Is Colgate-Palmolive Company’s (NYSE:CL) Balance Sheet Strong Enough To Weather A Storm?

There are a number of reasons that attract investors towards large-cap companies such as Colgate-Palmolive Company (NYSE:CL), with a market cap of $65.99B. One such reason is its ‘too big to fail’ aura which gives it the appearance of a strong and healthy investment. However, investors may not be aware of the metrics used to measure financial health. The significance of doing due diligence on a company’s financial strength stems from the fact that over 20,000 companies go bankrupt in every quarter in the US alone. Thus, it becomes utmost important for an investor to test a company’s resilience for such contingencies. In simple terms, I believe these three small calculations tell most of the story you need to know. Check out our latest analysis for Colgate-Palmolive

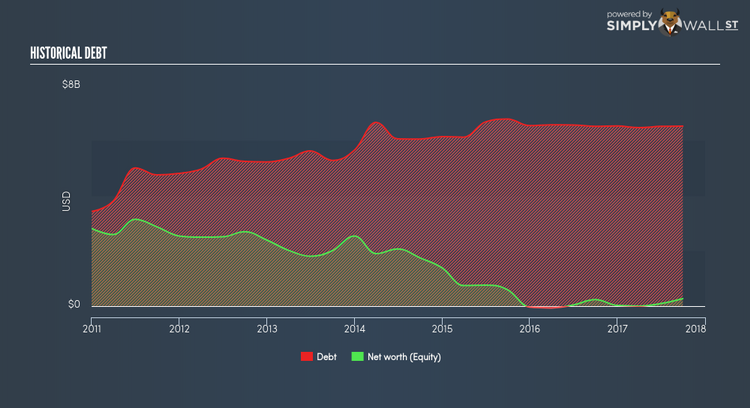

Is CL’s level of debt at an acceptable level?

A debt-to-equity ratio threshold varies depending on what industry the company operates, since some requires more debt financing than others. A ratio below 40% for large-cap stocks is considered as financially healthy, as a rule of thumb. For CL, the debt-to-equity ratio stands at above 100%, which indicates that the company is holding a high level of debt relative to its net worth. In the event of financial turmoil, the company may experience difficulty meeting interest and other debt obligations. No matter how high the company’s debt, if it can easily cover the interest payments, it’s considered to be efficient with its use of excess leverage. A company generating earnings (EBIT) at least three times its interest payments is considered financially sound. In CL’s case, its interest is excessively covered by its earnings as the ratio sits at 41.45x. Lenders may be less hesitant to lend out more funding as CL’s high interest coverage is seen as responsible and safe practice.

Does CL generate enough cash through operations?

A simple way to determine whether the company has put debt into good use is to look at its operating cash flow against its debt obligation. This is also a test for whether CL has the ability to repay its debt with cash from its business, which is less of a concern for large companies. In the case of CL, operating cash flow turned out to be 0.48x its debt level over the past twelve months. This is a good sign, as over a quarter of CL’s near term debt can be covered by its day-to-day cash income, which reduces its riskiness to its debtholders.

Next Steps:

Are you a shareholder? Although CL’s debt level is towards the higher end of the spectrum, investors shouldn’t panic since its cash flow coverage seems adequate to meet obligations which means its debt is being efficiently utilised. Given that CL’s capital structure may be different in the future, I suggest assessing market expectations for CL’s future growth on our free analysis platform.

Are you a potential investor? Although understanding the serviceability of debt is important when evaluating which companies are viable investments, it shouldn’t be the deciding factor. After all, debt financing is an important source of funding for companies seeking to grow through new projects and investments. That’s why I encourage potential investors to look at CL’s Return on Capital Employed (ROCE) in order to see management’s track record at deploying funds in high-returning projects.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.