Computer Services Stock Outlook: Growth Prospects Solid

The Computer – Services Industry includes companies that offer cyber and fraud analysis, data collection & analytics, enterprise IT, systems engineering and software application development solutions.

This industry is benefiting from changing global regulatory requirements and customer interest in emerging technologies and related services.

As enterprises continue to move their on-premise workload to cloud environments (emergence of hybrid cloud), application and infrastructure monitoring are gaining utmost importance. This is creating more demand for performance management monitoring tools that are not only scalable but also suitable for cloud-based environments.

In addition, the industry is benefiting from the growing need of cyber security solutions and services in the defense, intelligence and civilian agencies of the U.S. government, amid growing incidences of cyber attacks and hacking.

Also, the present focus on cost reduction and operational efficiencies in varied fields should continue to drive demand for services provided by the industry participants. Moreover, increasing adoption of automation technologies to gain higher efficiency in business process operations is a key catalyst for growth.

Industry Returns Are Positive

Robust demand for services in the healthcare, enterprise management and security solutions in support of mission-critical programs have been the key drivers of consistent earnings and impressive sales growth. These are mainly behind investor confidence instilled in the Computer Services industry’s growth prospects.

The Zacks Computer Services Industry, within the broader Zacks Computer And Technology Sector, has outperformed both the S&P 500 and its own sector over the past year.

While the stocks in this industry have collectively gained 19.6%, the Zacks S&P 500 Composite and Zacks Computer And Technology Sector have rallied 15.8% and 18.2%, respectively.

One-Year Price Performance

Stretched Valuation a Concern

However, the Computer Services industry’s valuation looks stretched at the moment. One might get a good sense of the industry’s relative valuation by looking at its price-to-earnings ratio (P/E), which essentially shows how much an investor is willing to pay for each unit of earnings.

Notably, a lower P/E ratio is always better.

The industry currently has a forward 12-month P/E ratio of 20.33, which is close to the highest level over the past year.

The space also looks expensive when compared with the market at large, as the forward 12-month P/E ratio for the S&P 500 is 17.38 and the median level is 17.63.

Price-to-Earnings Ratio (F12M)

Moreover, a comparison of the group’s P/E ratio with that of its border sector ensures that the group is trading at a huge premium. The Zacks Computer And Technology Sector’s forward 12-month P/E ratio of 20.02 for the same period are way below the Zacks Computer Services Industry’s ratios.

Price-to-Earnings Ratio (F12M)

Improving Earnings Outlook to Drive Outperformance

Nevertheless, strong industry fundamentals and expectations of solid top-line growth should continue to generate positive shareholder returns in the near future.

However, what really matters to investors is whether this group has the potential to perform better than the broader market in the quarters ahead.

One reliable measure that can help investors understand the industry’s prospects for a solid price performance going forward is its earnings outlook. Empirical research shows that earnings outlook for the industry, a reflection of the earnings revisions trend for the constituent companies, has a direct bearing on its stock market performance.

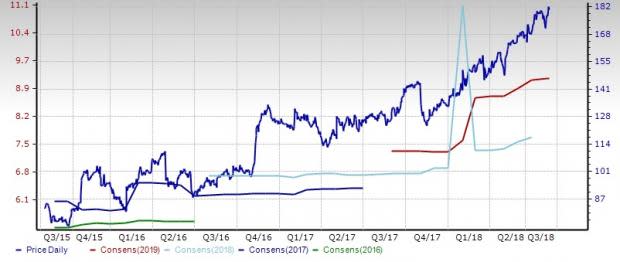

The Price & Consensus chart for the industry shows the market's evolving bottom-up earnings expectations for it and the industry's aggregate stock market performance.

Price and Consensus: Zacks Computer Services Industry

This becomes even clearer by focusing on the aggregate bottom-up EPS revisions trend. The chart below shows the evolution of aggregate consensus expectations for 2018.

Please note that the $2.18 EPS estimate for the industry for 2018 is not the actual bottom-up EPS estimate for every company in the Zacks Computer Services industry, but rather an illustrative aggregate number created by our proprietary analytics model. The key factor to keep in mind is not the EPS of the industry for 2018, but how this projection has evolved recently.

As you can see here, the $2.18 EPS estimate for 2018 has increased from the end of July. In other words, the sell-side analysts covering the companies in the Zacks Computer Services industry have been optimistic about raising their estimates.

Current Fiscal Year EPS Estimate Revisions

Zacks Industry Rank Indicates Solid Prospects

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates continued outperformance in the near term.

The Zacks Computer Services industry currently carries a Zacks Industry Rank #49, which places it at the top 19% of 256 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Our proprietary Heat Map shows that the industry’s rank has continuously improved over the past five weeks.

Long-Term Growth Prospects Strong

The long-term (3-5 years) EPS growth estimate for the Zacks Computer Services industry appears promising. The group’s mean estimate of long-term EPS growth rate of 10.92% is better than 9.82% for the Zacks S&P 500 composite.

Mean Estimate of Long-Term EPS Growth Rate

Computer Services’ long-term growth prospects are alluring. Growing adoption of cyber security solutions, call for automated services, stringent regulatory requirements and the need for cost effective solutions bode well for the industry.

Moreover, another indication of solid long-term prospects is the improvement in the group’s revenues.

Bottom Line

The near-term growth prospect for the Zacks Computer Services is encouraging for investors. As computers continue to dominate our lives, the need for computer professionals in both business and residential settings will always increase and the industry should continue to do well.

Despite stretched valuations, investors can build positions in the Computer Services industry based on the above-mentioned factors as well as a strong earnings outlook.

Here, we list three stocks that have been witnessing positive earnings estimate revisions and carry a Zacks Rank #1 (Strong Buy) or 2 (Buy).

(You can see the complete list of today’s Zacks #1 Rank stocks here.)

ManTech International Corp. (MANT): The stock has rallied 57.6% over the past year. The company sports a Zacks Rank #2 and has an average four-quarter positive earnings surprise of 6.07%.

Price and Consensus: MANT

Syntel, Inc. (SYNT): The stock has gained 121.0% over the past year. The company carries a Zacks Rank #2 (Buy) and has an average four-quarter positive earnings surprise of 27.1%.

Price and Consensus: SYNT

CACI International Inc. (CACI): The stock has gained 39.4% over the past year. The company has a Zacks Rank #2 and an average four-quarter positive earnings surprise of 17.2%.

Price and Consensus: CACI

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Syntel, Inc. (SYNT) : Free Stock Analysis Report

ManTech International Corporation (MANT) : Free Stock Analysis Report

CACI International, Inc. (CACI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research