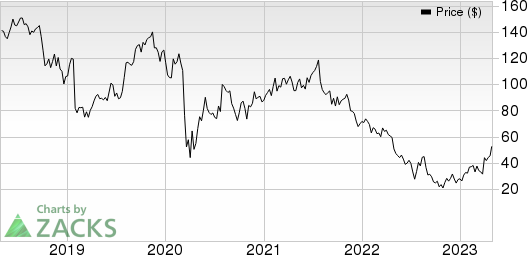

Cimpress (CMPR) Shares Gain 19.3% Since Q3 Earnings Release

Cimpress plc CMPR reported impressive third-quarter fiscal 2023 results, wherein earnings beat the Zacks Consensus Estimate by 17.1% and sales beat the same by 5.7%. Shares of the company have increased 19.3% since the earnings release on Apr 26.

CMPR incurred an adjusted loss of 97 cents per share, narrower than the Zacks Consensus Estimate of a loss of $1.17 per share. This compared unfavorably with our estimate of a loss of $1.18. Cimpress incurred a loss of $2.75 per share in the year-ago quarter.

Top-Line Details

Total revenues in the fiscal third quarter were $742.1 million, reflecting an increase of 12.9% from $657.4 million in the year-ago quarter. The organic constant-currency revenue growth was 16%, driven by growth across all businesses. The top line beat the consensus estimate of $702 million. This compared unfavorably with our estimate of $685.2 million.

Segmental Information

The National Pen segment generated revenues of $81.1 million, up from $72.2 million in the prior-year quarter. This compared unfavorably with the Zacks Consensus Estimate of $145 million. Our estimate for the quarter was $81.1 million. Vistaprint — the largest revenue-generating segment — reported aggregate revenues of $396.6 million, up from $349.2 million in the year-ago quarter. This compared unfavorably with the Zacks Consensus Estimate of $372 million. Our estimate for the quarter was $356.9 million.

The Upload and Print segment’s revenues increased to $225.1 million from $195.4 million in the year-ago quarter. The segment consists of two subgroups, namely PrintBrothers and The Print Group. PrintBrothers’ revenues increased to $139.6 million from $120 million in the fiscal third quarter. The Print Group generated revenues of $85.5 million, up from $75.4 million in the fiscal third quarter. Revenues from All Other Businesses increased to $49 million from $48.5 million in the quarter. This compared well with the Zacks Consensus Estimate of $49 million. Our estimate for the quarter was $49.7 million.

Cimpress plc Price, Consensus and EPS Surprise

Cimpress plc price-consensus-eps-surprise-chart | Cimpress plc Quote

Margin Details

In the quarter, Cimpress' cost of revenues was $394.9 million, up 13.6% on a year-over-year basis. The metric represented 53.2% of total revenues. Total selling, general & administrative expenses were $52.6 million, up from $50.9 million reported in the year-ago quarter. The same represented 7.1% of total revenues in the quarter.

Gross profit increased 8.5% year over year to $347 million. The margin was 46.8%, up 70 basis points due to higher volumes and the reduced net impact of cost inflation. Net interest expenses rose 26% to $30.5 million.

Balance Sheet and Cash Flow

As of Mar 31, 2023, Cimpress had $115 million of cash and cash equivalents, compared with $277.1 million at the end of the fourth quarter of fiscal 2022. Also, CMPR’s total debt (net of issuance costs) was $1,693.3 million. In the fiscal third quarter, Cimpress refrained from buying back shares.

In the first nine months of fiscal 2023, net cash provided by operating activities was $68.5 million, compared with $131.7 million cash provided a year ago.

Zacks Rank & Other Stocks to Consider

CMPR currently carries a Zacks Rank #2 (Buy). Some other top-ranked companies are discussed below:

Alamo Group Inc. ALG presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

ALG’s earnings surprise in the last four quarters was 6.0%, on average. In the past 60 days, estimates for Alamo’s 2023 earnings have increased 7.5%. The stock has gained 17.5% in the past six months.

Ingersoll Rand Inc. IR presently sports a Zacks Rank of 1. IR’s earnings surprise in the last four quarters was 8.5%, on average.

In the past 60 days, estimates for Ingersoll Rand’s 2023 earnings have increased 3.3%. The stock has rallied 12.8% in the past six months.

Allegion plc ALLE presently carries a Zacks Rank of 2. ALLE’s earnings surprise in the last four quarters was 12.5%, on average.

In the past 60 days, Allegion’s earnings estimates have increased 1.1% for 2023. The stock has gained 6.4% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Alamo Group, Inc. (ALG) : Free Stock Analysis Report

Allegion PLC (ALLE) : Free Stock Analysis Report

Cimpress plc (CMPR) : Free Stock Analysis Report