Comstock Mining (LODE) Reports Break-Even Earnings in Q4

Comstock Mining LODE recently announced selected financial results for 2021. The company reported break-even earnings per share in fourth-quarter 2021, faring better than the Zacks Consensus Estimate of a loss of 3 cents per share. The company had reported a loss per share of 14 cents in the year-ago quarter. For 2021, the company reported a loss per share of 49 cents per share against earnings per share of 49 cents in 2020.

Revenues were $0.4 million in the quarter under review, which beat the Zacks Consensus Estimate by a margin of 4.21%. The top-line figure came in higher than revenues of $0.06 million in the fourth quarter of 2020.

Comstock Mining, Inc. Price, Consensus and EPS Surprise

Comstock Mining, Inc. price-consensus-eps-surprise-chart | Comstock Mining, Inc. Quote

As of Dec 31, 2021, Comstock Mining had $5.9 million in cash and equivalents. As of 2021-end, total assets were $127 million compared with $43 million, as of Dec 31, 2020. Net equity nearly tripled to $93 million during 2021 from around $32 million as of Dec 31, 2020.

Acquisitions

The company has been active on the buyout front in the past year. It has acquired Comstock Innovations (formerly Plain Sight Innovations). It adds a portfolio of intellectual property that contributes to global decarbonization by converting massive supplies of unused and under-utilized woody-biomass resources into cellulosic ethanol, renewable diesel, sustainable aviation fuel, and other drop-in fuels.

LODE acquired LINICO Corporation, which is an emerging leader in the production of electrification products, including lithium carbonate and graphite from recycled lithium-ion batteries, with its proprietary extraction technologies. The company also bought Comstock Engineering (formerly Renewable Process Solutions).

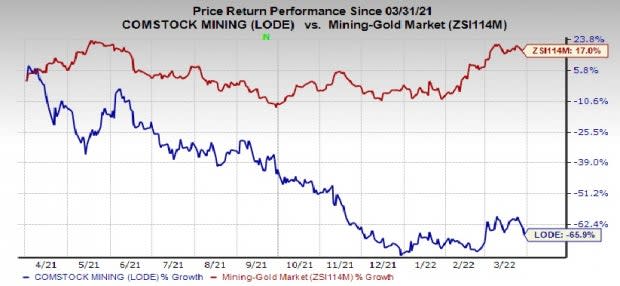

Price Performance

Image Source: Zacks Investment Research

Comstock Mining’s shares have fallen 65.9% in the past year against the industry’s growth of 17%.

Zacks Rank & Stocks to Consider

Comstock Mining currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space include The Mosaic Company MOS, AdvanSix Inc. ASIX and Allegheny Technologies Incorporated ATI.

Mosaic has a projected earnings growth rate of 125% for the current year. The Zacks Consensus Estimate for MOS' current-year earnings has been revised upward by 33.3% in the past 60 days.

Mosaic’s earnings beat the Zacks Consensus Estimate in three of the last four quarters and missed once, the average surprise being 3.7%. MOS has rallied around 104% in a year. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AdvanSix has a projected earnings growth rate of 64.8% for the current year. The Zacks Consensus Estimate for ASIX’s current-year earnings has been revised upward by 58% in the past 60 days.

AdvanSix’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, while missing in one, the average surprise being 23.6%. ASIX has soared 96% in a year. The company flaunts a Zacks Rank #1.

Allegheny, currently carrying a Zacks Rank #2 (Buy), has an expected earnings growth rate of 661.5% for the current year. The Zacks Consensus Estimate for ATI's earnings for the current year has been revised 45.6% upward in the past 60 days.

Allegheny’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 127.2%. ATI has rallied around 26% over a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allegheny Technologies Incorporated (ATI) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

Comstock Mining, Inc. (LODE) : Free Stock Analysis Report

AdvanSix (ASIX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research