The Consensus EPS Estimates For ad pepper media International N.V. (ETR:APM) Just Fell A Lot

The latest analyst coverage could presage a bad day for ad pepper media International N.V. (ETR:APM), with the covering analyst making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Both revenue and earnings per share (EPS) estimates were cut sharply as the analyst factored in the latest outlook for the business, concluding that they were too optimistic previously.

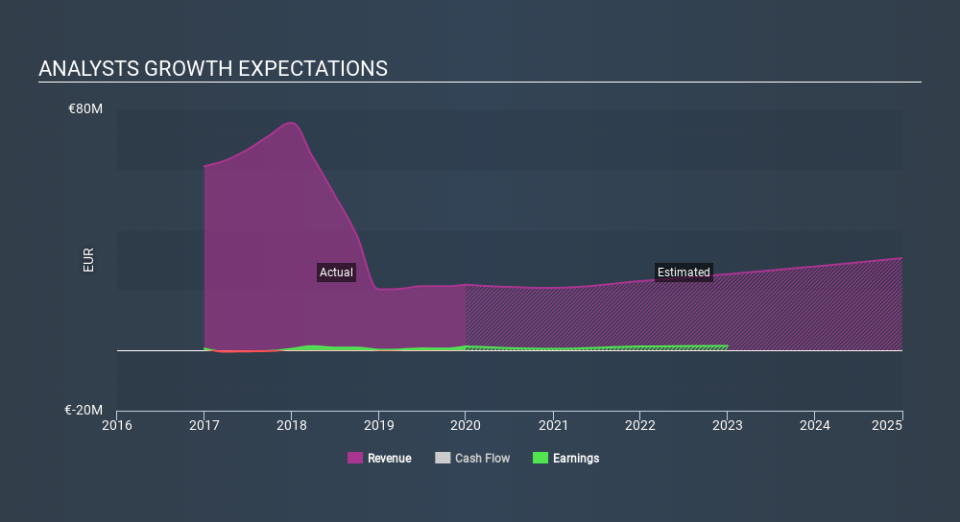

Following the downgrade, the consensus from solo analyst covering ad pepper media International is for revenues of €21m in 2020, implying a perceptible 4.8% decline in sales compared to the last 12 months. Statutory earnings per share are anticipated to plummet 69% to €0.02 in the same period. Prior to this update, the analyst had been forecasting revenues of €24m and earnings per share (EPS) of €0.06 in 2020. It looks like analyst sentiment has declined substantially, with a measurable cut to revenue estimates and a large cut to earnings per share numbers as well.

View our latest analysis for ad pepper media International

It'll come as no surprise then, to learn that the analyst has cut their price target 13% to €3.40.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the ad pepper media International's past performance and to peers in the same industry. We would also point out that the forecast 4.8% revenue decline is better than the historical trend, which saw revenues shrink -13% annually over the past five years

The Bottom Line

The most important thing to take away is that the analyst cut their earnings per share estimates, expecting a clear decline in business conditions. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. Given the scope of the downgrades, it would not be a surprise to see the market become more wary of the business.

In light of the downgrade, our automated discounted cash flow valuation tool suggests that ad pepper media International could now be moderately overvalued. You can learn more about our valuation methodology for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.