Conagra (CAG) Seems a Solid Investment Choice: Time to Buy?

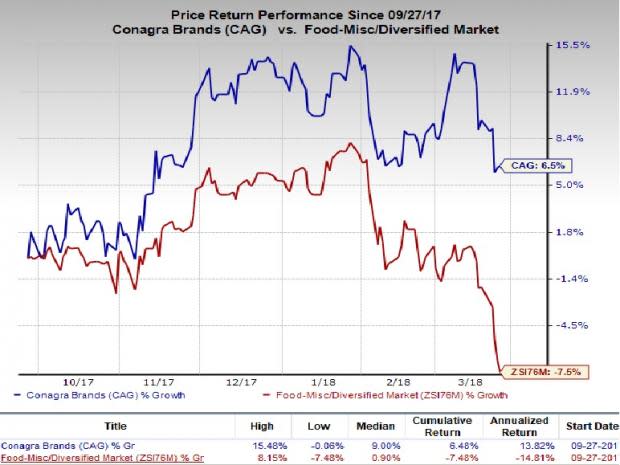

Conagra Brands, Inc. CAG will assure a promising investment move if the stock is added to your portfolio at the moment. Over the last six months, Conagra’s shares have yielded a return of 6.5%, against 7.5% loss recorded by its industry.

Notably, the attractiveness of this stock as a current investment choice is further accentuated by its favorable VGM Score of B.

Why Grab the Stock?

Value-over-Volume Strategy: Conagra is currently following a unique value-over-volume strategy, through which it is prioritizing over price/mix metric and margins, instead of volumes. In sync with this, the company ensures that its robust volume performance is driven by stronger innovation as well as new merchandizing, distribution, and consumer trail-related investments; instead of price discounts.

Top-Line Prospects: Sturdy demand for premium brands like Healthy Choice, Marie Callender, Slim Jim, Duke's, Bigs and Frontera is expected to boost Conagra’s revenues in the quarters ahead.

Moreover, new investments planned to strengthen its frozen business and brand renovation initiatives undertaken to improve snacks business would likely aid in improving Conagra’s top-line results in the upcoming quarters.

The company also believes that favorable foreign currency translation impact will drive its near-term revenue growth.

The company’s projected sales growth for fiscal 2019 (ending May 2019) is currently pegged at 1.5%.

Inorganic Pose: Conagra intends to boost its competency by reshaping its portfolio through meaningful inorganic moves. In sync with this, the company tries to acquire high-margin generating businesses and divest the less-profitable ones. For instance, the strategic acquisition of Angie's Artisan Treats, LLC (completed in October 2017) and Sandwich Bros. (completed in February 2018) is likely continue boosting revenues and profitability in the quarters ahead. On the other hand, Del Monte’s spin-off will likely be accomplished by the end of May this year.

Improving Profitability: Conagra reported better-than-expected earnings in fiscal third quarter on the back of lower corporate tax rate (on account of new Tax Cuts and Jobs Act implementation in December 2017), reduced interest expenses, rise in Ardent Mills joint venture profitability and share buyback moves.

Going forward, the company intends to improve its bottom-line performance by exiting from low-margin businesses, driving robust top-line performance, improving share repurchase activity and lowering tax rates.

Notably, Conagra has lifted its earnings view for fiscal 2018 to $2.03-$2.05 per share range from the prior outlook of $1.84-$1.89 per share.

Shareholders’ Interest: Conagra is also highly committed toward its shareholders and tries to provide adequate returns to them through dividends and share buyback offers. In fiscal third-quarter 2018, the company repurchased roughly 8 million of common stock for $280 million.

Additionally, Conagra is on track with its aim to buyback $1.1 billion shares in full-year fiscal 2018 (Ending May 2018).

Upward Estimate Revisions: Over the past 60 days, the Zacks Consensus Estimate for Conagra moved 6.3% upward to $2.03 and 7.6% to $2.27 for fiscal 2018 and 2019, respectively.

The positive earnings estimate revision indicates upbeat sentiments and substantiates the Zacks Rank #2 (Buy) for this stock.

The stock’s projected earnings per share (EPS) growth rate for fiscal 2018 and 2019 is pegged at 16.7% and 11.7%, respectively.

Other Stocks to Consider

Other top-ranked stocks in the same space are listed below:

Medifast, Inc. MED flaunts a Zacks Rank of 1 (Strong Buy). The company’s earnings per share (EPS) are projected to be up 15% in the next three to five years. You can see the complete list of today’s Zacks #1 Rank stocks here.

Post Holdings, Inc. POST sports a Zacks Rank of 1. The company’s EPS is estimated to rise 14% over the next three to five years.

US Foods Holding Corp. USFD also carries a Zacks Rank #1. The company’s EPS is predicted to grow 17% during the same time frame.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Conagra Brands Inc. (CAG) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

US Foods Holding Corp. (USFD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research