Commodity ETFs: Oil Paces Weekly Gainers, Corn Slumps on Crop Report

U.S. Oil Fund (USO) has been on a tear in March with crude prices bouncing from about $90 to $97 a barrel amid signs of steady improvement in the U.S. economy.

USO was poised for a 3.5% gain for the holiday-shortened week.

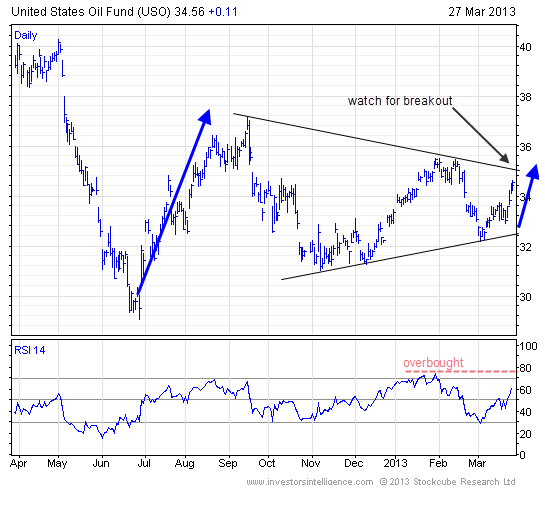

“The fund has done little for the past three years, merely trading a snoozer of range between $30 and $45 [a share],” says Investors Intelligence technical analyst Tarquin Coe.

“March has been a kind month for the fund. This may be start of a rally, something which is long overdue. The ETF needs to defeat the trendline drawn down from the September 2012 peak and last month’s high, after which the fund should extend up towards the $40 level. Momentum is still a good distance from being overbought,” he said in a newsletter.

“The energy sector funds and stocks have shown improvement over recent sessions, so a rotation may be commencing as other industry areas are overextended,” the analyst added.

Elsewhere in commodities ETFs, Teucrium Corn Fund (CORN) plunged 6% on Thursday following a government report that U.S. farmers intend to plant the biggest crop since 1936. [Corn ETF Crashes as Farmers Plant Most Since 1930s]

In the major U.S. equity indices, the S&P 500 on Thursday rose above its all-time closing high from 2007.

“We will still be very news dependent, as we always are, so I don’t expect any big, material explosions to the upside, but we just continue to slowly move higher,” said Darrell Cronk, regional chief investment officer for Wells Fargo Private Bank, in a Reuters report. “As you continue to set those new index highs, as you continue to see positive macro data, it will probably continue to bring people in off the sidelines.”

The S&P 500 was on track for a weekly gain 0.6% in afternoon trading Thursday, while the Dow added 0.3% and the Nasdaq Composite climbed 0.4%.

The top three unleveraged ETFs the past five sessions were iShares MSCI Philippines (EPHE), iPath S&P GSCI Crude Oil (OIL) and U.S. Oil Fund with gains of at least 5%.

The bottom three unleveraged ETFs over the last five sessions were Teucrium Corn Fund, iPath Grains (JJG) and iShares MSCI Spain (EWP) with setbacks of more than 5%.

Markets will be closed for Good Friday.

Next week’s economic data features reports on ISM manufacturing, construction spending, factory orders, auto sales, ISM non-manufacturing, ADP private sector payrolls, consumer credit and international trade. However, the main event next week will be the March employment report scheduled to cross on Friday.

U.S. Oil Fund

The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.