Clorox (CLX) Q3 Earnings & Sales Beat on Solid Demand

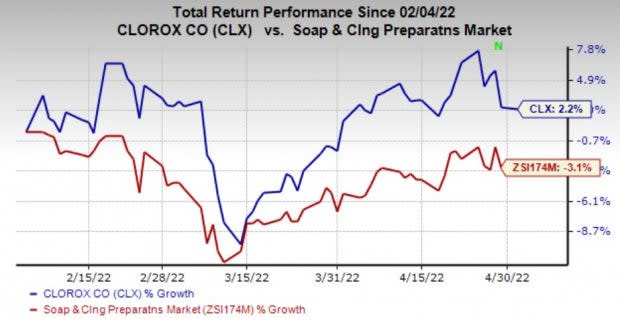

The Clorox Company CLX reported third-quarter fiscal 2022 results, wherein the top and bottom lines beat the Zacks Consensus Estimate, but the bottom line fell short of estimates. Despite rising inflation and continued uncertainty, results gained from solid demand for its products and brand strength. Also, management is encouraged by the company’s portfolio, innovation pipeline, cost savings efforts and pricing actions. Shares of the Zacks Rank #3 (Hold) company have gained 2.2% in the past three months against the industry’s 3.1% decline.

However, this Zacks Rank #4 (Sell) company lowered its bottom line view for fiscal 2022 to include impacts from the ongoing inflationary pressures. As a result, Clorox’s shares declined 2.1% in the after-market session on May 2.

Q3 Highlights

Adjusted earnings of $1.31 per share decreased 19% year over year but surpassed the Zacks Consensus Estimate of 97 cents. The earnings decline can be attributed to lower gross margin which was partly offset by reduced advertising spending and higher sales. Adjusted earnings excluded 10 cents related to investments in the company's long-term digital capabilities and productivity enhancements.

The company posted net sales of $1,809 million, beating the Zacks Consensus Estimate of $1,808 million. The top line rose 2% both year over year and on an organic basis. Sales gained from higher shipments across all segments.

The gross margin contracted 760 basis points (bps) to 35.9% in the fiscal third quarter. Elevated manufacturing and logistics costs, and higher commodity costs was partly offset by pricing benefits and cost savings initiatives.

Image Source: Zacks Investment Research

Segmental Discussion

Sales of the Health and Wellness segment declined 3% to $662 million, owing to soft sales across all three business units. The downside was led by a 3-point related to higher trade spending and a 3-point impact from unfavorable price mix which more than offset 3 points of pricing benefit.

The Household segment’s sales improved 6% to $539 million, driven by sales growth in two of the three business units stemming from 4 point of pricing gains and 2 point of higher volumes.

Sales at the Lifestyle segment rose 4% year over year to $306 million owing to growth across all three businesses. This was mainly due to a 6-point rise in volume which was somewhat offset by 2 point impact from unfavorable price mix.

In the International segment, sales of $302 million were up 1% year over year as an 4-point gain from favorable price mix and 2 point of rise in volumes was fully offset by a 5-point impact from unfavorable currency. Organic sales for the segment improved 6%.

Financials

Clorox ended third-quarter fiscal 2022 with cash and cash equivalents of $241 million, and long-term debt of $1,887 million. In the first nine months of fiscal 2022, the company generated $451 million of net cash from operations.

Fiscal 2022 Guidance

Management updated its fiscal 2022 view to take into account the adverse impacts from cost inflation. The gross margin is now expected to decline 800 bps in fiscal 2022 compared with a 750 bps decline mentioned earlier. The revised gross margin guidance stems from higher-than-anticipated commodity costs, and manufacturing and logistics expenses.

Consequently, adjusted earnings for fiscal 2022 are estimated to be $4.05-$4.30 per share, down from $4.25-$4.50 per share mentioned earlier. The revised guidance suggests a year-over-year decline of 44-41% compared with a decline of 41-38% stated earlier. The company notes that adjusted earnings per share will exclude long-term investments in digital capabilities and productivity enhancements to provide greater visibility to the underlying operating performance.

On a GAAP basis, earnings per share are anticipated to be $3.60-$3.85, down from $3.80-$4.05 stated earlier. The new guidance suggests a decline of 35-31% from the year-ago period compared with the 32-27% decline mentioned earlier.

It still envisions a sales decline of 1-4%, both on a reported and organic basis, for fiscal 2022. For the first half of fiscal 2022, sales is likely to decline 7%.

The company now projects selling and administrative expenses as a percentage of sales to be 14-15% for fiscal 2022, compared with prior view of 15%. This view includes 1% of this impact to come from the planned investments in digital capabilities and productivity enhancements.

Clorox stated that it expects to invest $90 million in long-term strategic digital capabilities and productivity enhancements in fiscal 2022. Of this, it expects $73 million (45 cents per share) to flow through to the profit and loss statement, most of which is expected to be recorded in selling and administrative expenses.

The company expects advertising and sales promotion expenses to be 10% of net sales. The higher spending mainly relates to an increase in brand investments to support its innovation pipeline and customer engagement efforts. The effective tax rate is anticipated at 22-23%.

The Clorox Company Price, Consensus and EPS Surprise

The Clorox Company price-consensus-eps-surprise-chart | The Clorox Company Quote

Business Developments

The company continues to gain market share, marking the third straight quarter of double-digit growth for its disinfecting wipes. During the quarter, Clorox launched Kingsford flavor boosters for charcoal and pellet grills, Glad compostable drawstring bags in Canada, Glad to Be Green 50% ocean bound plastic recycled trash bags in Australia as well as Glad ForceFlex Plus with Clorox trash bags available in Eucalyptus and Peppermint fragrances.

Also, it inked a multiyear deal with ASM Global to become their official cleaning and disinfecting product partner. As part of the deal, ASM Global facilities will use Clorox disinfecting wipes, hand sanitizer and electrostatic sprayers. In another development, it announced a new 12-year virtual power purchase agreement in sync with its commitment to 100% renewable electricity for its U.S. and Canada operations.

Stocks to Consider

We highlighted some better-ranked stocks from the broader Consumer Staples space, namely The Duckhorn Portfolio NAPA, McCormick & Company MKC and Sysco Corporation SYY.

McCormick is one of the leading manufacturers, marketers and distributors of spices, seasonings, specialty foods and flavors. It also currently carries a Zacks Rank #2 (Buy). It has an expected long-term earnings growth rate of 6.1%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for McCormick’s current financial-year sales and EPS suggests growth of 5% and 3.9%, respectively, from the year-ago period’s reported figures. MKC has a trailing four-quarter earnings surprise of 7.3%, on average.

Duckhorn, a premier producer of wines in North America, currently has a Zacks Rank #2 and an expected long-term earnings growth rate of 11.3%. NAPA has a trailing four-quarter earnings surprise of 122.4%, on average.

The Zacks Consensus Estimate for Duckhorn’s current financial-year sales and earnings per share suggests growth of 9.6% and 3.5%, respectively, from the year-ago reported numbers. The consensus mark for NAPA’s earnings per share has been unchanged in the past 30 days.

Sysco, marketer and distributer of food and related products, currently has a Zacks Rank #2. It has an expected long-term earnings growth rate of 11%. The company has a trailing four-quarter earnings surprise of 3.7%, on average.

The Zacks Consensus Estimate for Sysco’s current financial-year sales and earnings per share suggests growth of 35.9% and 145.5%, respectively, from the corresponding year-ago reported numbers. The consensus mark for SYY’s earnings per share has been unchanged in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Clorox Company (CLX) : Free Stock Analysis Report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

The Duckhorn Portfolio, Inc. (NAPA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research