ConocoPhillips (COP) Wins Approval to Develop Tommeliten Field

ConocoPhillips COP received approval from the U.K. and Norway authorities for the development and operation of the Tommeliten A field in the North Sea.

Tommeliten A is a subsea development that involves two subsea templates, which can hold up to 12 production wells. The field facilities will be tied back to the Ekofisk Complex.

The project involves the installation of a processing module at the Ekofisk complex to deal with additional production from the Tommeliten A field. ConocoPhillips operates the Tommeliten A unit with a 28% stake.

In November 2021, the company submitted a plan for the development and operation of the Tommeliten A field. The field’s development will help maintain the gas supply from the Ekofisk area from the middle of this decade. It is a further development of the petroleum resources and infrastructure in the mature areas of the Norwegian Continental Shelf.

The total capital expenditure associated with the project is estimated to be NOK 13 billion. The Tommeliten A field is estimated to hold 80-180 million barrels of oil equivalent, primarily comprising gas condensate. Production from the field is expected to begin in 2024.

The field development will unlock the production of new resources in the area and strengthen Ekofisk’s outcome. Notably, ConocoPhillips awarded a large topside modification contract to Aker Solutions for this project.

The Norway authorities expect the project to quickly reach the highest production level once the field starts to produce. ConocoPhillips expects the Tommeliten A field to produce for 25 years.

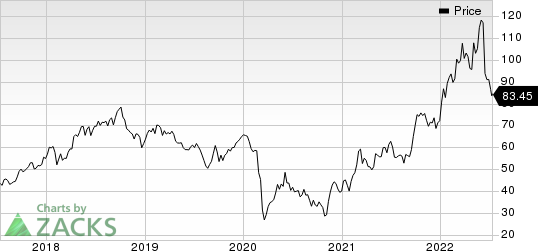

ConocoPhillips Price

ConocoPhillips price | ConocoPhillips Quote

ConocoPhillips currently carries a Zack Rank #3 (Hold). Investors interested in the energy sector might look at the following stocks that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Enterprise Products Partners EPD is among the leading midstream energy players in North America. The partnership is also well-positioned to generate additional cash flow from under-construction growth capital projects worth $4.6 billion.

Enterprise Products Partners is strongly committed to returning cash to shareholders. The partnership’s board of directors increased its cash distribution to 46.5 cents per unit, suggesting a 3.3% hike from the previous dividend of 45 cents.

Suncor Energy, Inc. SU is Canada’s premier integrated energy company. In 2021, Suncor reduced net debt by almost C$4 billion and returned the same to shareholders through dividends and share repurchases.

Suncor has cash and cash equivalents of C$2.1 billion. The company’s robust liquidity position will allow it to sustain its dividend, even if oil prices stay lower for longer. SU recently hiked its dividend by 12% to 47 Canadian cents per share (after doubling it previously) and increased the buyback authorization to roughly 10% of its public float.

PDC Energy, Inc. PDCE is an independent upstream operator that explores, develops and produces natural gas, crude oil and natural gas liquids. As of Mar 31, 2022, PDCE had $1.65 billion in total liquidity, while its credit facility currently has a total borrowing base of $3 billion.

A tight leash on costs, coupled with strong commodity prices, is set to translate into strong levels of free cash flow for PDC Energy. As proof of this, PDCE anticipates generating $1.7 billion in adjusted free cash flow this year (assuming price realizations of $95 per barrel of oil and natural gas at $6), while returning $800 million-$1 billion to its shareholders during this period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ConocoPhillips (COP) : Free Stock Analysis Report

Enterprise Products Partners L.P. (EPD) : Free Stock Analysis Report

Suncor Energy Inc. (SU) : Free Stock Analysis Report

PDC Energy, Inc. (PDCE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research