Clovis (CLVS) Q2 Earnings Miss, PARP Drug Rubraca Sales Down

Clovis Oncology CLVS reported second-quarter 2021 net loss of 61 cents per share, wider than the Zacks Consensus Estimate of a loss of 57 cents but narrower than the year-ago period’s loss of $1.15.

Adjusted loss (excluding acquired in-process research and development, and foreign currency loss) was 59 cents per share compared with $1.11 in the year-ago quarter.

Net revenues — entirely from Clovis’ only marketed drug, Rubraca — were down almost 8% year over year to $36.8 million for the quarter, missing the Zacks Consensus Estimate of $40.8 million.

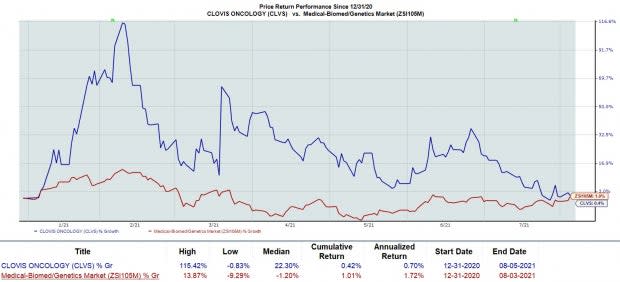

Shares of Clovis have risen 0.4% in the year so far compared with the industry’s 1% growth.

Image Source: Zacks Investment Research

Quarter in Detail

Sales of Rubraca — a PARP inhibitor — in the United States were $27.7 million, down 24.5% year over year. Ex-U.S. market sales were $9.1 million for the second quarter, up 184.4% year over year. Lower sales were due to COVID-19 impacts.

For the second quarter, research & development expenses decreased 35% year over year to $45.8 million, primarily due to lower spending on Rubraca clinical studies.

Selling, general and administrative expenses declined 21% year over year to $32.9 million, driven by cost-saving initiatives and savings due to the COVID-19 situation globally.

Clovis ended the quarter with $230.2 million of cash equivalents and available-for-sale securities compared with $190.9 million on Mar 31, 2021.

The company expects cash resources along with anticipated revenues and available financing sources to be enough to support its operations for at least the next 12 months.

Pipeline Updates

Rubraca

The phase III ATHENA study is evaluating Rubraca as monotherapy and in combination with Bristol-Myers‘ BMY Opdivo in advanced ovarian cancer as first-line maintenance treatment. While top-line data from the combination arm of the study is anticipated in second-half 2022, top-line data from the monotherapy arm of the study is now expected in first-quarter 2022, delayed from the earlier projection in second-half 2021.

A confirmatory phase III TRITON3 study is evaluating Rubraca in metastatic castration-resistant prostate cancer (mCRPC) patients with tumor with BRCA mutations and ATM mutations. Data from this study is expected in second-quarter 2022. The study will serve as a confirmatory study for continued approval of Rubraca in mCRPC.

FAP-2286

In June 2021, the company initiated enrolment in phase I/II LuMIERE study to evaluate FAP-2286 in multiple tumor types. While the phase I portion of the study will determine the dose and tolerability of the candidate, the phase II portion will consist of expansion cohorts planned in multiple tumor types.

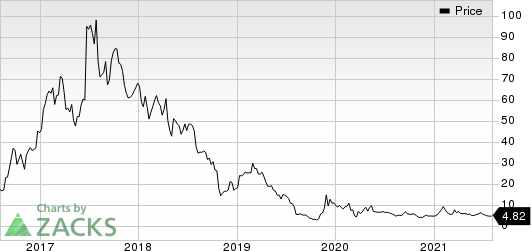

Clovis Oncology, Inc. Price

Clovis Oncology, Inc. price | Clovis Oncology, Inc. Quote

Zacks Rank & Stocks to Consider

Clovis currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector include Repligen RGEN and Vertex Pharmaceuticals VRTX, each currently carrying a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Repligen’s earnings per share estimates for 2021 have increased from $2.26 to $2.69 in the past 30 days. The same for 2022 has risen from $2.56 to $2.94 over the same period. The stock has rallied 31.9% in the year so far.

Vertex’s earnings per share estimates for 2021 have been raised from $11.20 to $12.28 in the past 30 days. The same for 2022 has been revised upward from $12.25 to $13.02 over the same period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Repligen Corporation (RGEN) : Free Stock Analysis Report

Clovis Oncology, Inc. (CLVS) : Free Stock Analysis Report

To read this article on Zacks.com click here.