Comcast's (CMCSA) Initiatives to Boost Ad Sales in 2020

Comcast Corporation CMCSA is hoping to simplify ad sales for an increasingly crowded and disparate digital video-ad marketplace.

The company, which had announced its new One Platform initiative for NBCUniversal at CES, recently unveiled the details of its expanded technology suite and partnerships related to its One Platform connected TV and digital advertising strategy.

Per an IHS Markit report, new AVOD rollouts and improved ad-tech are expected to drive U.S. online video advertising revenues to $27 billion in 2023, at a CAGR of 11% between 2018 and 2023 that suggests Comcast is well positioned to benefit from bright growth prospects in the industry.

One Platform Ad Tech and Sales Strategy

NBCUniversal is expanding its AdSmart suite of products including its proprietary audience graph, linear audience optimizer and programmatic linear API.

The company’s linear optimization solution will include Nielsen demo target audiences along with 4C Insights’ technology and data science to aid advertisers target audiences across all screens more efficiently.

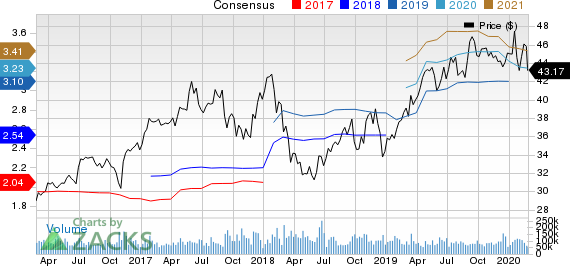

Comcast Corporation Price and Consensus

Comcast Corporation price-consensus-chart | Comcast Corporation Quote

Additionally, through Comcast-owned FreeWheel, NBCUniversal is unifying scheduling and trafficking of campaigns across linear and digital platforms concurrently.

Moreover, the company is also expanding its CFlight cross-platform impression measurement to include OTT co-viewing, out-of-home measurement (OOH) and short-form video.

Further, the company is introducing four transaction models for One Platform — broad reach, demo target, advanced target and sponsorship/live events.

Comcast’s Xumo Acquisition to Aid Ad Revenues

Meanwhile, Comcast acquired Xumo, an advertising-supported free streaming service, which pulls streams from partners like ABC News, Fox Sports and USA Today and comes pre-installed on smart televisions. The financial terms of the acquisition were undisclosed.

The company-owned platform called Elixir, which automates the process for running ad-supported streaming channels and adjusts programming and advertising in real time is likely to boost ad revenues for Comcast in the near term.

Additionally, Xumo’s partnership with smart TV manufacturers such as LG, Panasonic and Vizio is expected to give Comcast a bigger foothold in marketing or showcasing Xfinity and other Comcast services and reaching customers through smart TVs. Xumo has around 10 million monthly active users (MAUs), up from 5.5 million MAUs reported in the spring of 2019, per a Variety report.

Others Players Vying for Free Ad-Based Streaming Revenues

Xumo’s acquisition is part of a small run on free ad-supported streaming services. Notably, Ad-revenues from ad-based video on demand increased 395 to $3.8 billion last year, per Magna Global data. In 2020, the industry is expected to hit $5 billion in sales, up 31% year over year.

Notably, ViacomCBS VIAC acquired PlutoTV for $340 million last year. Earlier this month, Pluto reported 22 million active users, up 75% year over year. The company expects the ad-supported service to reach 30 million subscribers by the end of December 2020.

Recently, The Wall Street Journal reported that Fox FOXA is in talks to acquire Tubi for more than $500 million. Currently, Tubi has about 25 million monthly active users, up from 20 million in mid-2019. Total viewing time was more than 163 million hours in December, up 160% year over year, per Business Insider report.

Moreover, Comcast-owned NBCUniversal is reportedly in talks with Walmart WMT to purchase Vudu even as it prepares for the launch of its Peacock streaming platform in April.

Xumo will help support Peacock by giving it a wider audience, more channels and technology. In addition to subscription tiers, Peacock will also offer a free, ad-supported service for customers.

Zacks Rank

Comcast currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comcast Corporation (CMCSA) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Fox Corporation (FOXA) : Free Stock Analysis Report

ViacomCBS Inc. (VIAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research