Citizens' (CFG) Q1 Earnings Beat Estimates on Fee Income Growth

Citizens Financial Group CFG has reported first-quarter 2021 adjusted earnings per share of $1.41, surpassing the Zacks Consensus Estimate of 97 cents. Also, the bottom line compares favorably with the year-ago quarter’s 9 cents.

Increase in fee income on the back of a solid rise in mortgage banking and capital market fees supported revenue growth. Further, deposit balances showed improvement. Also, capital position remained strong. However, contraction of margin is a headwind.

Following the release, the stock gained nearly 2% during pre-market trading, indicating that investors are optimistic about the company’s ability to bear the impact of the pandemic. Nonetheless, the full session’s price movement is likely to display a better picture.

After considering notable items, net income was $611 million or $1.37 per share compared with the $34 million or 3 cents per share reported in the prior-year quarter.

Revenues Up on Higher Fee Income, Costs Remain Flat

Total revenues for the first quarter were $1.66 billion, surpassing the consensus estimate of $1.65 billion. Additionally, the top line was up slightly, year over year.

Citizens’ net interest income fell 3.7% year on year at $1.1 billion. Also, net interest margin contracted 34 basis points (bps) to 2.76%. This was, however, partly mitigated by improved funding mix and deposit pricing.

Non-interest income climbed 9% year over year to $542 million. This upside stemmed largely from a rise in mortgage banking fees and capital market fees.

Non-interest expenses remain under control, year over year, at $1.01 billion. On an adjusted basis, expenses rose 2%.

Efficiency ratio remained flat at 61% year over year, in the January-March quarter.

As of Mar 31, 2021, period-end total loan and lease balances slightly fell sequentially to $122.2 billion. However, total deposits increased 2.8% to $151.3 billion.

Credit Quality: A Mixed Bag

Reflecting a strong credit performance across the consumer and commercial loan portfolios, and improvement in the macroeconomic outlook, provision for credit losses witnessed a reversal of $140 million compared with the $600-million provision expense in the year-ago quarter. However, net charge-offs for the quarter jumped 15.3% to $158 million.

Non-accrual loans and leases were up 29.2% to $1.1 billion. As of Mar 31, 2021, allowance for loan and lease losses increased 7.7% to $2.38 billion.

Capital Position

Citizens remained well capitalized in the first quarter. As of Mar 31, 2021, common equity tier-1 capital ratio was 10.1% compared with 9.4% at the end of the prior-year quarter. Further, Tier-1 leverage ratio was 9.5%, down 10 bps year over year. Total capital ratio was 13.4%, up from 12.5%, during the same time.

Capital Deployment Update

During the first quarter, the company returned $262 million to shareholders, in the form of share repurchases and common stock dividends.

Our Viewpoint

Citizens’ results highlight a decent quarter despite the unfavorable impact of the coronavirus crisis and lower interest rates. Pick up in mortgage business helped the company offset the pressure on margin.

We are further optimistic as the company continues to make investments in technology to improve customers’ experience. Apart from these, its progress in TOP programs and balance-sheet optimization initiatives bodes well for long-term growth.

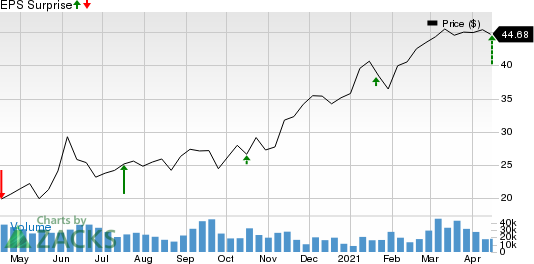

Citizens Financial Group, Inc. Price and EPS Surprise

Citizens Financial Group, Inc. price-eps-surprise | Citizens Financial Group, Inc. Quote

Currently, Citizens Financial carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

First Republic Bank’s FRC first-quarter 2021 earnings of $1.79 per share surpassed the Zacks Consensus Estimate of $1.54.

Bank of America Corporation’s BAC first-quarter earnings of 86 cents per share handily beat the Zacks Consensus Estimate of 65 cents. Also, the bottom line compared favorably with the 40 cents earned in the prior-year quarter level.

U.S. Bancorp USB reported first-quarter 2021 earnings per share of $1.45, which surpassed the Zacks Consensus Estimate of 95 cents. The bottom line compared favorably with the prior-year quarter’s figure of 72 cents.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of America Corporation (BAC) : Free Stock Analysis Report

Citizens Financial Group, Inc. (CFG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research