Circling Back To The Underperforming Qatar ETF (QAT)

Nearly a year ago this time (November 8, 2016) we profiled Qatar based QAT (iShares MSCI Qatar Capped, Expense Ratio 0.61%) because the country itself was in the news.

In fact, the day that we profiled the fund last year was the day of the historic U.S. Presidential election, which Donald Trump of course unlikely won, where we cited that “Qatar has been in the headlines recently, in tandem with WikiLeaks/DNC developments heading into today’s U.S. Presidential election in terms of possible donations to the Clinton Foundation – as well as potentially providing clandestine support historically for ISIS.”

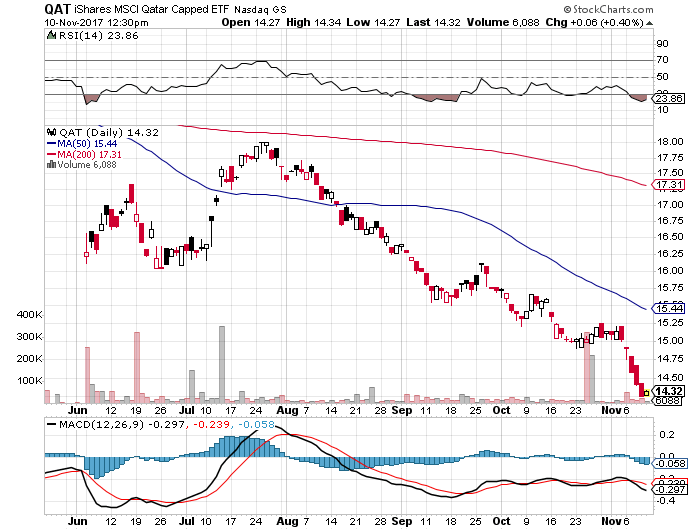

Clearly, what a difference a year makes, as ISIS has been considerably weakened in the past year through a massive loss of territory in Syria and Iraq, and Qatar itself has been rather hard hit in terms of its economy and stock market. QAT itself today is trading marginally higher from its new 52-week low registered yesterday, and trading volume in the fund has picked up somewhat after several very heavy volume days back in late October.

In the past we have suggested that portfolio managers whom are bearish on QAT could short the ETF, and from the pick-up in activity in the fund in terms of trading volume and volatility over the past year or so, this does seem to be taking place from time to time.

QAT has $52.6 million in assets under management presently, including adding a net of $17 million year-to-date, even though as we mentioned, the path of the fund has been lower throughout the past quarter to new 52-week low territory. Thanks to the asset growth, QAT has become the third largest “Middle East” focused ETF in the U.S. listed landscape behind the $56 million PAK (Global X MSCI Pakistan, Expense Ratio 0.91%) and the $87 million EIS (iShares MSCI Israel Capped, Expense Ratio 0.64%).

When we break down the underlying portfolio of QAT we see a huge overweight in the Financial sector (54%), followed by lesser allocations to Industrials (17%), Real Estate (10%), Telecommunications (7%), as well as other sectors. Bearish headlines concerning Qatari banks have been commonplace for months now, as we recently read of the countries of Saudi Arabia, the UAE, Bahrain, and Egypt severing ties with Qatar on June 5th of this year and since then in mid-October, we learned that Qatari authorities took steps to freeze the bank accounts of one of the Sheikhs in the royal family.

The iShares MSCI Qatar Capped ETF (QAT) was trading at $14.32 per share on Friday afternoon, up $0.06 (+0.42%). Year-to-date, QAT has declined -21.91%, versus a 16.43% rise in the benchmark S&P 500 index during the same period.

QAT currently has an ETF Daily News SMART Grade of C (Neutral), and is ranked #70 of 84 ETFs in the Emerging Markets Equities ETFs category.

Disclaimer: The content of this article is excerpted from a daily newsletter from Street One Financial. While ETF Daily News may edit the contents and add a relevant title to the piece, the author, Paul Weisbruch, does not endorse or recommend any issuer or security mentioned herein.

About the Author: Paul Weisbruch

Paul Weisbruch is the VP of ETF/Options Sales and Trading at Street One Financial. Prior to joining the team at Street One, Paul served as the Director of RIA and Institutional ETF Sales at RevenueShares ETFs from December 2007 until November of 2009. Before RevenueShares, Paul was employed by Susquehanna International Group from 2000 until 2007 serving in roles including OTC/NYSE Institutional Block Trading, Nasdaq/OTC Market Making, ETF/Derivatives Intelligence and Strategy, Algorithmic Trading, as well as acting as the PHLX Floor Specialist in the ETFs, SPY and DIA.Paul has been actively involved in the ETF space from both a product and trading standpoint since 2000. Additionally, Paul has well forged relationships with national RIAs, institutional pension fund managers and consultants, mutual fund and hedge fund managers, and also the ETF media. Co-authoring the “S1F ETF Daily” since 2009, the daily piece has become a must for many portfolio managers in the ETF space, with segments regularly appearing in the likes of Barron’s, WSJ, and ETFTrends.com for instance.

He holds his Series 4 (Registered Options Principal), 6, 7, 55 (Equity Trader), 63, and 65 licenses. He graduated from the University of Pittsburgh (B.S. – Economics), graduating magna cum laude, and has an MBA from Villanova University.