ConnectOne Bancorp, Inc.'s (NASDAQ:CNOB) Attractive Combination: Does It Earn A Place In Your Dividend Portfolio?

Dividend paying stocks like ConnectOne Bancorp, Inc. (NASDAQ:CNOB) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

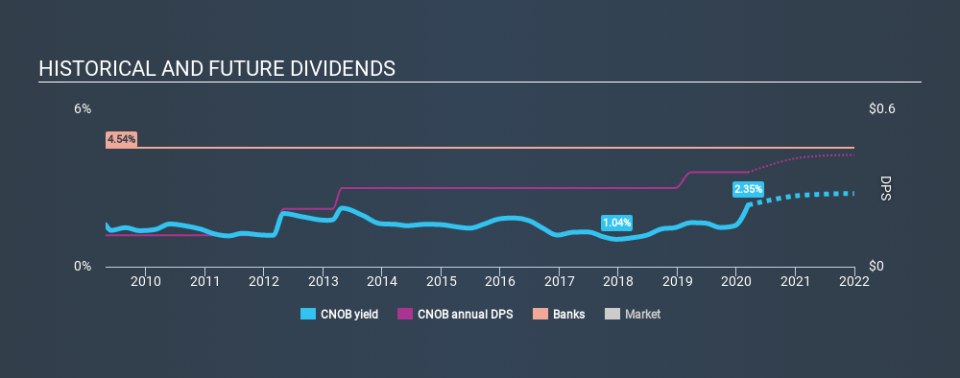

A 2.4% yield is nothing to get excited about, but investors probably think the long payment history suggests ConnectOne Bancorp has some staying power. The company also bought back stock during the year, equivalent to approximately 2.0% of the company's market capitalisation at the time. Remember though, given the recent drop in its share price, ConnectOne Bancorp's yield will look higher, even though the market may now be expecting a decline in its long-term prospects. Some simple analysis can reduce the risk of holding ConnectOne Bancorp for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on ConnectOne Bancorp!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Looking at the data, we can see that 17% of ConnectOne Bancorp's profits were paid out as dividends in the last 12 months. We like this low payout ratio, because it implies the dividend is well covered and leaves ample opportunity for reinvestment.

Consider getting our latest analysis on ConnectOne Bancorp's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. ConnectOne Bancorp has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. The dividend has been stable over the past 10 years, which is great. We think this could suggest some resilience to the business and its dividends. During the past ten-year period, the first annual payment was US$0.12 in 2010, compared to US$0.36 last year. Dividends per share have grown at approximately 12% per year over this time.

With rapid dividend growth and no notable cuts to the dividend over a lengthy period of time, we think this company has a lot going for it.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see ConnectOne Bancorp has grown its earnings per share at 21% per annum over the past five years. The company is only paying out a fraction of its earnings as dividends, and in the past been able to use the retained earnings to grow its profits rapidly - an ideal combination.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're glad to see ConnectOne Bancorp has a low payout ratio, as this suggests earnings are being reinvested in the business. Next, growing earnings per share and steady dividend payments is a great combination. Overall, we think there are a lot of positives to ConnectOne Bancorp from a dividend perspective.

Market movements attest to how highly valued a consistent dividend policy is to one to which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 3 warning signs for ConnectOne Bancorp that investors should take into consideration.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.