rate of 24.1%.

United Natural UNFI has a Zacks Rank #2 and its bottom line outpaced the Zacks Consensus Estimate by 13.6% in the trailing four quarters, on average.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

United Natural Foods, Inc. (UNFI) : Free Stock Analysis Report

Sanderson Farms, Inc. (SAFM) : Free Stock Analysis Report

Pilgrims Pride Corporation (PPC) : Free Stock Analysis Report

To read this article on Zacks.com click here.