Should You Be Concerned About Viking Therapeutics Inc’s (NASDAQ:VKTX) Risks?

If you are a shareholder in Viking Therapeutics Inc’s (NASDAQ:VKTX), or are thinking about investing in the company, knowing how it contributes to the risk and reward profile of your portfolio is important. The beta measures VKTX’s exposure to the wider market risk, which reflects changes in economic and political factors. Not all stocks are expose to the same level of market risk, and the market as a whole represents a beta of one. A stock with a beta greater than one is considered more sensitive to market-wide shocks compared to a stock that trades below the value of one.

View our latest analysis for Viking Therapeutics

What is VKTX’s market risk?

With a beta of 1.91, Viking Therapeutics is a stock that tends to experience more gains than the market during a growth phase and also a bigger reduction in value compared to the market during a broad downturn. Based on this beta value, VKTX can help magnify your portfolio return, especially if it is predominantly made up of low-beta stocks. If the market is going up, a higher exposure to the upside from a high-beta stock can push up your portfolio return.

Could VKTX’s size and industry cause it to be more volatile?

With a market cap of USD $186.25M, VKTX falls within the small-cap spectrum of stocks, which are found to experience higher relative risk compared to larger companies. However, VKTX operates in the biotechs industry, which has commonly demonstrated muted reactions to market-wide shocks. Therefore, investors can expect a high beta associated with the size of VKTX, but a lower beta given the nature of the industry it operates in. It seems as though there is an inconsistency in risks from VKTX’s size and industry.

Is VKTX’s cost structure indicative of a high beta?

During times of economic downturn, low demand may cause companies to readjust production of their goods and services. It is more difficult for companies to lower their cost, if the majority of these costs are generated by fixed assets. Therefore, this is a type of risk which is associated with higher beta. I examine VKTX’s ratio of fixed assets to total assets to see whether the company is highly exposed to the risk of this type of constraint. Given that fixed assets make up an insignificant portion of total assets, VKTX doesn’t rely heavily upon these expensive, inflexible assets to run its business during downturns. Thus, we can expect VKTX to be more stable in the face of market movements, relative to its peers of similar size but with a higher portion of fixed assets on their books. However, this is the opposite to what VKTX’s actual beta value suggests, which is higher stock volatility relative to the market.

What this means for you:

You could benefit from higher returns during times of economic growth. However, in times of a downturn, it may be safe to look at a more defensive stock which can cushion the impact of lower demand. It’s always wise to take into account your portfolio sensitivity to the market before you invest in VKTX, as well as where we are in the current economic cycle. In order to fully understand whether VKTX is a good investment for you, we also need to consider important company-specific fundamentals such as Viking Therapeutics’s financial health and performance track record. I urge you to complete your research by taking a look at the following:

1. Future Outlook: What are well-informed industry analysts predicting for VKTX’s future growth? Take a look at our free research report of analyst consensus for VKTX’s outlook.

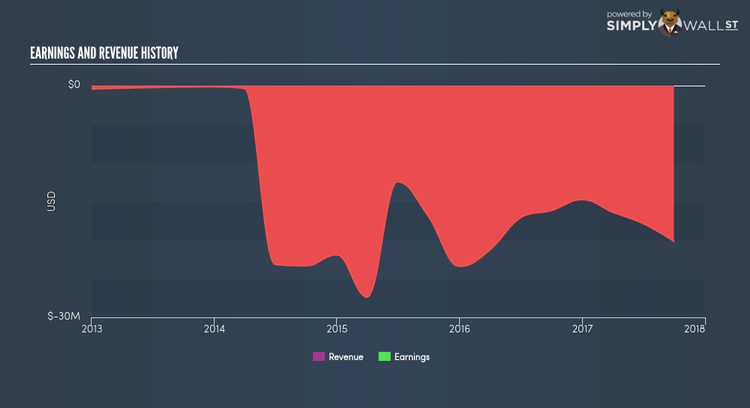

2. Financial Health: Is VKTX’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

3. Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.