Computer - IT Services Outlook: Near-Term Pain to Persist

The Zacks Computer – IT Services industry comprises an array of companies with diversified end-markets and customer base.

The industry includes consultancy, customer relationship management (CRM), communications, IT management & operations, cloud-based web development platform professional information solution, and outsourcing service providers.

Increasing U.S. protectionism is hurting growth prospects of this industry. Lack of skilled workers particularly from STEM (Science, Technology, Engineering and Mathematics) fields in the United States has been bothering industry participants for quite some time.

Moreover, the U.S. government’s plan to reduce the issuance of H1-B visas to foreign nationals particularly from countries like India is a key concern for this industry.

Further, the ongoing trade war between the United States and China has created an uncertain environment that is not conducive for investments, particularly on infrastructure related services.

Further, volatility in foreign exchange primarily due to current macro-economic scenario and headwinds in the emerging markets does not bode well for the Zacks Computer – IT Services Industry.

Industry Comparison With S&P 500 & Sector

The Zacks Computer – IT Services Industry, within the broader Zacks Computer And Technology Sector, has outperformed both the S&P 500 and its own sector in the past year.

While the stocks in this industry have collectively gained 53.9%, the Zacks S&P 500 Composite and Zacks Computer And Technology Sector have rallied 17.6% and 22.1%, respectively.

The outperformance can be attributed to the ongoing digital transition, which is increasing demand for IT service solutions. Robust adoption of technologies, which enhance the digital workplace such as work-stream collaboration, workforce analytics and video message oriented middleware (MOM); security (endpoint detection and response), analytics (smart data discovery) and storage (in-memory data grids), is driving growth.

One-Year Price Performance

Computer – IT Services Stocks Appear Pretty Expensive

Since there has been an exponential surge in debt level since 2015, it makes sense to value the industry based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio. This is because this valuation metric takes into account the level of debt.

For capital-intensive companies, the EV/EBITDA is a preferable valuation metric because it is not influenced by changing capital structures and ignores the effect of non-cash expenses.

Owing to the overall industry outperformance in the past year, the valuation is really expensive now. The industry currently has a trailing 12-month EV/EBITDA ratio of 15.7X, which is marginally below the high of 16.2X in the past year but well above the median level of 14.8X. Clearly, the aggregate valuation picture for the space appears rich.

The space also looks quite pricey when compared to the market at large as the trailing 12-month EV/EBITDA ratio for the S&P 500 is 11.5X and the median level is 11.4X.

Enterprise Value/EBITDA Ratio (TTM)

Moreover, a comparison of the group’s EV/EBITDA ratio with that of its border sector ensures that the group is trading at a huge premium. The Zacks Computer And Technology Sector’s forward 12-month EV/EBITDA ratio of 10.9X and the median level of 10.9X for the same period are way below the Zacks Computer IT Services Industry’s respective ratios.

Enterprise Value/EBITDA Ratio (TTM)

The premium to the broader market expanded materially in early 2018, as evident in the chart above, and is rising since then. The industry also trades at a premium to the broader sector on other conventional valuation metrics, for instance P/B.

Dim Earnings Outlook Keeps Us Cautious

Escalating operational expenses, soaring debt levels, increasing foreign exchange volatility and moderate spending are expected to hurt shareholder returns in the near term.

However, what really matters to investors is whether this group has the potential to perform better than the broader market in the quarters ahead.

One reliable measure that can help investors understand the industry’s prospects for a solid price performance going forward is its earnings outlook. Empirical research shows that earnings outlook for the industry, a reflection of the earnings revisions trend for the constituent companies, has a direct bearing on its stock market performance.

The Price & Consensus chart for the industry shows the market's evolving bottom-up earnings expectations for it and the industry's aggregate stock market performance.

Price and Consensus: Zacks Computer – IT Services Industry

This becomes even clearer by focusing on the aggregate bottom-up EPS revisions trend. The chart below shows the evolution of aggregate consensus expectations for 2018.

Please note that the $2.18 EPS estimate for the industry for 2018 is not the actual bottom-up EPS estimate for every company in the Zacks Computer – IT Services industry, but rather an illustrative aggregate number created by our proprietary analytics model. The key factor to keep in mind is not the EPS of the industry for 2018, but how this projection has evolved recently.

As you can see here, the $2.18 EPS estimate for 2018 has increased marginally from the end of June and substantially from the end of May. However, it is still down from $2.19 at the end of April.

Hence, the trend shows that the sell-side analysts covering the companies in the Zacks Computer – IT Services industry have been somewhat modest in raising their estimates.

Zacks Industry Rank Indicates Bleak Near-Term Prospects

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates underperformance in the near term.

The Zacks categorized Computer - IT Services industry currently carries a Zacks Industry Rank #213, which places it at the bottom 17% of 256 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Our proprietary Heat Map shows that the industry’s rank has continuously deteriorated over the past five weeks.

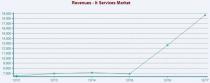

Revenue Trend Might Support Long-Term Prospects

Revenues have shown marked improvement since 2015. The growth can be attributed to strong adoption of cloud-based services.

However, surging debt level remains a concern for industry participants.

Bottom Line

The near-term growth prospect for the Zacks Computer – IT Services is hardly encouraging. Moreover, the valuation looks pricey at the moment and the escalating debt level is a concern.

Below are two stocks that carry a bearish Zacks Rank that we would recommend investors to stay away from for the time being.

DXC Technology Company (DXC): Tysons, VA-based DXC Technology carries a Zacks Rank #5 (Strong Sell). The Zacks Consensus Estimate for current-year earnings moved 10.8% lower for the current year in the last 60 days.

Price and Consensus: DXC

Wix.com Ltd. (WIX): Tel Aviv, Israel-based Wix carries a Zacks Rank #4 (Sell). The Zacks Consensus Estimate for current-year EPS was revised 3.3% downward in the last 60 days.

Price and Consensus: WIX

However, there are a couple of stocks in the Zacks Computer - IT Services industry that investors can acquire given their solid growth prospects. These have either a Zacks Rank #1 (Strong Buy) or Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Science Applications International Corp (SAIC): McLean, VA-based SAIC sports a Zacks Rank #1. The Zacks Consensus Estimate for current-year EPS increased 4.2% in the last 60 days.

Price and Consensus: SAIC

Fluent, Inc. (FLNT): Beverly Hills, CA-based Fluent carries a Zacks Rank #2. The Zacks Consensus Estimate for the current year increased by 32 cents from a loss of 29 cents per share to earnings of 3 cents per share in the last 60 days.

Price and Consensus: FLNT

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wix.com Ltd. (WIX) : Free Stock Analysis Report

SCIENCE APPLICATIONS INTERNATIONAL CORPORATION (SAIC) : Free Stock Analysis Report

IDI, Inc. (FLNT) : Free Stock Analysis Report

DXC Technology Company. (DXC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research